- China

- /

- Consumer Durables

- /

- SZSE:002718

Even after rising 10% this past week, Zhejiang Youpon Integrated CeilingLtd (SZSE:002718) shareholders are still down 19% over the past year

While not a mind-blowing move, it is good to see that the Zhejiang Youpon Integrated Ceiling Co.,Ltd. (SZSE:002718) share price has gained 19% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 20% in a year, falling short of the returns you could get by investing in an index fund.

On a more encouraging note the company has added CN¥155m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Zhejiang Youpon Integrated CeilingLtd

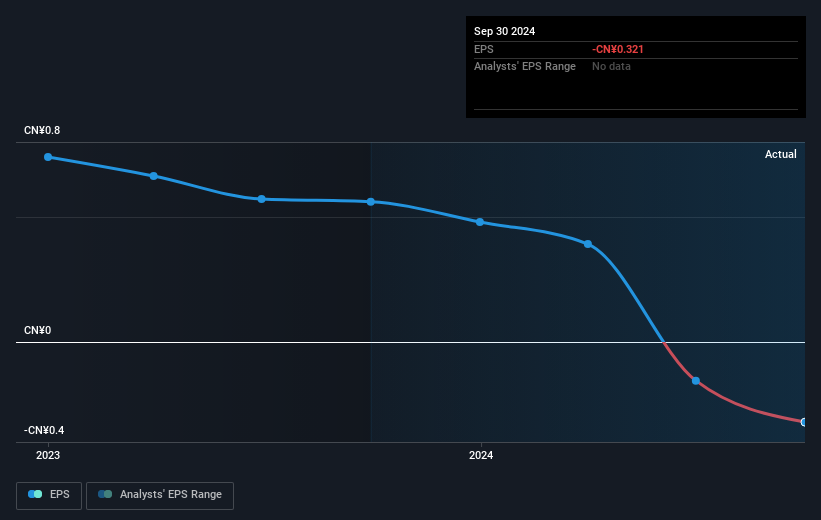

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Zhejiang Youpon Integrated CeilingLtd fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. We hope for shareholders' sake that the company becomes profitable again soon.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Zhejiang Youpon Integrated CeilingLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Zhejiang Youpon Integrated CeilingLtd had a tough year, with a total loss of 19% (including dividends), against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Zhejiang Youpon Integrated CeilingLtd has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course Zhejiang Youpon Integrated CeilingLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Zhejiang Youpon Integrated CeilingLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Youpon Integrated CeilingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002718

Zhejiang Youpon Integrated CeilingLtd

Zhejiang Youpon Integrated Ceiling Co.,Ltd.

Adequate balance sheet very low.

Market Insights

Community Narratives