- Singapore

- /

- Capital Markets

- /

- SGX:T55

3 Promising Penny Stocks With Market Caps Larger Than US$30M

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent volatility and economic indicators showing varied trends, investors continue to seek opportunities across the spectrum of equities. Penny stocks, often seen as a niche investment option, still hold potential for growth when backed by robust financial health. These smaller or newer companies can offer affordability and growth potential, making them an intriguing area for exploration in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.984 | £757.4M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$40.74B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £469.45M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.47 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,820 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited is a transport infrastructure and civil engineering company operating in Singapore and Australia, with a market cap of SGD102.83 million.

Operations: The company generates revenue from Maintenance (SGD50.04 million), Construction (SGD148.35 million), and Rental Income (SGD6.31 million).

Market Cap: SGD102.83M

OKP Holdings, with a market cap of SGD102.83 million, trades significantly below its estimated fair value and maintains a strong financial position with more cash than debt. The company has stable weekly volatility and its interest payments are well-covered by profits. While the board is highly experienced, recent earnings growth has been negative, impacted by large one-off items such as a SGD5.8 million gain. Despite reducing its debt-to-equity ratio over five years and covering both short-term and long-term liabilities with assets, profit margins have declined from last year’s 24.9% to 12.7%.

- Click here to discover the nuances of OKP Holdings with our detailed analytical financial health report.

- Understand OKP Holdings' track record by examining our performance history report.

TIH (SGX:T55)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TIH Limited is a private equity firm focused on mergers and acquisitions, restructuring, joint ventures, turnarounds, and special situations investments with a market cap of SGD54.38 million.

Operations: The company's revenue is derived from two main segments: Fund Management, contributing SGD6.32 million, and Investment Business, generating SGD13.05 million.

Market Cap: SGD54.38M

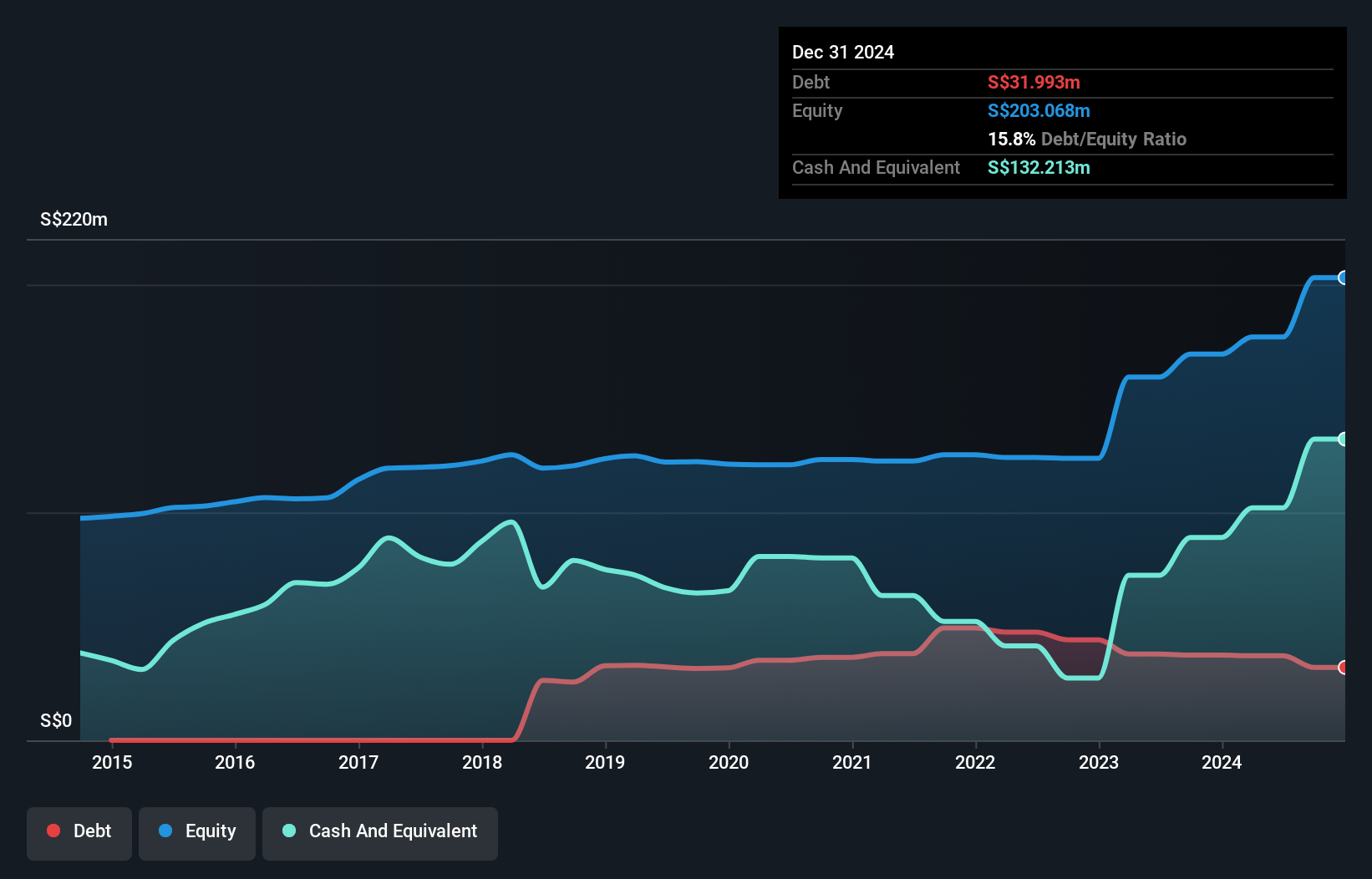

TIH Limited, with a market cap of SGD54.38 million, has recently turned profitable, making it challenging to compare its earnings growth to the broader Capital Markets industry. The company is debt-free and has short-term assets of SGD60.6 million that comfortably exceed both its short-term liabilities (SGD23.0 million) and long-term liabilities (SGD72.0K). Despite a low Return on Equity at 8.8%, TIH trades at a Price-To-Earnings ratio of 5x, below the Singapore market average of 11.9x, suggesting potential undervaluation relative to peers in the sector. The board's experience averages 6.6 years in tenure, contributing stability amidst an unstable dividend track record.

- Unlock comprehensive insights into our analysis of TIH stock in this financial health report.

- Examine TIH's past performance report to understand how it has performed in prior years.

Ningbo Xianfeng New MaterialLtd (SZSE:300163)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ningbo Xianfeng New Material Co., Ltd develops and manufactures screen fabrics globally with a market cap of CN¥1.09 billion.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CN¥1.09B

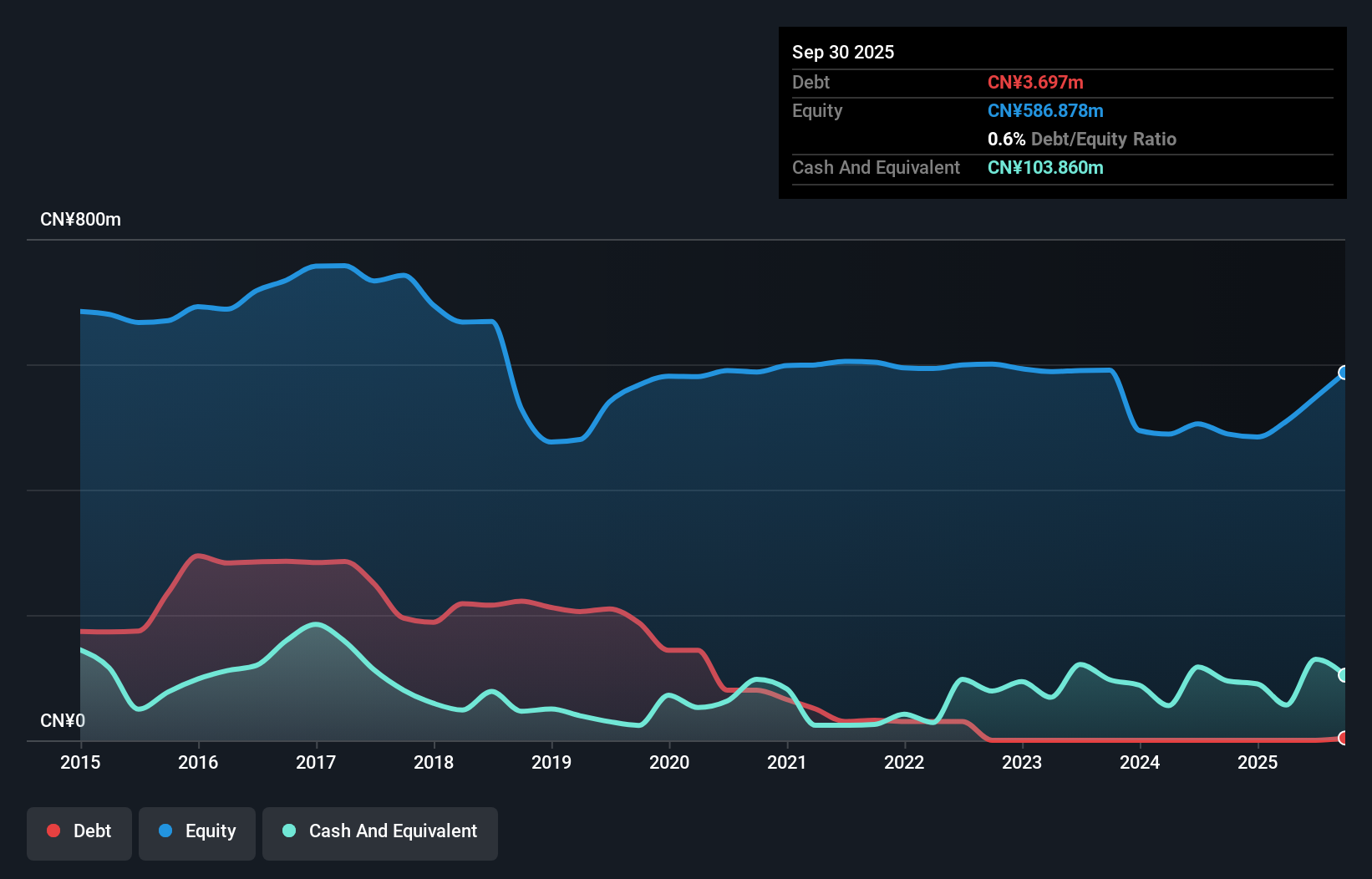

Ningbo Xianfeng New Material Co., Ltd, with a market cap of CN¥1.09 billion, is currently unprofitable, reporting a net loss of CN¥5.53 million for the nine months ending September 2024. Despite this, the company has no debt and maintains sufficient cash runway for over three years based on current free cash flow levels. Its short-term assets (CN¥321.4 million) surpass both short and long-term liabilities combined, indicating solid liquidity management. Recent developments include a minor stake acquisition by Lang Haitao for CN¥28.9 million in December 2024, reflecting some investor interest despite ongoing financial challenges.

- Take a closer look at Ningbo Xianfeng New MaterialLtd's potential here in our financial health report.

- Assess Ningbo Xianfeng New MaterialLtd's previous results with our detailed historical performance reports.

Next Steps

- Discover the full array of 5,820 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIH might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T55

TIH

A private equity firm specializing in M&A, restructuring, joint ventures, turnaround, and special situations investments.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives