- China

- /

- Consumer Durables

- /

- SZSE:002718

Investors Appear Satisfied With Zhejiang Youpon Integrated Ceiling Co.,Ltd.'s (SZSE:002718) Prospects As Shares Rocket 30%

Zhejiang Youpon Integrated Ceiling Co.,Ltd. (SZSE:002718) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

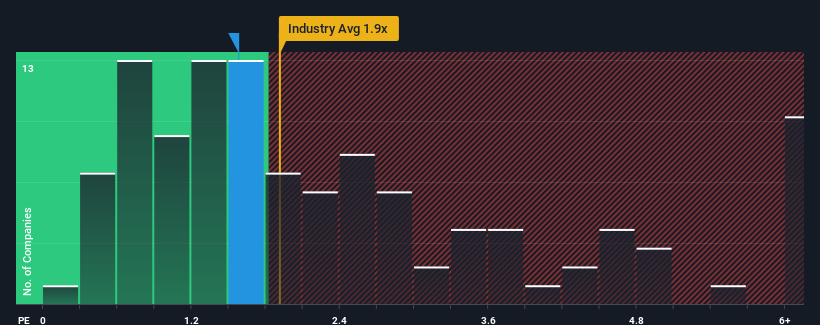

In spite of the firm bounce in price, there still wouldn't be many who think Zhejiang Youpon Integrated CeilingLtd's price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S in China's Consumer Durables industry is similar at about 1.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Zhejiang Youpon Integrated CeilingLtd

What Does Zhejiang Youpon Integrated CeilingLtd's P/S Mean For Shareholders?

It looks like revenue growth has deserted Zhejiang Youpon Integrated CeilingLtd recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Youpon Integrated CeilingLtd's earnings, revenue and cash flow.How Is Zhejiang Youpon Integrated CeilingLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Zhejiang Youpon Integrated CeilingLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Zhejiang Youpon Integrated CeilingLtd's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does Zhejiang Youpon Integrated CeilingLtd's P/S Mean For Investors?

Zhejiang Youpon Integrated CeilingLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that Zhejiang Youpon Integrated CeilingLtd maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Zhejiang Youpon Integrated CeilingLtd has 3 warning signs (and 1 which is concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Zhejiang Youpon Integrated CeilingLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Youpon Integrated CeilingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002718

Zhejiang Youpon Integrated CeilingLtd

Zhejiang Youpon Integrated Ceiling Co.,Ltd.

Adequate balance sheet very low.

Market Insights

Community Narratives