- China

- /

- Consumer Durables

- /

- SZSE:300160

Discovering Jiangsu Xiuqiang Glasswork And 2 Other Promising Small Caps

Reviewed by Simply Wall St

In the midst of a busy earnings season and mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts in the global markets. As investors navigate this complex landscape, identifying promising small-cap companies like Jiangsu Xiuqiang Glasswork can offer unique opportunities for growth, particularly when these firms demonstrate strong fundamentals and potential for expansion despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 40.13% | 22.83% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Xiuqiang Glasswork (SZSE:300160)

Simply Wall St Value Rating: ★★★★★★

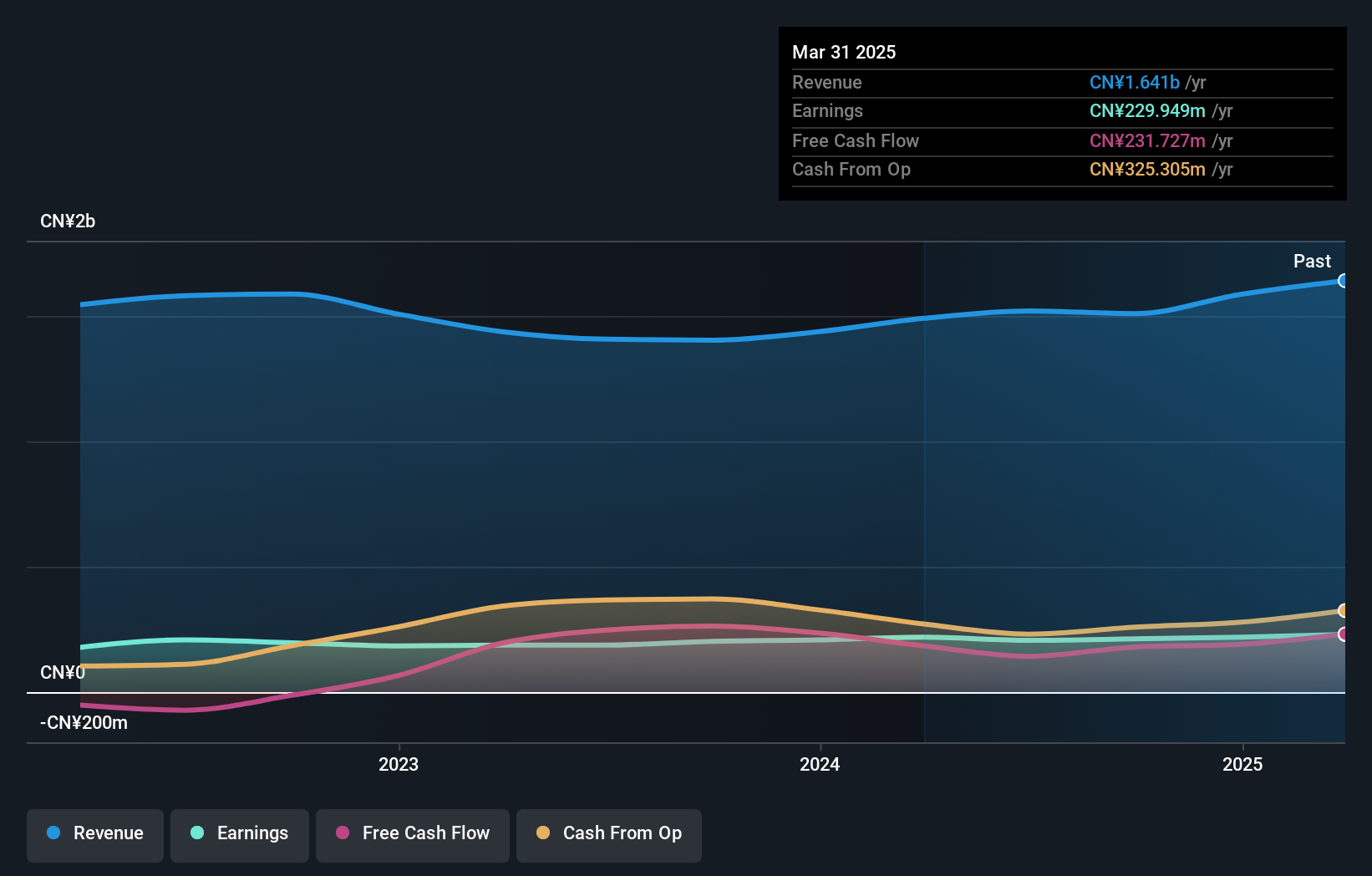

Overview: Jiangsu Xiuqiang Glasswork Co., Ltd. focuses on the research, development, production, and sale of glass deep-processing products utilizing printing, coating, and multi-surface technology in China with a market capitalization of CN¥4.62 billion.

Operations: Xiuqiang Glasswork generates revenue primarily from its glass deep-processing industry, amounting to CN¥1.51 billion. The company's market capitalization stands at CN¥4.62 billion, reflecting its significant presence in the sector.

Jiangsu Xiuqiang Glasswork, a smaller player in the industry, has shown resilience with its earnings growth of 5.1% over the past year, outpacing the Consumer Durables sector's -2.1%. The company boasts high-quality earnings and operates debt-free, having reduced its debt from a 35.3% debt-to-equity ratio five years ago to zero today. Recent financials highlight sales of CNY 1.13 billion for nine months ending September 2024, up from CNY 1.06 billion last year, with net income slightly rising to CNY 181.76 million compared to CNY 177.11 million previously; basic EPS stands at CNY 0.2352 versus last year's CNY 0.2291.

- Click to explore a detailed breakdown of our findings in Jiangsu Xiuqiang Glasswork's health report.

Understand Jiangsu Xiuqiang Glasswork's track record by examining our Past report.

Delta Galil Industries (TASE:DELG)

Simply Wall St Value Rating: ★★★★★★

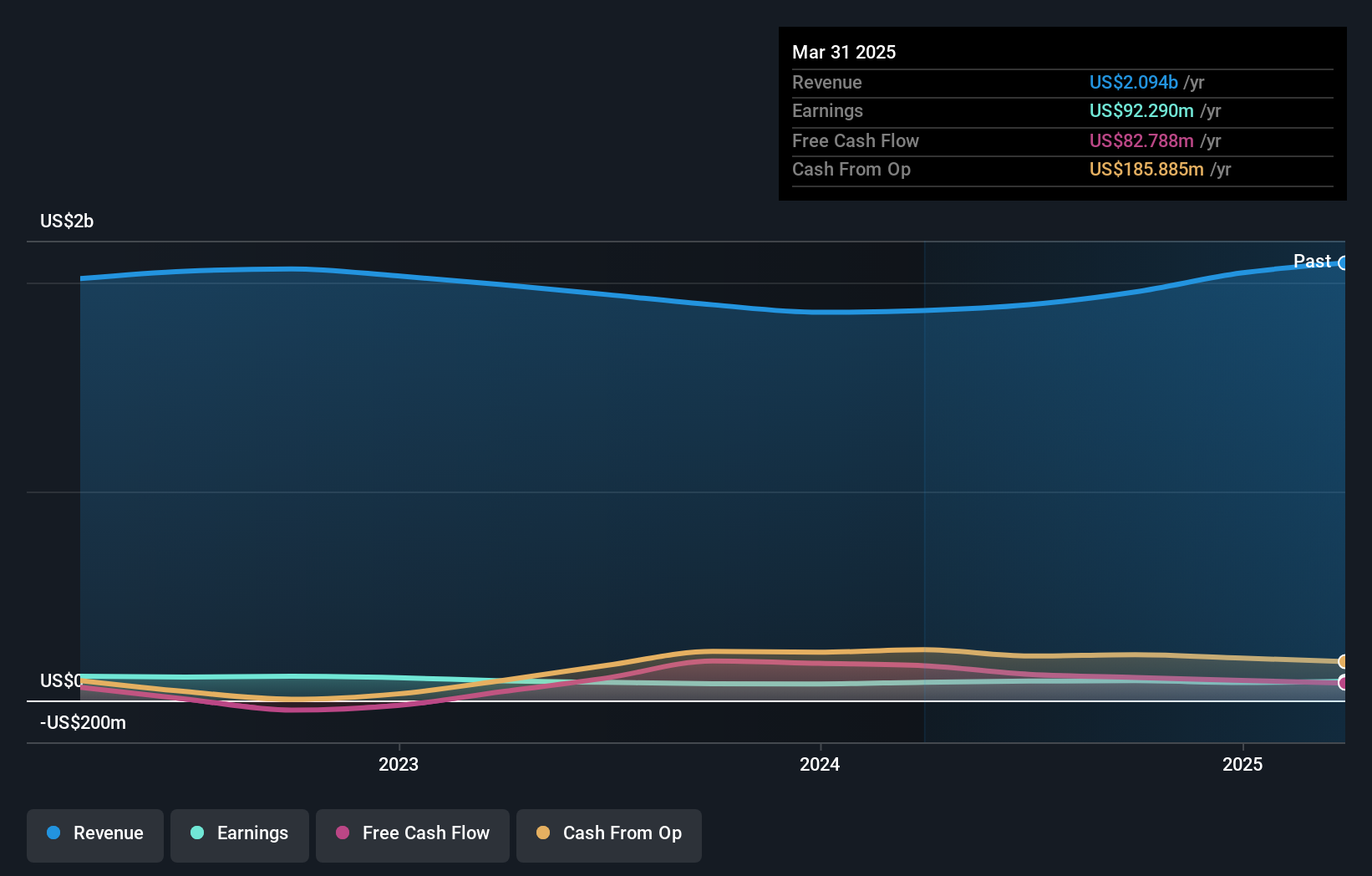

Overview: Delta Galil Industries Ltd. is involved in the design, development, production, marketing, and sale of intimate and activewear products with a market capitalization of ₪4.39 billion.

Operations: Delta Galil's revenue primarily stems from Private Brands and Brands segments, contributing $737.37 million and $619.89 million, respectively. The Delta Israel segment adds $282.34 million to the total revenue, while Seven for All Mankind generates $201.23 million.

Delta Galil, a dynamic player in the apparel sector, recently formed a strategic partnership with Reliance Retail Ventures to expand its market reach in India. This venture could enhance its presence by leveraging Delta's innovation and product excellence. Financially, the company reported robust earnings growth of 7.1% over the past year, outperforming industry peers at 6.8%. With a satisfactory net debt to equity ratio of 18.7%, Delta Galil's financial health appears solid. Trading at 70% below estimated fair value suggests potential for investors seeking undervalued opportunities in this vibrant segment of the market.

- Click here and access our complete health analysis report to understand the dynamics of Delta Galil Industries.

Assess Delta Galil Industries' past performance with our detailed historical performance reports.

Sinfonia TechnologyLtd (TSE:6507)

Simply Wall St Value Rating: ★★★★★★

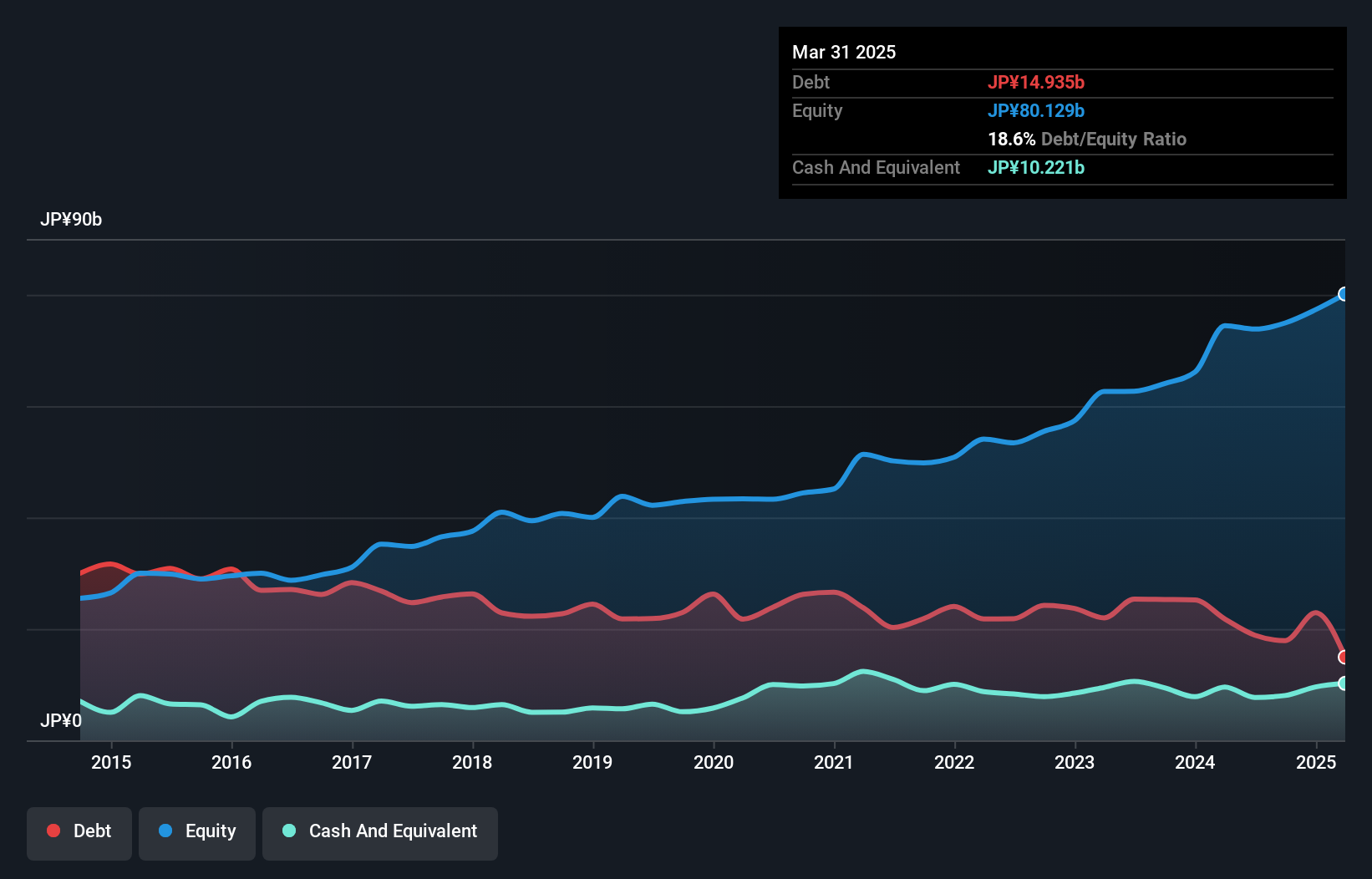

Overview: Sinfonia Technology Co., Ltd. is engaged in the manufacturing and sale of diverse equipment, with a market capitalization of ¥151.12 billion.

Operations: Sinfonia Technology generates revenue primarily from Motion Equipment and Engineer Ring & Service, contributing ¥38.02 billion and ¥25.71 billion respectively. The Clean Conveyance System and Power Electronics Equipment segments add ¥22.27 billion and ¥24.80 billion to the revenue stream.

Sinfonia Technology, a small player in the electrical industry, has shown promising financial health with a net debt to equity ratio of 15.1%, which is satisfactory. Over the last five years, its earnings have grown at an impressive 25.1% annually, although recent growth at 10.2% lagged behind the industry's 14.4%. The company remains profitable and free cash flow positive, with interest payments well-covered by profits. Despite these strengths, its share price has been highly volatile recently, suggesting market uncertainty or speculative trading activity around this stock's future potential in the sector.

Where To Now?

- Access the full spectrum of 4704 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300160

Jiangsu Xiuqiang Glasswork

Researches, develops, manufactures, markets, and sells glass deep-processing products based on printing, coating, and multi-curved surface technology in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives