- China

- /

- Consumer Durables

- /

- SZSE:300374

China Railway Prefabricated Construction Co., Ltd.'s (SZSE:300374) P/S Is Still On The Mark Following 31% Share Price Bounce

The China Railway Prefabricated Construction Co., Ltd. (SZSE:300374) share price has done very well over the last month, posting an excellent gain of 31%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.8% in the last twelve months.

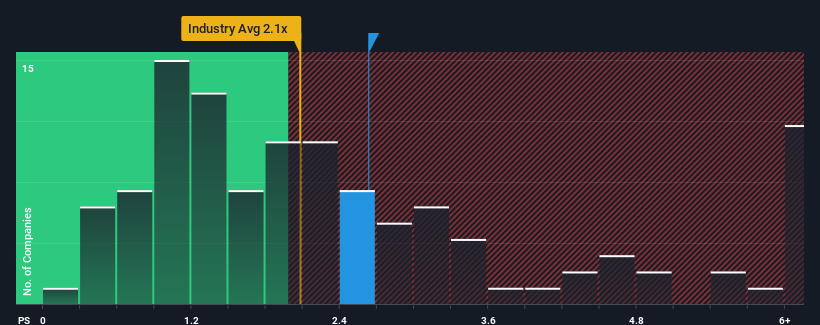

Following the firm bounce in price, you could be forgiven for thinking China Railway Prefabricated Construction is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in China's Consumer Durables industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for China Railway Prefabricated Construction

How Has China Railway Prefabricated Construction Performed Recently?

China Railway Prefabricated Construction certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Railway Prefabricated Construction.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China Railway Prefabricated Construction's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 124%. Pleasingly, revenue has also lifted 56% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in mind, it's not hard to understand why China Railway Prefabricated Construction's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in China Railway Prefabricated Construction's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that China Railway Prefabricated Construction maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Durables industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - China Railway Prefabricated Construction has 1 warning sign we think you should be aware of.

If you're unsure about the strength of China Railway Prefabricated Construction's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300374

China Railway Prefabricated Construction

China Railway Prefabricated Construction Co., Ltd.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success