- China

- /

- Consumer Durables

- /

- SHSE:603818

Improved Revenues Required Before Qu Mei Home Furnishings Group Co.,Ltd (SHSE:603818) Shares Find Their Feet

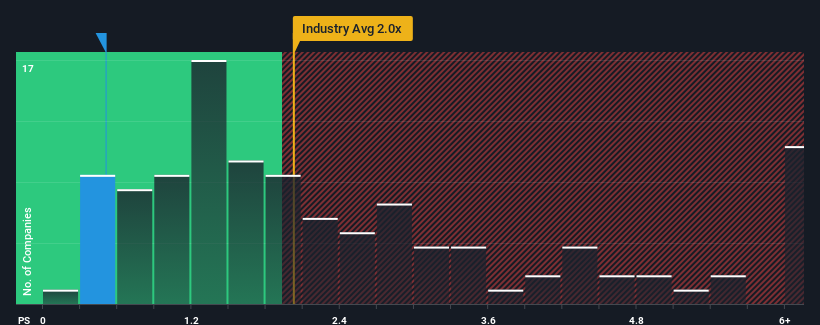

When you see that almost half of the companies in the Consumer Durables industry in China have price-to-sales ratios (or "P/S") above 2x, Qu Mei Home Furnishings Group Co.,Ltd (SHSE:603818) looks to be giving off some buy signals with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Qu Mei Home Furnishings GroupLtd

How Has Qu Mei Home Furnishings GroupLtd Performed Recently?

For instance, Qu Mei Home Furnishings GroupLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Qu Mei Home Furnishings GroupLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Qu Mei Home Furnishings GroupLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. This means it has also seen a slide in revenue over the longer-term as revenue is down 3.3% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Qu Mei Home Furnishings GroupLtd's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Qu Mei Home Furnishings GroupLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You always need to take note of risks, for example - Qu Mei Home Furnishings GroupLtd has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Qu Mei Home Furnishings GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qu Mei Home Furnishings GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603818

Qu Mei Home Furnishings GroupLtd

Research, develops, designs, manufactures, and sells home furnishing products in China.

Good value with moderate growth potential.

Market Insights

Community Narratives