- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2428

Asian Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by trade tensions and monetary policy shifts, Asia's economic landscape remains a focal point for investors seeking stability and growth. In this environment, dividend stocks can offer a compelling proposition, providing regular income streams while potentially benefiting from the region's evolving economic dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.08% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.89% | ★★★★★★ |

| NCD (TSE:4783) | 4.20% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.00% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

Click here to see the full list of 1060 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

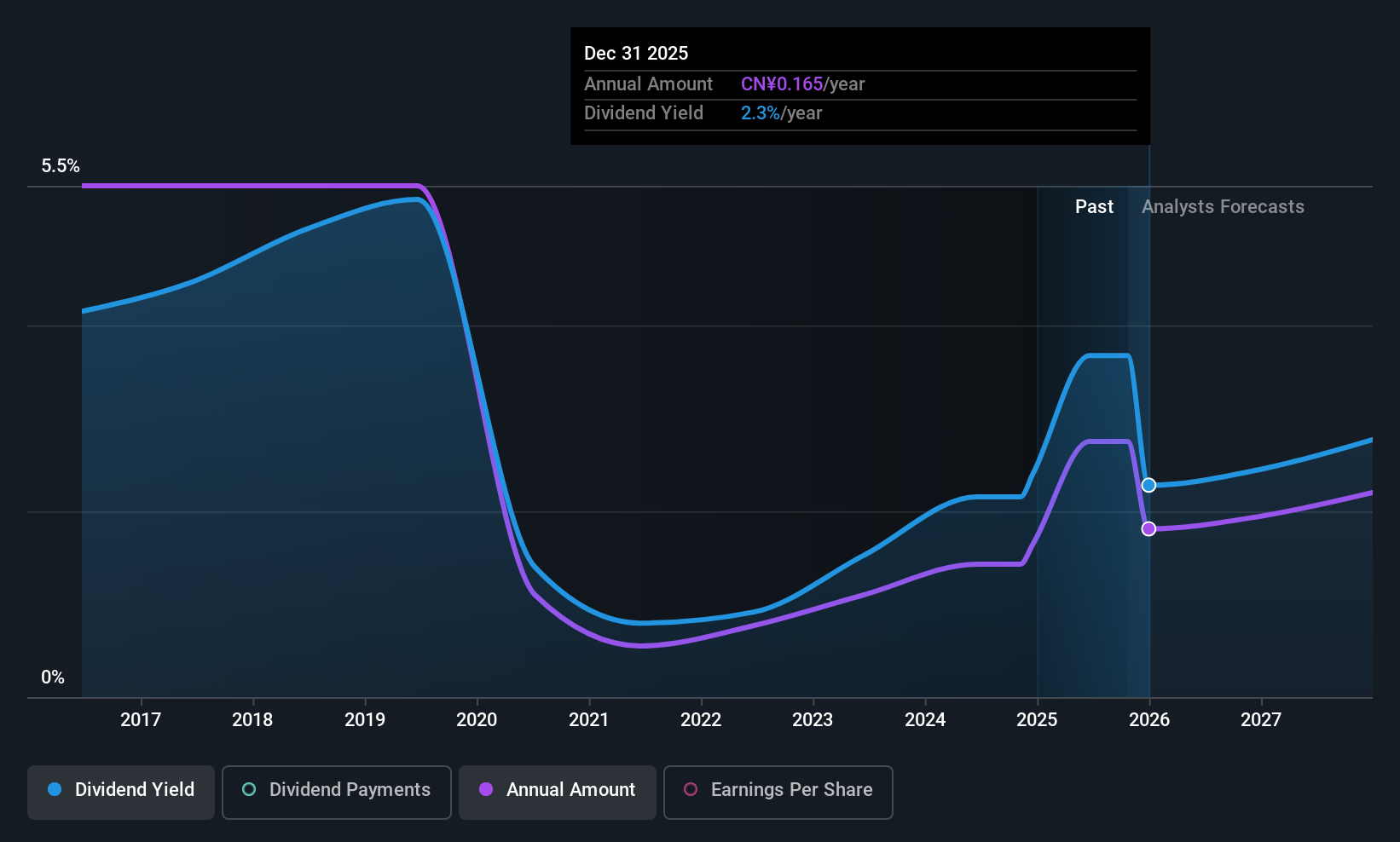

Lu Thai Textile (SZSE:000726)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lu Thai Textile Co., Ltd. produces and sells yarn-dyed fabrics, shirts, and garments across various international markets including Mainland China, Japan, South Korea, Southeast Asia, Europe, and the United States with a market cap of CN¥5.43 billion.

Operations: Lu Thai Textile Co., Ltd.'s revenue primarily comes from its Textile and Apparel segment, which generated CN¥5.70 billion, followed by the Electricity and Steam segment with CN¥234.20 million.

Dividend Yield: 3.4%

Lu Thai Textile's dividend payments are well-supported by earnings and cash flows, with payout ratios of 34.4% and 22.4%, respectively. Despite a history of volatility in dividend payments over the past decade, recent affirmations include a proposed CNY1 per 10 shares for the first half of 2025. The company's net income more than doubled year-on-year to CNY360.22 million, indicating strong financial health that could support future dividends despite past inconsistencies.

- Dive into the specifics of Lu Thai Textile here with our thorough dividend report.

- The valuation report we've compiled suggests that Lu Thai Textile's current price could be quite moderate.

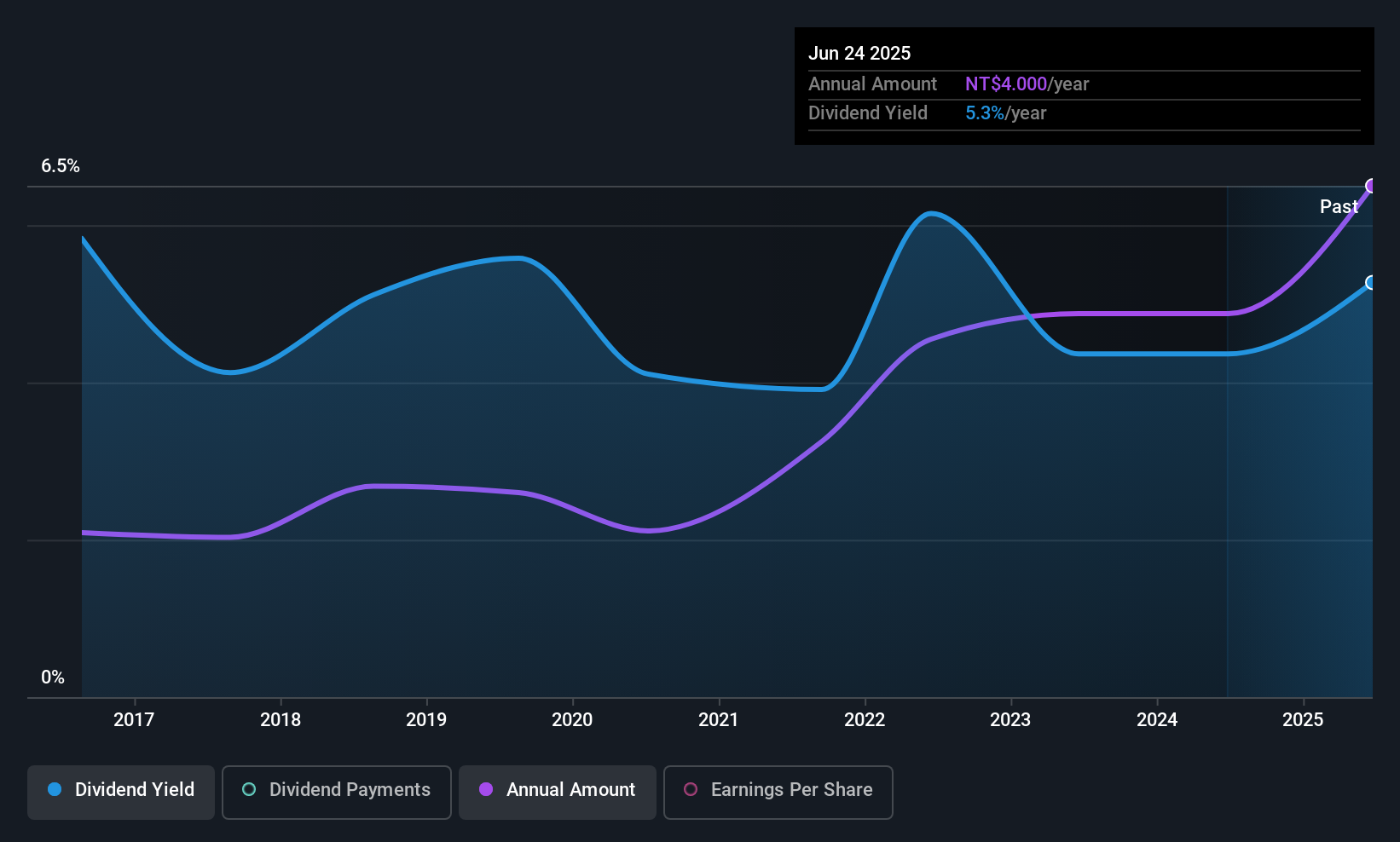

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal integrated circuits to various clients including integrated device manufacturers and fabless design companies across global markets; it has a market cap of NT$39.86 billion.

Operations: Ardentec Corporation's revenue segments include NT$8.11 billion from Ardentec Corporation and NT$4.27 billion from Quanzhi Technology (Shares) Company.

Dividend Yield: 4.8%

Ardentec's dividend payments are supported by earnings and cash flows, with payout ratios of 87.3% and 86.5%, respectively. Despite a volatile dividend history over the past decade, recent financials show stable growth, with second-quarter net income rising to TWD 563.3 million from TWD 551.4 million year-on-year. However, its current yield of 4.76% is below the top quartile in Taiwan's market, reflecting potential limitations in competitive dividend returns despite good relative value among peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Ardentec.

- Our valuation report unveils the possibility Ardentec's shares may be trading at a discount.

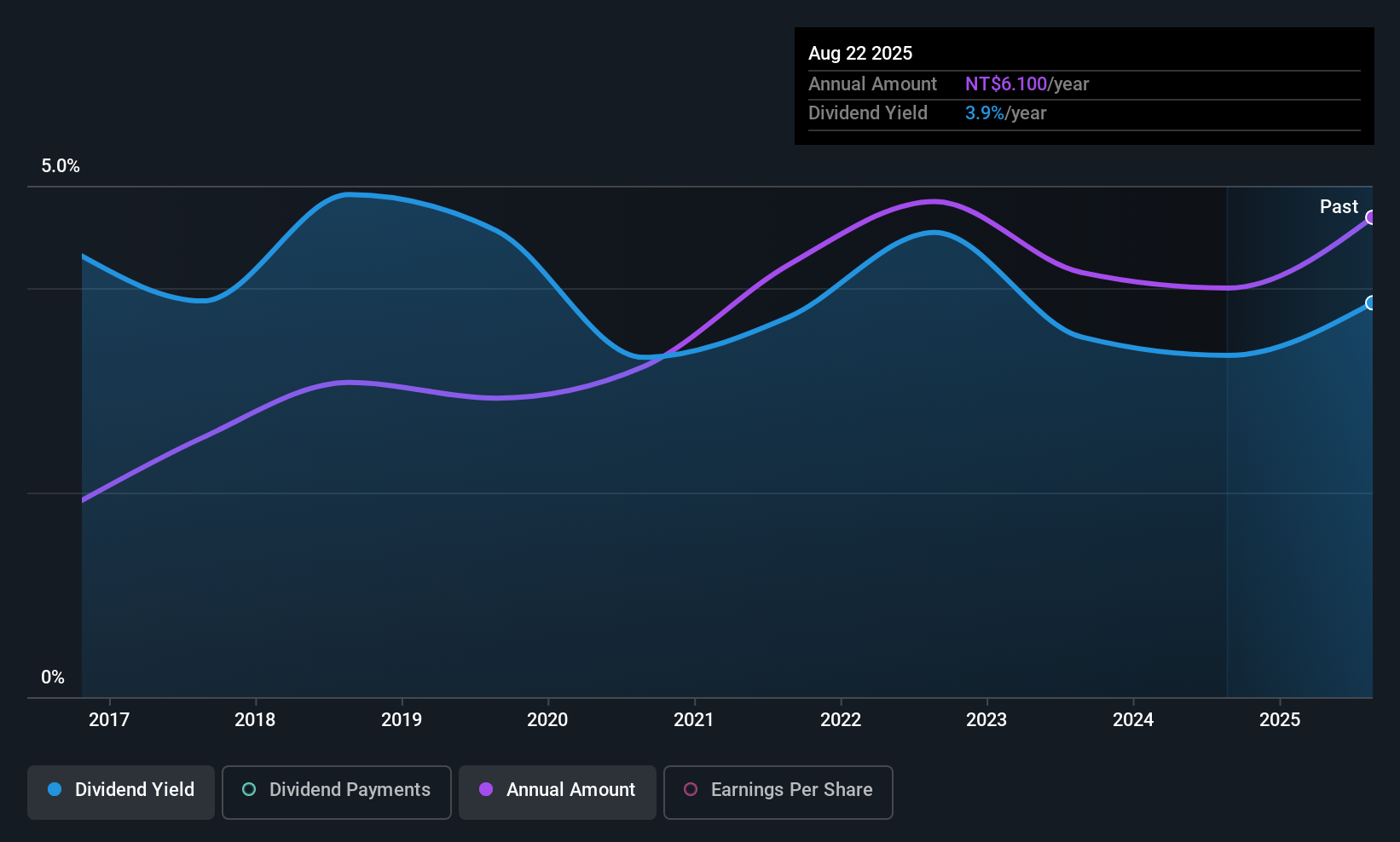

Thinking Electronic Industrial (TWSE:2428)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Thinking Electronic Industrial Co., Ltd. is engaged in the manufacturing, processing, and selling of electric devices, thermistors, varistors, and wires across Taiwan, China, Europe, and other international markets, with a market cap of NT$23.83 billion.

Operations: Thinking Electronic Industrial Co., Ltd. generates revenue from its main segments, including NT$3.81 billion from The Company and NT$3.05 billion from Thinking(Changzhou) Electronic Co., Ltd.

Dividend Yield: 3.3%

Thinking Electronic Industrial's dividend strategy is supported by a payout ratio of 53.9%, indicating dividends are well-covered by earnings and cash flows. Despite a decline in recent net income, the company's dividends have been stable and reliable over the past decade, with consistent growth. However, its current yield of 3.28% is lower than Taiwan's top quartile benchmark of 5.33%. The stock offers reasonable value with a price-to-earnings ratio below the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Thinking Electronic Industrial.

- The analysis detailed in our Thinking Electronic Industrial valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1060 companies within our Top Asian Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thinking Electronic Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2428

Thinking Electronic Industrial

Manufactures, processes, and sells electric devices, thermistors, varistors, and wires in Taiwan, China, Europe, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives