- China

- /

- Consumer Durables

- /

- SHSE:605318

Subdued Growth No Barrier To Fsilon Furnishing and Construction Materials Corporation (SHSE:605318) With Shares Advancing 27%

Fsilon Furnishing and Construction Materials Corporation (SHSE:605318) shares have continued their recent momentum with a 27% gain in the last month alone. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

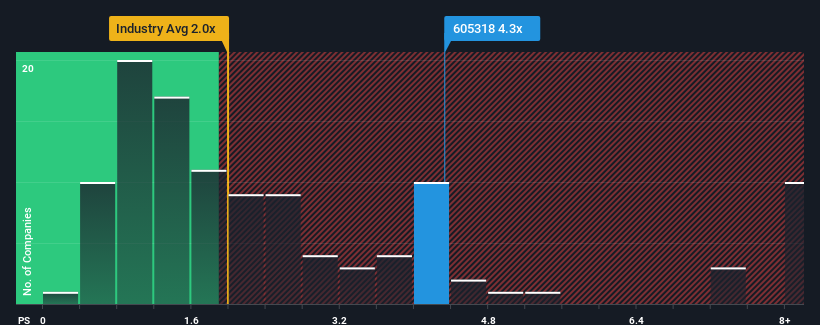

Following the firm bounce in price, when almost half of the companies in China's Consumer Durables industry have price-to-sales ratios (or "P/S") below 2x, you may consider Fsilon Furnishing and Construction Materials as a stock not worth researching with its 4.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Fsilon Furnishing and Construction Materials

How Has Fsilon Furnishing and Construction Materials Performed Recently?

We'd have to say that with no tangible growth over the last year, Fsilon Furnishing and Construction Materials' revenue has been unimpressive. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Fsilon Furnishing and Construction Materials, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Fsilon Furnishing and Construction Materials?

Fsilon Furnishing and Construction Materials' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 8.9% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Fsilon Furnishing and Construction Materials' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Fsilon Furnishing and Construction Materials' P/S?

The strong share price surge has lead to Fsilon Furnishing and Construction Materials' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Fsilon Furnishing and Construction Materials currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 3 warning signs for Fsilon Furnishing and Construction Materials (2 make us uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Fsilon Furnishing and Construction Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605318

Fsilon Furnishing and Construction Materials

Engages in the research and development, production, and sale of integrated ceiling, integrated wall, and other products in Russia, East Asia, Southeast Asia, and internationally.

Mediocre balance sheet very low.

Market Insights

Community Narratives