- China

- /

- Consumer Durables

- /

- SZSE:002032

Zhejiang Supor (SZSE:002032) Will Pay A Smaller Dividend Than Last Year

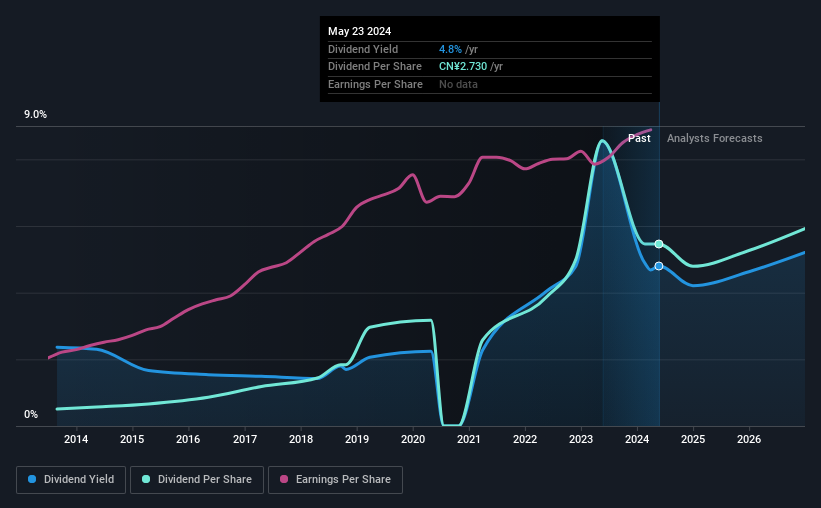

Zhejiang Supor Co., Ltd.'s (SZSE:002032) dividend is being reduced from last year's payment covering the same period to CN¥2.73 on the 28th of May. The dividend yield of 4.8% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for Zhejiang Supor

Zhejiang Supor Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 99% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

The next 12 months is set to see EPS grow by 22.0%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 99%, which probably can't continue without putting some pressure on the balance sheet.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of CN¥0.254 in 2014 to the most recent total annual payment of CN¥2.73. This means that it has been growing its distributions at 27% per annum over that time. Zhejiang Supor has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Zhejiang Supor has seen EPS rising for the last five years, at 5.6% per annum. While EPS is growing at a decent rate, but future growth could be limited by the amount of earnings being paid out to shareholders.

Zhejiang Supor's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Zhejiang Supor that investors should know about before committing capital to this stock. Is Zhejiang Supor not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Supor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002032

Zhejiang Supor

Engages in research and development, production, and distribution of kitchen utensils, stainless steel products, daily hardware, small domestic appliances, and cookware in China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives