- China

- /

- Energy Services

- /

- SZSE:300157

Qinghai Huading Industrial And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, marked by tariff uncertainties and mixed economic signals, including a gradual cooling in the U.S. labor market and fluctuating manufacturing activity. In such times, investors often turn to unique opportunities that may offer growth potential at lower price points. Penny stocks, though considered a niche investment area today, continue to attract attention for their potential to deliver impressive returns when backed by strong financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Huading Industrial Co., Ltd. specializes in the research, development, production, and sale of CNC machine tools and elevator accessories in China, with a market cap of CN¥1.40 billion.

Operations: The company generates its revenue of CN¥269.85 million from its operations within China.

Market Cap: CN¥1.4B

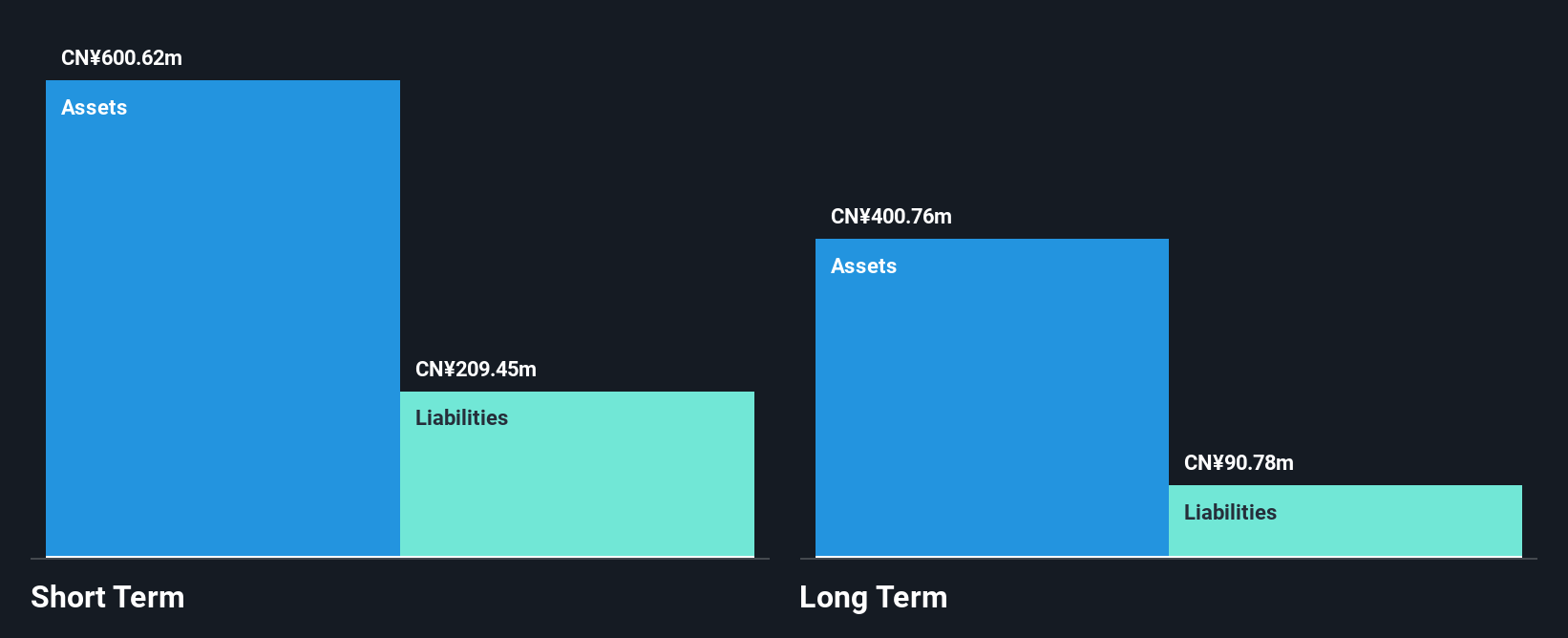

Qinghai Huading Industrial, with a market cap of CN¥1.40 billion, has demonstrated financial resilience through its strong balance sheet, where short-term assets of CN¥552.90 million cover both short and long-term liabilities. The company has more cash than total debt and has reduced its debt to equity ratio significantly over the past five years. Despite being unprofitable with a negative return on equity, it has managed to reduce losses by 15.8% annually over five years. However, the stock remains highly volatile and lacks an experienced management team or board, which could pose challenges for future stability and growth.

- Click here to discover the nuances of Qinghai Huading Industrial with our detailed analytical financial health report.

- Examine Qinghai Huading Industrial's past performance report to understand how it has performed in prior years.

Goldlok Holdings(Guangdong)Ltd (SZSE:002348)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Goldlok Holdings (Guangdong) Co., Ltd. operates in the toys and Internet education sectors in China with a market capitalization of CN¥3.18 billion.

Operations: Goldlok Holdings (Guangdong) Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.18B

Goldlok Holdings (Guangdong) Ltd, with a market cap of CN¥3.18 billion, operates in the toys and Internet education sectors but is currently unprofitable. Despite having a stable cash runway for over a year and short-term assets covering both short and long-term liabilities, its high volatility remains a concern. The management team and board are relatively inexperienced, with an average tenure of 1.4 years each. While the company has managed to reduce losses by 33.7% annually over five years, its debt-to-equity ratio has increased to 36.9%, indicating rising financial leverage challenges amidst ongoing profitability issues.

- Get an in-depth perspective on Goldlok Holdings(Guangdong)Ltd's performance by reading our balance sheet health report here.

- Explore historical data to track Goldlok Holdings(Guangdong)Ltd's performance over time in our past results report.

New JCM GroupLtd (SZSE:300157)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New JCM Group Co., Ltd, along with its subsidiaries, operates in the equipment manufacturing sector both in China and internationally, with a market capitalization of CN¥2.21 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥2.21B

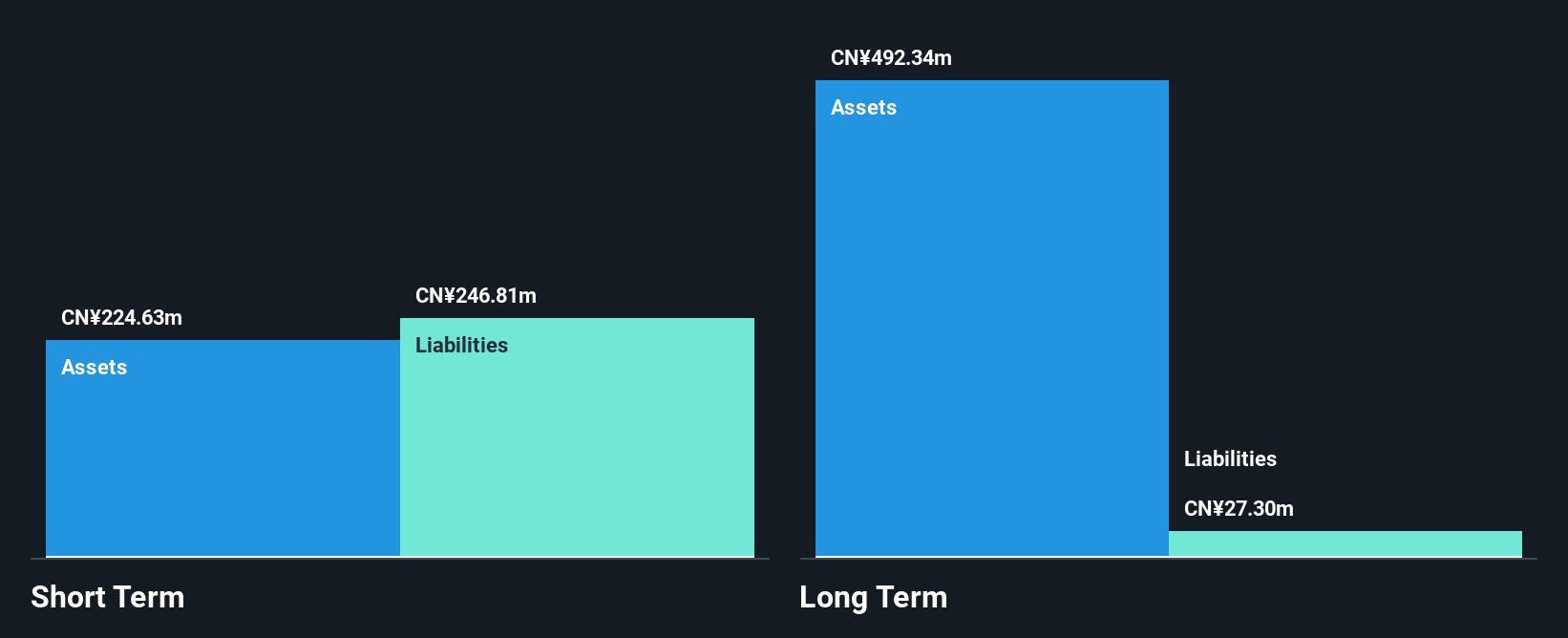

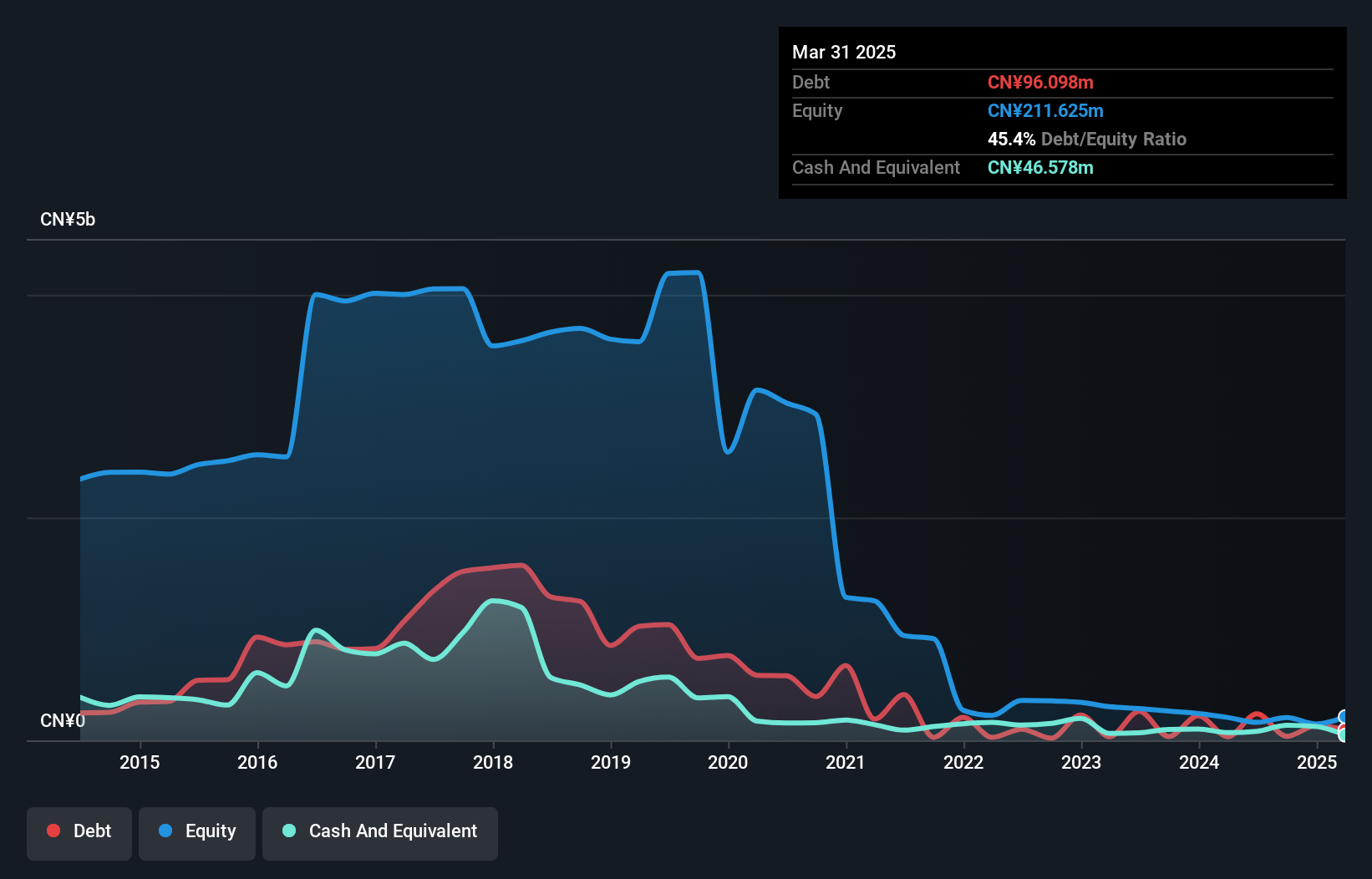

New JCM Group Co., Ltd, with a market cap of CN¥2.21 billion, is currently pre-revenue and unprofitable but has reduced losses by 35.8% annually over the past five years. The company maintains a robust cash runway exceeding three years, despite its high share price volatility and negative return on equity at -99.67%. While short-term assets fall short of covering short-term liabilities, they surpass long-term liabilities. The management team is experienced with an average tenure of 2.9 years; however, the board lacks experience with similar tenure levels. An upcoming shareholders meeting will address settlement agreements.

- Click here and access our complete financial health analysis report to understand the dynamics of New JCM GroupLtd.

- Review our historical performance report to gain insights into New JCM GroupLtd's track record.

Make It Happen

- Discover the full array of 5,706 Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New JCM GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300157

New JCM GroupLtd

Engages in equipment manufacturing business in China and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives