- China

- /

- Consumer Durables

- /

- SHSE:688696

Xgimi Technology Co.,Ltd. (SHSE:688696) Might Not Be As Mispriced As It Looks After Plunging 28%

Xgimi Technology Co.,Ltd. (SHSE:688696) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

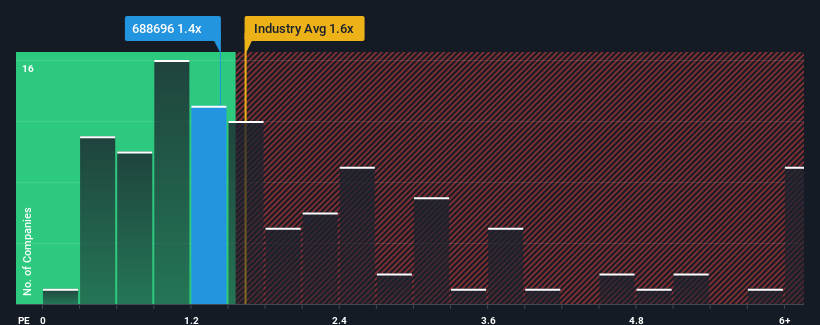

In spite of the heavy fall in price, it's still not a stretch to say that Xgimi TechnologyLtd's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in China, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Xgimi TechnologyLtd

What Does Xgimi TechnologyLtd's P/S Mean For Shareholders?

Xgimi TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xgimi TechnologyLtd.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Xgimi TechnologyLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 11% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Xgimi TechnologyLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Xgimi TechnologyLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Xgimi TechnologyLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Xgimi TechnologyLtd that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688696

Xgimi TechnologyLtd

Designs, manufactures, and sells multi-functional smart projectors and laser TVs in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives