- China

- /

- Consumer Durables

- /

- SZSE:002150

Exploring Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a positive shift, with major U.S. stock indexes rebounding and value stocks outperforming growth shares amid easing inflation and strong bank earnings. This environment has created a fertile ground for small-cap stocks to gain traction as investors seek opportunities beyond the well-trodden paths of large-cap equities. In this context, identifying promising small-cap companies involves looking for those with solid fundamentals, innovative business models, and the ability to capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Jiangsu Tongrun Equipment TechnologyLtd (SZSE:002150)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Tongrun Equipment Technology Co., Ltd specializes in the production and sale of metal tool cabinets in China, with a market capitalization of CN¥4.58 billion.

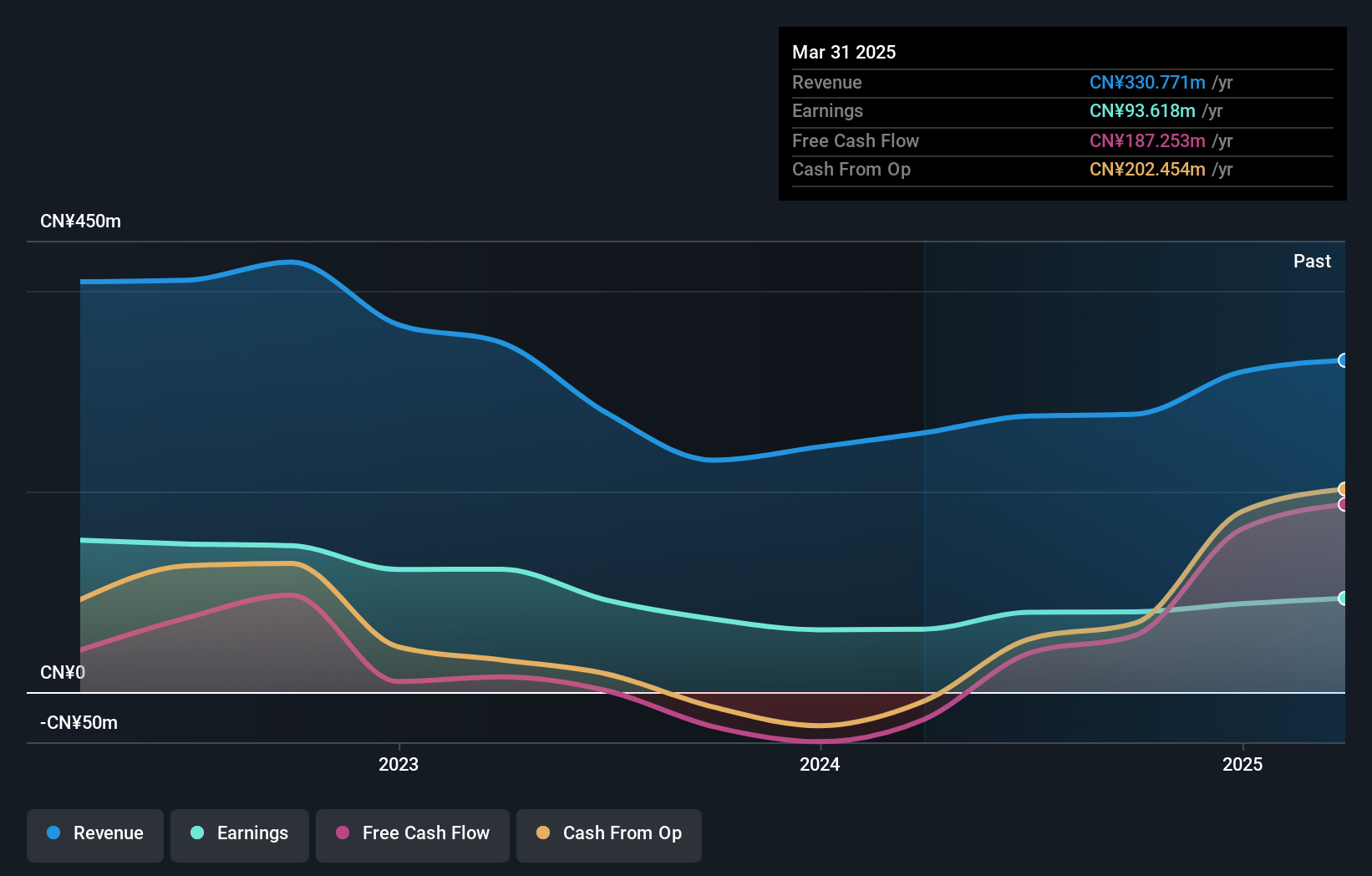

Operations: Tongrun Equipment generates revenue primarily from the production and sale of metal tool cabinets. The company experienced a net profit margin of 6.5% in its recent financial period, indicating its profitability after accounting for all expenses.

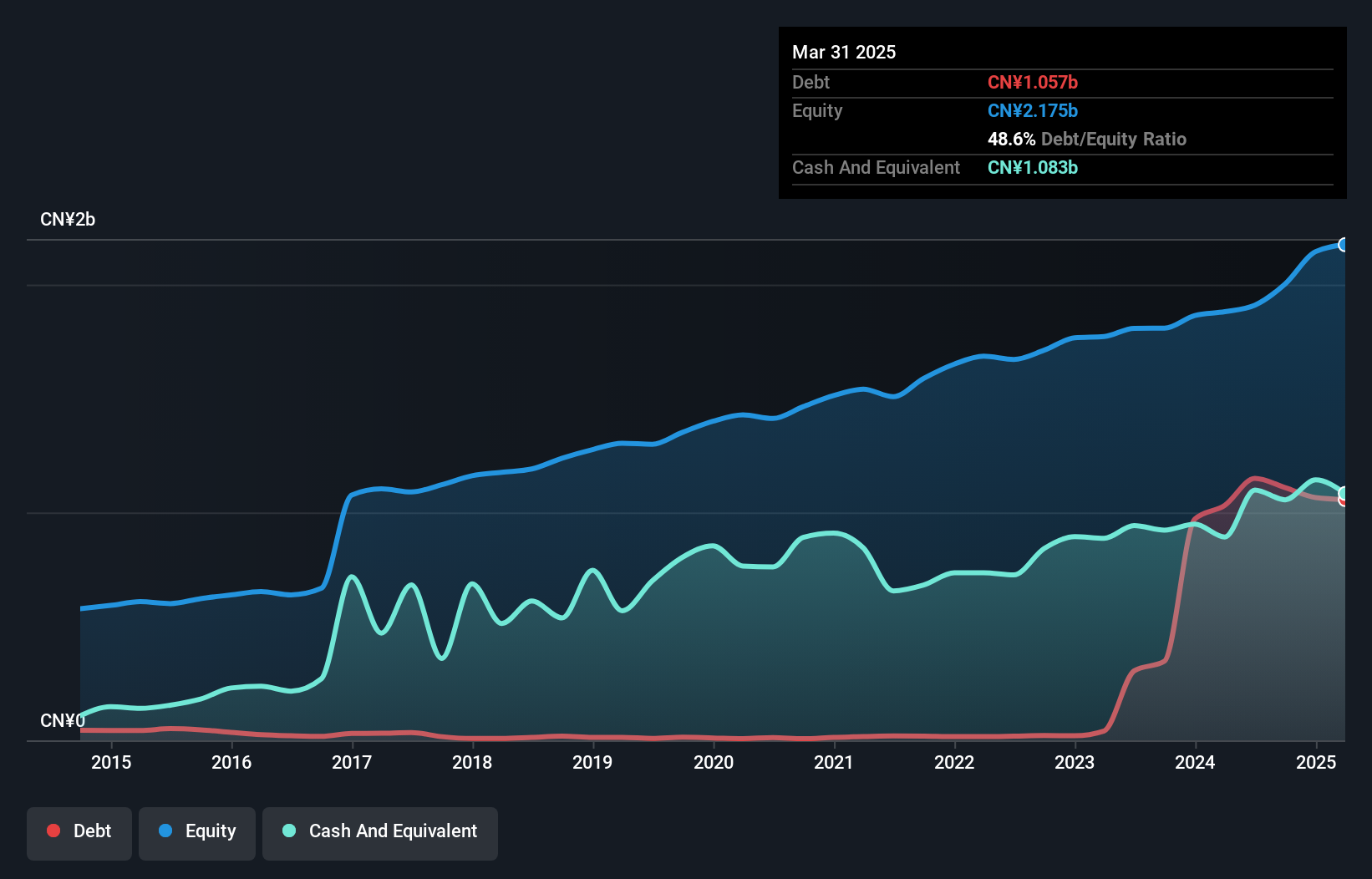

Jiangsu Tongrun Equipment Technology, a smaller player in the market, has shown significant earnings growth of 90.8% over the past year, outpacing the Consumer Durables industry's -0.2%. Despite this positive trajectory, its financials were notably impacted by a one-off gain of CN¥222.7 million in the last 12 months ending September 2024. The company's debt to equity ratio has risen sharply from 1% to 55.4% over five years, yet it maintains a satisfactory net debt to equity ratio of 2.7%. Recent investor activism led to approved proposals for related party transactions and capital amendments at their December meeting.

Shenzhen Keanda Electronic Technology (SZSE:002972)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Keanda Electronic Technology Corp., Ltd. operates in the electronic technology sector and has a market cap of CN¥2.64 billion.

Operations: Financial data for Shenzhen Keanda Electronic Technology Corp., Ltd. is not provided in the text, limiting the ability to summarize revenue streams or cost breakdowns.

Shenzhen Keanda Electronic Technology, a nimble player in the electronics sector, has shown promising growth with earnings rising 9.6% over the past year, outpacing the industry average of 1.9%. The company holds more cash than its total debt and maintains a price-to-earnings ratio of 33x, slightly below the CN market average of 34.9x. Despite this growth, earnings have seen an annual decline of 11.6% over five years. Recent reports highlight sales reaching CNY 200 million for nine months ending September 2024, up from CNY 168 million previously; net income also increased to CNY 69 million from CNY 51 million last year.

Chief Telecom (TPEX:6561)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chief Telecom Inc. offers network integration, internet data center, communications integration, and cloud application services both in Taiwan and internationally with a market capitalization of NT$34.46 billion.

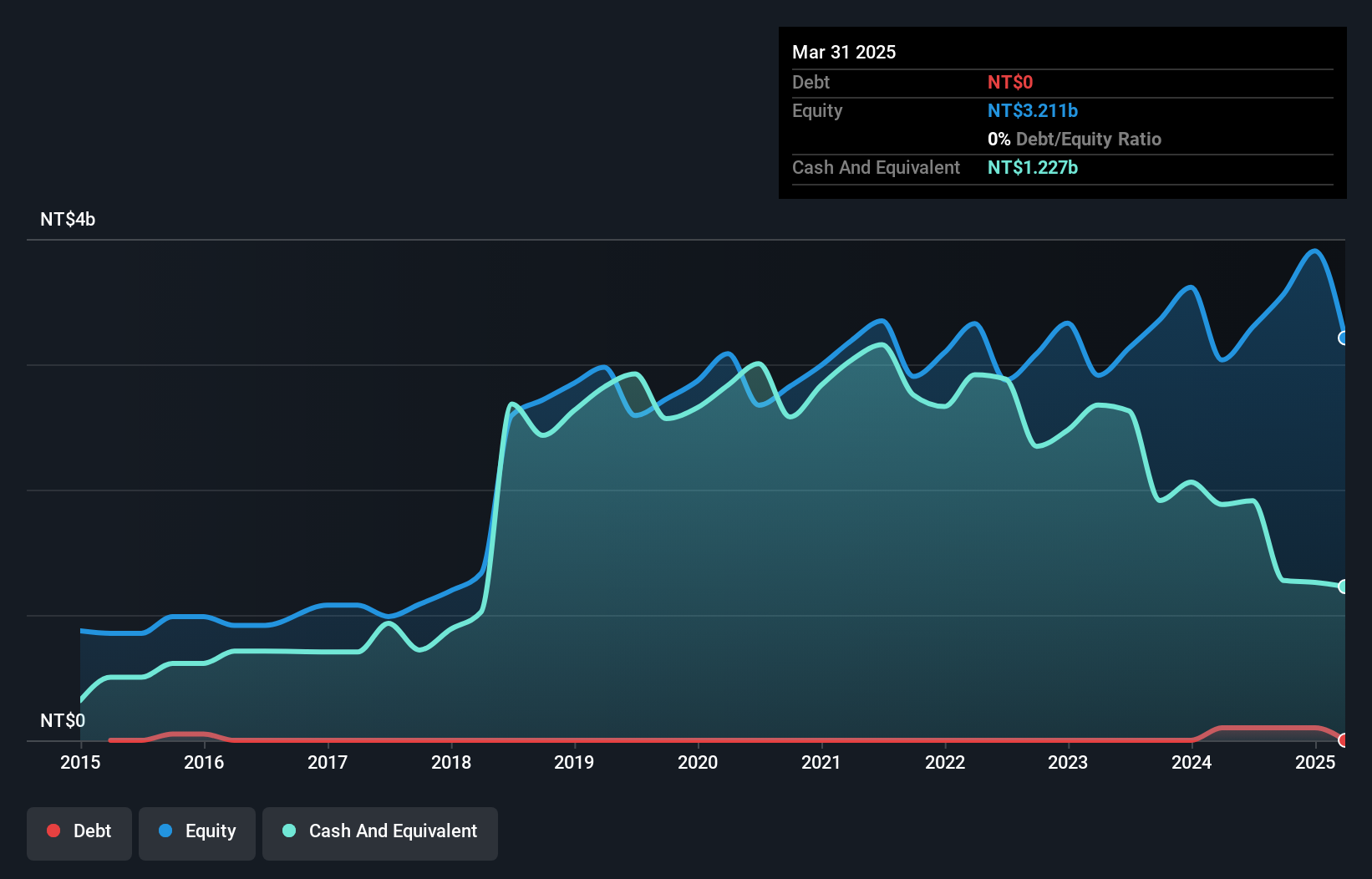

Operations: Chief Telecom generates revenue primarily from communications services, amounting to NT$3.58 billion. The company's net profit margin is a key financial indicator to consider when evaluating its profitability and efficiency.

Chief Telecom has demonstrated robust growth, with earnings rising 11.8% over the past year, outpacing the telecom industry's -26.4%. Trading at 51.5% below its estimated fair value, it offers an attractive proposition for investors seeking undervalued opportunities. The company's debt to equity ratio increased modestly to 2.8% over five years but remains well-managed as interest payments are covered 61 times by EBIT, indicating strong financial health. Recent leadership changes and strategic partnerships, such as Zettabyte's expansion at Chief Telecom's LY2 data center, underscore its commitment to innovation and sustainability in AI infrastructure development across Taiwan.

- Click to explore a detailed breakdown of our findings in Chief Telecom's health report.

Evaluate Chief Telecom's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4663 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002150

Jiangsu Tongrun Equipment TechnologyLtd

Engages in the research and development, production, and sales of photovoltaic energy storage equipment, components, and metal products in China.

High growth potential with proven track record.

Market Insights

Community Narratives