- China

- /

- Consumer Durables

- /

- SHSE:688696

A Piece Of The Puzzle Missing From Xgimi Technology Co.,Ltd.'s (SHSE:688696) 25% Share Price Climb

Xgimi Technology Co.,Ltd. (SHSE:688696) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

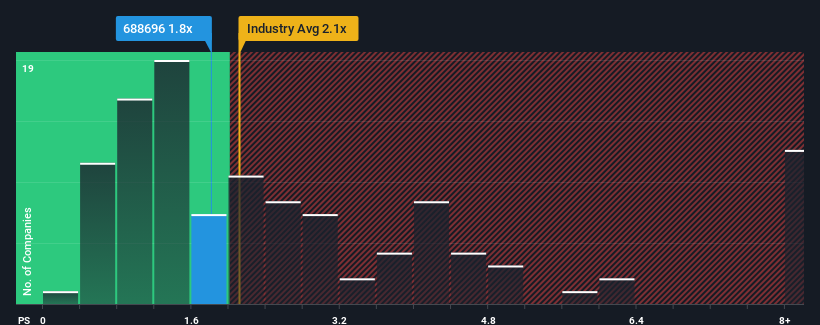

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Xgimi TechnologyLtd's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in China is also close to 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Xgimi TechnologyLtd

What Does Xgimi TechnologyLtd's P/S Mean For Shareholders?

Xgimi TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Xgimi TechnologyLtd will help you uncover what's on the horizon.How Is Xgimi TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Xgimi TechnologyLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 9.2% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 14% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Xgimi TechnologyLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Xgimi TechnologyLtd's P/S

Xgimi TechnologyLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Xgimi TechnologyLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 1 warning sign for Xgimi TechnologyLtd that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688696

Xgimi TechnologyLtd

Designs, manufactures, and sells multi-functional smart projectors and laser TVs in China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives