- China

- /

- Consumer Durables

- /

- SZSE:300793

Optimistic Investors Push Cosonic Intelligent Technologies Co., Ltd. (SZSE:300793) Shares Up 36% But Growth Is Lacking

Cosonic Intelligent Technologies Co., Ltd. (SZSE:300793) shares have continued their recent momentum with a 36% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 6.8% isn't as impressive.

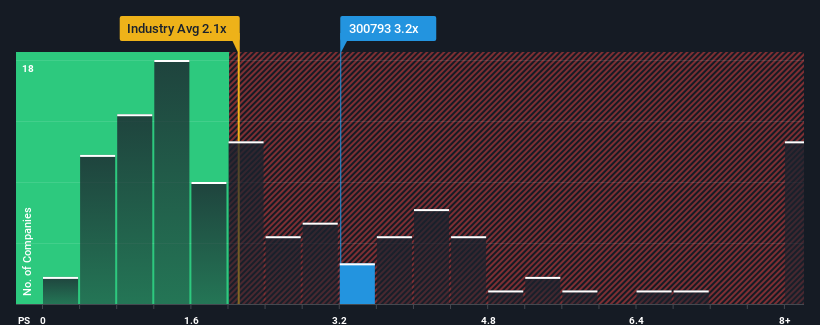

Since its price has surged higher, you could be forgiven for thinking Cosonic Intelligent Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in China's Consumer Durables industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Cosonic Intelligent Technologies

How Has Cosonic Intelligent Technologies Performed Recently?

Cosonic Intelligent Technologies has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Cosonic Intelligent Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Cosonic Intelligent Technologies would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 19% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 10% shows it's an unpleasant look.

With this information, we find it concerning that Cosonic Intelligent Technologies is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Cosonic Intelligent Technologies' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cosonic Intelligent Technologies currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 5 warning signs for Cosonic Intelligent Technologies that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300793

Cosonic Intelligent Technologies

Cosonic Intelligent Technologies Co., Ltd.

Adequate balance sheet low.

Market Insights

Community Narratives