- China

- /

- Consumer Durables

- /

- SHSE:603657

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) Stock Rockets 27% But Many Are Still Ignoring The Company

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

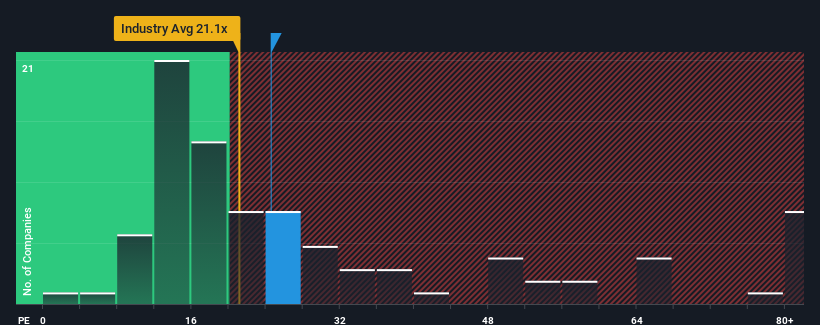

Even after such a large jump in price, Jinhua Chunguang TechnologyLtd's price-to-earnings (or "P/E") ratio of 24.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Jinhua Chunguang TechnologyLtd as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Jinhua Chunguang TechnologyLtd

Is There Any Growth For Jinhua Chunguang TechnologyLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jinhua Chunguang TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. This means it has also seen a slide in earnings over the longer-term as EPS is down 53% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 156% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Jinhua Chunguang TechnologyLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Jinhua Chunguang TechnologyLtd's P/E

Despite Jinhua Chunguang TechnologyLtd's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jinhua Chunguang TechnologyLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Jinhua Chunguang TechnologyLtd that you need to take into consideration.

If you're unsure about the strength of Jinhua Chunguang TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603657

Jinhua Chunguang TechnologyLtd

Engages in the research and development, production, and sales of cleaning appliance hoses, accessories and complete machine ODM/OEM products in China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives