- China

- /

- Consumer Durables

- /

- SZSE:002543

Guangdong Vanward New Electric Co., Ltd. (SZSE:002543) Stock Rockets 27% But Many Are Still Ignoring The Company

Guangdong Vanward New Electric Co., Ltd. (SZSE:002543) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 58%.

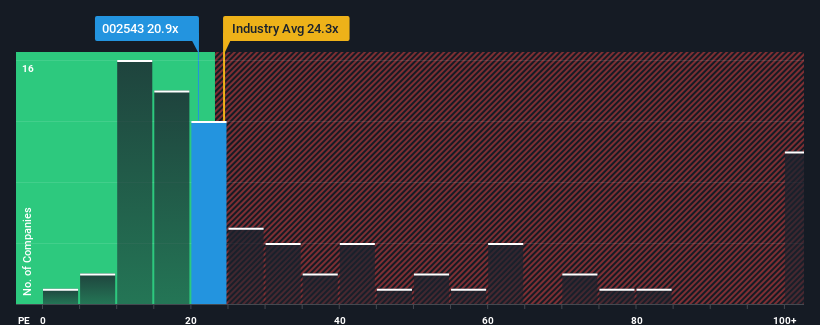

Even after such a large jump in price, Guangdong Vanward New Electric may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.9x, since almost half of all companies in China have P/E ratios greater than 35x and even P/E's higher than 67x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Guangdong Vanward New Electric has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Guangdong Vanward New Electric

Is There Any Growth For Guangdong Vanward New Electric?

The only time you'd be truly comfortable seeing a P/E as low as Guangdong Vanward New Electric's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. As a result, earnings from three years ago have also fallen 34% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the only analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we find it odd that Guangdong Vanward New Electric is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Guangdong Vanward New Electric's P/E

Guangdong Vanward New Electric's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guangdong Vanward New Electric currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Guangdong Vanward New Electric is showing 2 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002543

Guangdong Vanward New Electric

Provides solutions for kitchen and bathroom appliances and hot water heating systems in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives