- China

- /

- Aerospace & Defense

- /

- SHSE:688510

Spotlighting December 2024's Undiscovered Gems with Potential

Reviewed by Simply Wall St

In a global market characterized by the divergence of major indexes, with the S&P 500 and Nasdaq hitting record highs while small-cap stocks like those in the Russell 2000 face recent declines, investors are keenly observing economic indicators such as job growth and interest rate expectations to gauge future opportunities. Amidst this backdrop, identifying promising small-cap stocks requires careful consideration of their resilience to broader market volatility, potential for growth within niche markets, and ability to capitalize on favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shuhua Sports (SHSE:605299)

Simply Wall St Value Rating: ★★★★★★

Overview: Shuhua Sports Co., Ltd. is involved in the production and sale of fitness equipment both within China and internationally, with a market capitalization of CN¥3.68 billion.

Operations: Shuhua Sports generates revenue primarily from the sale of fitness equipment in both domestic and international markets. The company's cost structure includes production expenses, which directly impact its profitability.

Shuhua Sports, a smaller player in the sports equipment sector, showcases a mixed financial landscape. Over the past year, earnings growth hit 19.4%, outpacing the leisure industry average of -0.7%. The company's price-to-earnings ratio stands at 29.9x, which is favorable compared to the CN market's 37.6x. Despite these positives, recent earnings reports for nine months ending September 2024 revealed sales of CNY 904 million and net income of CNY 50.82 million—both slightly lower than last year's figures of CNY 917.55 million and CNY 56.88 million respectively—indicating potential challenges ahead in maintaining momentum amidst competitive pressures.

Wuxi HyatechLtd (SHSE:688510)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Hyatech Co., Ltd. is engaged in the research, development, manufacturing, and sale of aero-engine parts and forged medical orthopedic implants both in China and internationally, with a market capitalization of CN¥4.65 billion.

Operations: Wuxi Hyatech generates revenue primarily from the sale of aero-engine parts and forged medical orthopedic implants. The company's financial performance is influenced by its cost structure, which includes expenses related to research, development, and manufacturing processes.

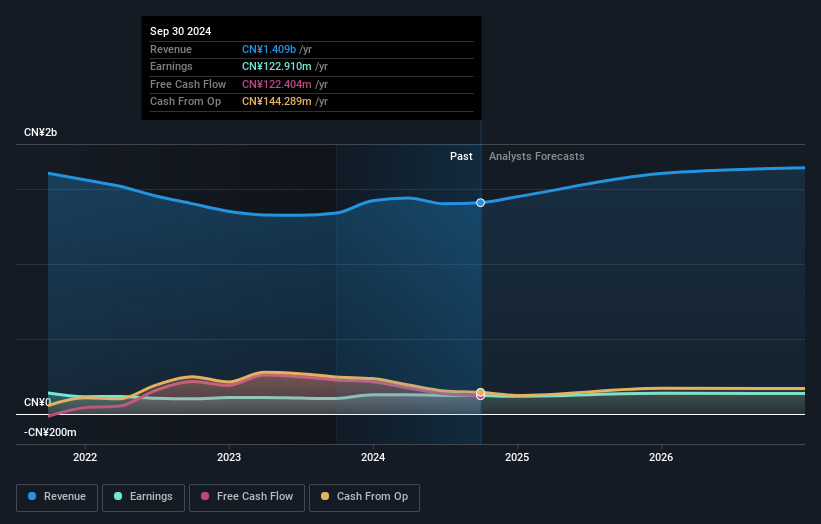

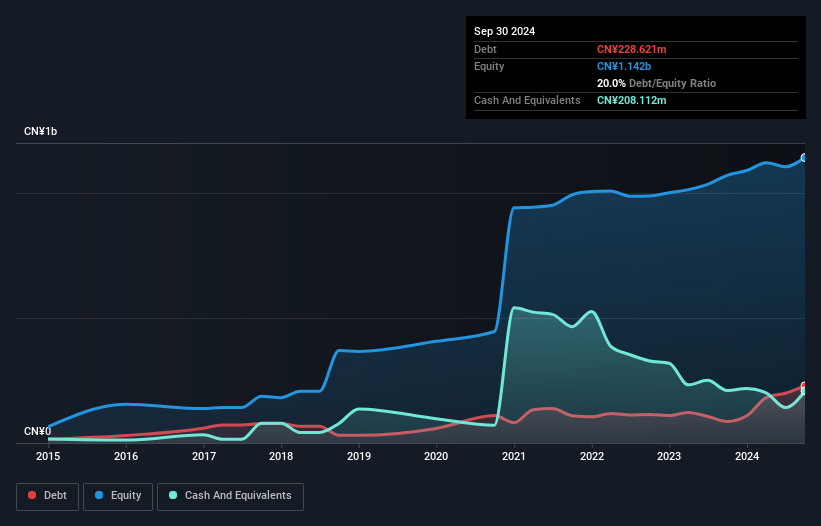

Wuxi Hyatech, a smaller player in the Aerospace & Defense sector, has shown impressive earnings growth of 40.5% over the past year, outpacing industry norms. The company boasts a satisfactory net debt to equity ratio of 1.8%, indicating sound financial health. Its price-to-earnings ratio stands at 41x, which is attractive compared to the industry average of 69.6x. Recent results highlight sales reaching CNY 520 million and net income hitting CNY 92.75 million for nine months ending September 2024, reflecting significant improvement from last year’s figures of CNY 399 million in sales and CNY 69.48 million in net income.

- Click here and access our complete health analysis report to understand the dynamics of Wuxi HyatechLtd.

Assess Wuxi HyatechLtd's past performance with our detailed historical performance reports.

Wuxi ETEK MicroelectronicsLtd (SHSE:688601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi ETEK Micro-Electronics Co., Ltd. specializes in the manufacturing of analog integrated circuits and has a market capitalization of approximately CN¥6.49 billion.

Operations: Wuxi ETEK generates revenue primarily from its integrated circuit segment, amounting to CN¥854.86 million. The company shows a focus on this core segment, with minimal adjustments noted in the financials.

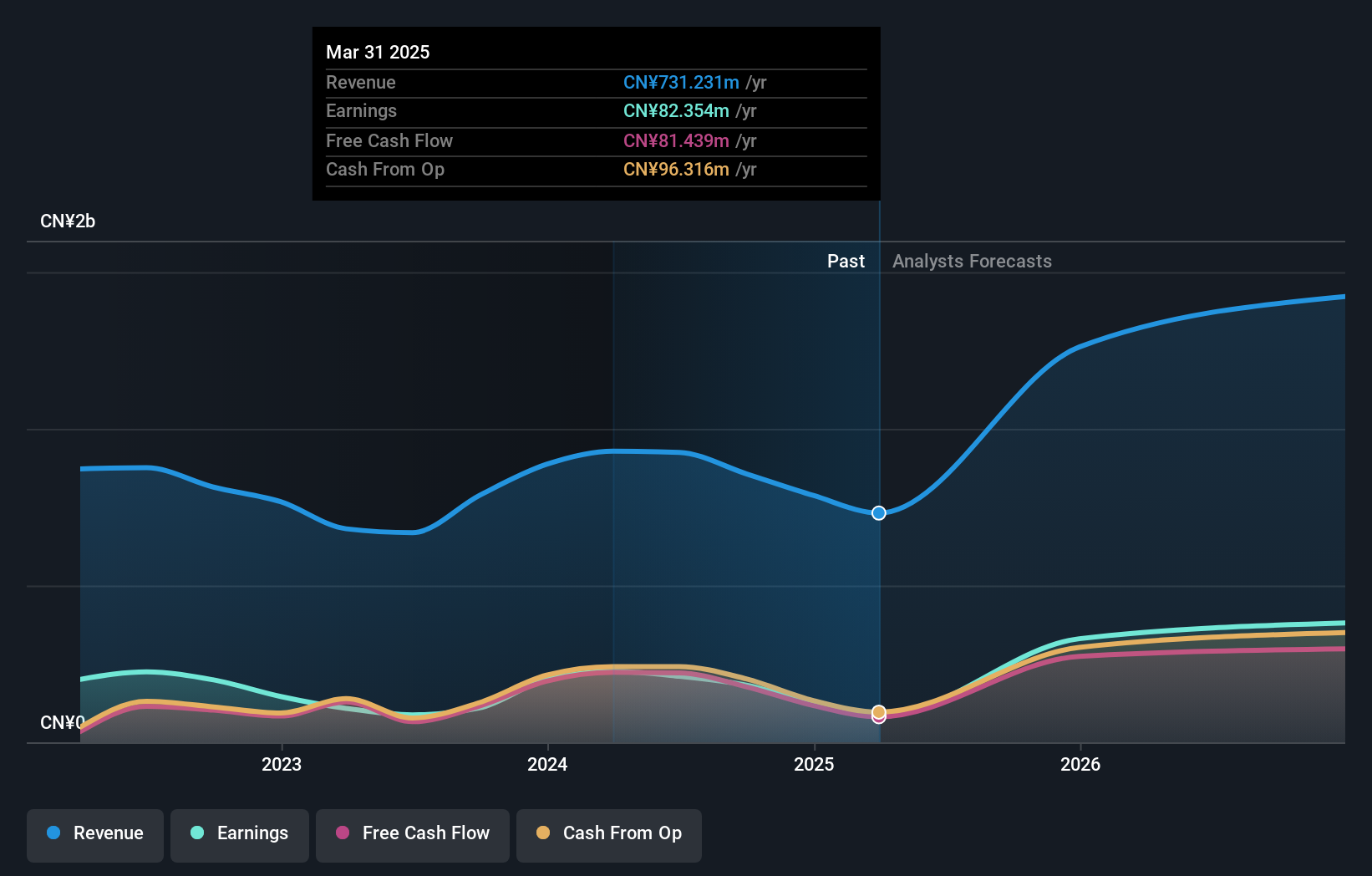

Wuxi ETEK Microelectronics, a semiconductor player, has shown promising growth with earnings surging 66% over the past year, outpacing the industry average of 12%. The company trades at a price-to-earnings ratio of 35.6x, slightly below the CN market's 37.6x, indicating good relative value. Despite recent volatility in its share price over three months, Wuxi ETEK remains profitable and free cash flow positive. Recent buyback activities saw them repurchase about 930,000 shares for CNY 40.19 million to bolster shareholder value amidst a reported net income dip to CNY 100 million from last year's CNY 119 million for nine months ending September.

Where To Now?

- Investigate our full lineup of 4626 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi HyatechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688510

Wuxi HyatechLtd

Research, develops, manufactures, and sells aero-engine parts and forged medical orthopedic implants in China and internationally.

High growth potential with excellent balance sheet.