- China

- /

- Consumer Durables

- /

- SHSE:603219

Ningbo Fujia Industrial Co., Ltd.'s (SHSE:603219) Share Price Not Quite Adding Up

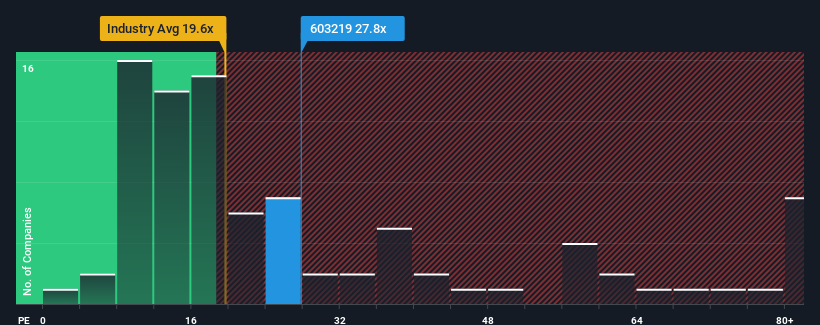

There wouldn't be many who think Ningbo Fujia Industrial Co., Ltd.'s (SHSE:603219) price-to-earnings (or "P/E") ratio of 27.8x is worth a mention when the median P/E in China is similar at about 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Ningbo Fujia Industrial could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Ningbo Fujia Industrial

How Is Ningbo Fujia Industrial's Growth Trending?

In order to justify its P/E ratio, Ningbo Fujia Industrial would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.8%. Still, the latest three year period has seen an excellent 35% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 8.4% over the next year. Meanwhile, the rest of the market is forecast to expand by 36%, which is noticeably more attractive.

With this information, we find it interesting that Ningbo Fujia Industrial is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Ningbo Fujia Industrial's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Ningbo Fujia Industrial currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Ningbo Fujia Industrial that you should be aware of.

If these risks are making you reconsider your opinion on Ningbo Fujia Industrial, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Fujia Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603219

Ningbo Fujia Industrial

Manufactures and sells vacuum cleaners, motors, and vacuum cleaner spare parts in China.

Flawless balance sheet low.

Market Insights

Community Narratives