Even With A 44% Surge, Cautious Investors Are Not Rewarding Anhui Anli Material Technology Co., Ltd.'s (SZSE:300218) Performance Completely

The Anhui Anli Material Technology Co., Ltd. (SZSE:300218) share price has done very well over the last month, posting an excellent gain of 44%. Looking back a bit further, it's encouraging to see the stock is up 89% in the last year.

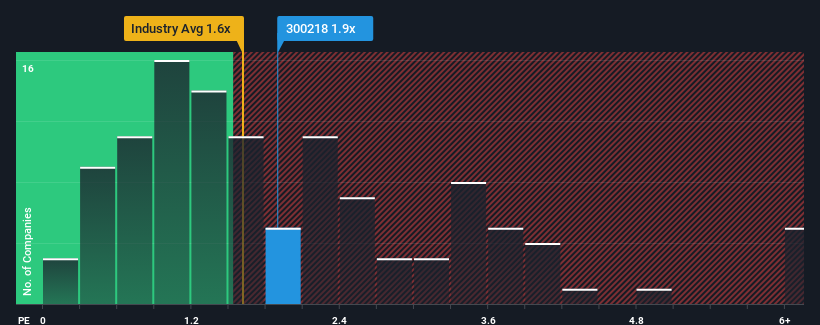

Although its price has surged higher, there still wouldn't be many who think Anhui Anli Material Technology's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in China's Luxury industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Anhui Anli Material Technology

How Has Anhui Anli Material Technology Performed Recently?

Recent times have been advantageous for Anhui Anli Material Technology as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Anli Material Technology.Is There Some Revenue Growth Forecasted For Anhui Anli Material Technology?

Anhui Anli Material Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. As a result, it also grew revenue by 16% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Anhui Anli Material Technology's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Anhui Anli Material Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Anhui Anli Material Technology currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Anhui Anli Material Technology (1 is a bit unpleasant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300218

Anhui Anli Material Technology

Engages in the research and development, production, sale, and servicing of ecological functional polyurethane synthetic leather products, polyurethane resin series products, and other polymer composite materials in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives