- China

- /

- Consumer Durables

- /

- SZSE:000801

Sichuan Jiuzhou Electronic Co., Ltd. (SZSE:000801) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Sichuan Jiuzhou Electronic Co., Ltd. (SZSE:000801) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

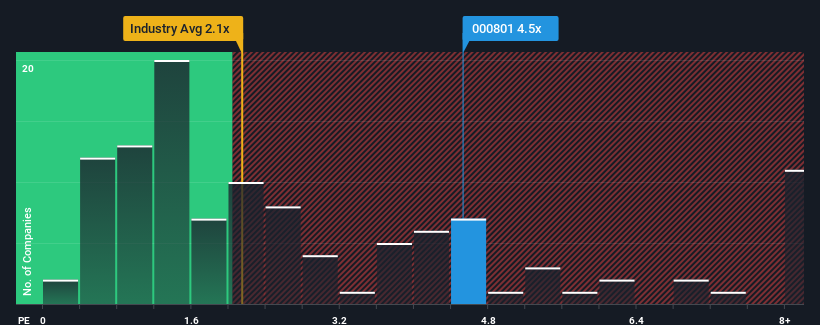

Since its price has surged higher, given around half the companies in China's Consumer Durables industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Sichuan Jiuzhou Electronic as a stock to avoid entirely with its 4.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sichuan Jiuzhou Electronic

What Does Sichuan Jiuzhou Electronic's P/S Mean For Shareholders?

For instance, Sichuan Jiuzhou Electronic's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Sichuan Jiuzhou Electronic, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sichuan Jiuzhou Electronic?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Sichuan Jiuzhou Electronic's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.7%. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 11% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Sichuan Jiuzhou Electronic's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Sichuan Jiuzhou Electronic's P/S?

Sichuan Jiuzhou Electronic's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sichuan Jiuzhou Electronic revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Sichuan Jiuzhou Electronic has 3 warning signs (and 1 which is concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000801

Sichuan Jiuzhou Electronic

Engages in the technology research and development, product manufacturing, and sale of intelligent terminals, air traffic control products, and microwave radio frequency products in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives