The Market Doesn't Like What It Sees From Jiangsu Jinling Sports Equipment Co.,Ltd.'s (SZSE:300651) Earnings Yet As Shares Tumble 25%

Jiangsu Jinling Sports Equipment Co.,Ltd. (SZSE:300651) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

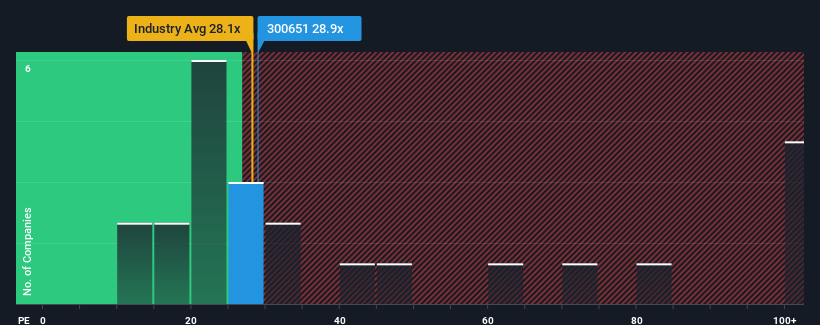

Even after such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Jiangsu Jinling Sports EquipmentLtd as an attractive investment with its 28.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Jiangsu Jinling Sports EquipmentLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Jiangsu Jinling Sports EquipmentLtd

How Is Jiangsu Jinling Sports EquipmentLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jiangsu Jinling Sports EquipmentLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.1%. Even so, admirably EPS has lifted 121% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Jiangsu Jinling Sports EquipmentLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Jiangsu Jinling Sports EquipmentLtd's P/E

The softening of Jiangsu Jinling Sports EquipmentLtd's shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jiangsu Jinling Sports EquipmentLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jiangsu Jinling Sports EquipmentLtd you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300651

Jiangsu Jinling Sports EquipmentLtd

Jiangsu Jinling Sports Equipment Co.,Ltd.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives