Mubang High-Tech Co.,Ltd. (SHSE:603398) Looks Just Right With A 28% Price Jump

Mubang High-Tech Co.,Ltd. (SHSE:603398) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

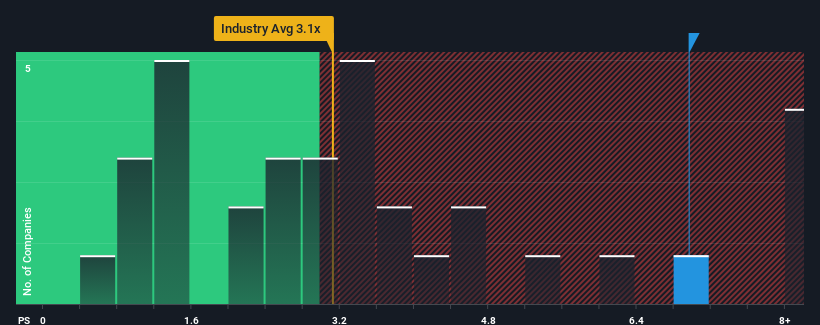

Following the firm bounce in price, you could be forgiven for thinking Mubang High-TechLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7x, considering almost half the companies in China's Leisure industry have P/S ratios below 3.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Mubang High-TechLtd

How Has Mubang High-TechLtd Performed Recently?

Recent times have been quite advantageous for Mubang High-TechLtd as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Mubang High-TechLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Mubang High-TechLtd's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Mubang High-TechLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. The strong recent performance means it was also able to grow revenue by 141% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 20% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Mubang High-TechLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Mubang High-TechLtd's P/S?

Shares in Mubang High-TechLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Mubang High-TechLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Mubang High-TechLtd is showing 3 warning signs in our investment analysis, and 2 of those are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603398

Mubang High-TechLtd

Researches, develops, produces, and sells educational plastic block and infant preschool building block toys in China.

Low risk with worrying balance sheet.

Market Insights

Community Narratives