- China

- /

- Consumer Durables

- /

- SZSE:300616

Guangzhou Shangpin Home Collection Co., Ltd. (SZSE:300616) Stock Catapults 38% Though Its Price And Business Still Lag The Industry

Guangzhou Shangpin Home Collection Co., Ltd. (SZSE:300616) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

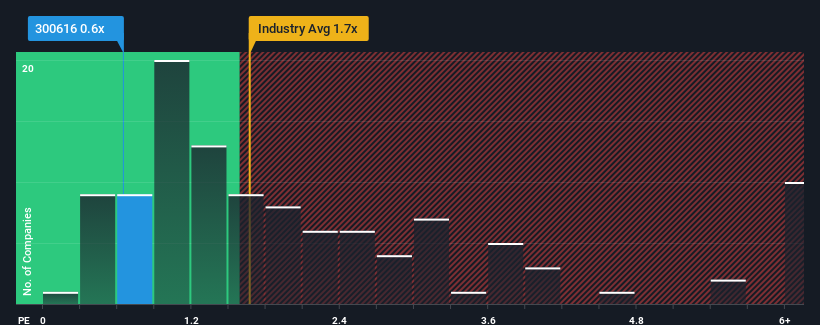

Even after such a large jump in price, Guangzhou Shangpin Home Collection's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Consumer Durables industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guangzhou Shangpin Home Collection

How Guangzhou Shangpin Home Collection Has Been Performing

Guangzhou Shangpin Home Collection could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Guangzhou Shangpin Home Collection will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Guangzhou Shangpin Home Collection?

The only time you'd be truly comfortable seeing a P/S as low as Guangzhou Shangpin Home Collection's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. As a result, revenue from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.6% as estimated by the four analysts watching the company. That's not great when the rest of the industry is expected to grow by 9.2%.

With this in consideration, we find it intriguing that Guangzhou Shangpin Home Collection's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Guangzhou Shangpin Home Collection's P/S

Guangzhou Shangpin Home Collection's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Guangzhou Shangpin Home Collection maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Guangzhou Shangpin Home Collection's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Guangzhou Shangpin Home Collection (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300616

Guangzhou Shangpin Home Collection

Guangzhou Shangpin Home Collection Co., Ltd.

Fair value with moderate growth potential.

Market Insights

Community Narratives