- China

- /

- Consumer Durables

- /

- SZSE:300217

Here's Why Zhenjiang Dongfang Electric Heating TechnologyLtd (SZSE:300217) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Zhenjiang Dongfang Electric Heating TechnologyLtd (SZSE:300217), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Zhenjiang Dongfang Electric Heating TechnologyLtd

Zhenjiang Dongfang Electric Heating TechnologyLtd's Improving Profits

Zhenjiang Dongfang Electric Heating TechnologyLtd has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Zhenjiang Dongfang Electric Heating TechnologyLtd's EPS grew from CN¥0.21 to CN¥0.45, over the previous 12 months. Year on year growth of 113% is certainly a sight to behold.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Zhenjiang Dongfang Electric Heating TechnologyLtd is growing revenues, and EBIT margins improved by 11.9 percentage points to 20%, over the last year. Both of which are great metrics to check off for potential growth.

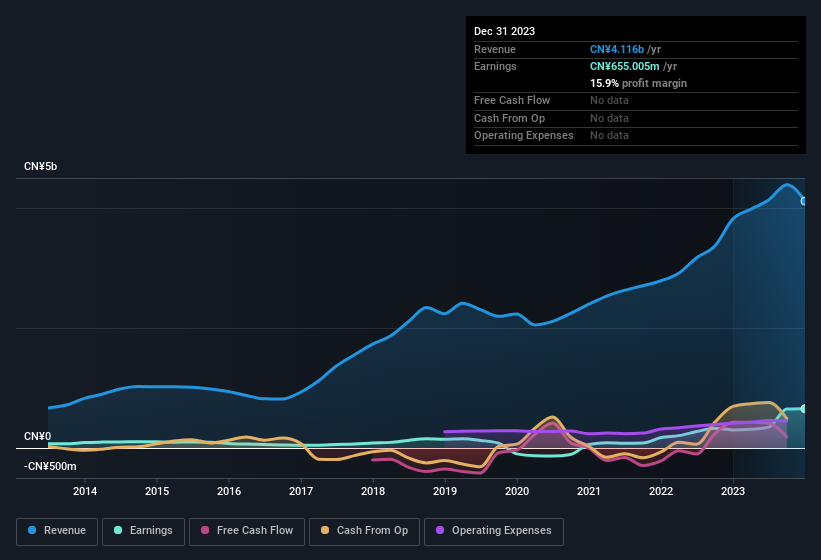

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Zhenjiang Dongfang Electric Heating TechnologyLtd's future EPS 100% free.

Are Zhenjiang Dongfang Electric Heating TechnologyLtd Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Zhenjiang Dongfang Electric Heating TechnologyLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 36% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. at the current share price. This is an incredible endorsement from them.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Zhenjiang Dongfang Electric Heating TechnologyLtd, with market caps between CN¥2.9b and CN¥12b, is around CN¥947k.

The Zhenjiang Dongfang Electric Heating TechnologyLtd CEO received CN¥600k in compensation for the year ending December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Zhenjiang Dongfang Electric Heating TechnologyLtd To Your Watchlist?

Zhenjiang Dongfang Electric Heating TechnologyLtd's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. Zhenjiang Dongfang Electric Heating TechnologyLtd certainly ticks a few boxes, so we think it's probably well worth further consideration. Of course, just because Zhenjiang Dongfang Electric Heating TechnologyLtd is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhenjiang Dongfang Electric Heating TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300217

Zhenjiang Dongfang Electric Heating TechnologyLtd

Designs, manufactures, and sells various electric heaters in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives