ZheJiang AoKang ShoesLtd (SHSE:603001) spikes 14% this week, taking one-year gains to 26%

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the ZheJiang AoKang Shoes Co.,Ltd. (SHSE:603001) share price is 22% higher than it was a year ago, much better than the market return of around 9.8% (not including dividends) in the same period. So that should have shareholders smiling. Unfortunately the longer term returns are not so good, with the stock falling 19% in the last three years.

The past week has proven to be lucrative for ZheJiang AoKang ShoesLtd investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for ZheJiang AoKang ShoesLtd

Given that ZheJiang AoKang ShoesLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

ZheJiang AoKang ShoesLtd actually shrunk its revenue over the last year, with a reduction of 11%. The stock is up 22% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

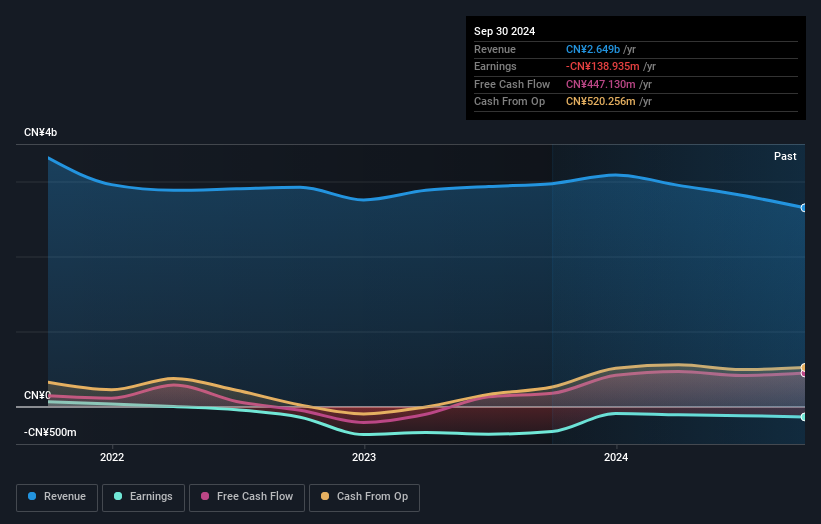

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for ZheJiang AoKang ShoesLtd the TSR over the last 1 year was 26%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that ZheJiang AoKang ShoesLtd has rewarded shareholders with a total shareholder return of 26% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 0.5% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - ZheJiang AoKang ShoesLtd has 2 warning signs (and 1 which is significant) we think you should know about.

We will like ZheJiang AoKang ShoesLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if ZheJiang AoKang ShoesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603001

ZheJiang AoKang ShoesLtd

Manufactures, sells, and retails shoes, clothes, leather goods, hats, bags, and other products in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives