- China

- /

- General Merchandise and Department Stores

- /

- SZSE:002640

Global Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

Global markets have recently experienced a downturn, with AI-related concerns weighing heavily on investor sentiment and leading to losses across major indices. Despite the broader market challenges, penny stocks continue to capture attention as potential investment opportunities due to their unique position in the financial landscape. Though often overlooked, these smaller or newer companies can offer significant growth potential when backed by solid financials. In this article, we will highlight several penny stocks that stand out for their balance sheet strength and long-term promise.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.695 | £535.43M | ✅ 4 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.655 | $380.77M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,573 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd, with a market cap of CN¥4.43 billion, is engaged in the production and sale of yarns in China.

Operations: No revenue segments have been reported.

Market Cap: CN¥4.43B

Zhewen Pictures Group Co., Ltd has demonstrated a steady financial performance with sales reaching CN¥2.74 billion for the first nine months of 2025, slightly up from the previous year. Despite a modest earnings growth of 1% over the past year, this is below its impressive five-year average growth rate. The company maintains a healthy balance sheet, with short-term assets exceeding both short and long-term liabilities and more cash than total debt. However, management and board inexperience may pose challenges. The stock's price-to-earnings ratio suggests it is valued attractively compared to the broader Chinese market.

- Click here to discover the nuances of Zhewen Pictures Groupltd with our detailed analytical financial health report.

- Examine Zhewen Pictures Groupltd's past performance report to understand how it has performed in prior years.

Yotrio Group (SZSE:002489)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yotrio Group Co., Ltd. manufactures and sells outdoor furniture products across China, Europe, North and South America, Australia, Asia, Africa, and internationally with a market cap of CN¥8.44 billion.

Operations: No specific revenue segments are reported.

Market Cap: CN¥8.44B

Yotrio Group has shown robust financial growth, with earnings increasing by 43.1% over the past year, surpassing the Leisure industry's average. The company reported sales of CN¥3.47 billion for the first nine months of 2025, up from CN¥3.30 billion a year earlier, and net income rose to CN¥678.61 million from CN¥487.45 million last year. Despite a low return on equity at 14.2%, Yotrio maintains strong financial health with short-term assets covering both short and long-term liabilities and more cash than debt, though operating cash flow does not sufficiently cover its debt obligations.

- Jump into the full analysis health report here for a deeper understanding of Yotrio Group.

- Explore historical data to track Yotrio Group's performance over time in our past results report.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Top E-Commerce Co., Ltd. is a cross-border e-commerce company operating in China and internationally, with a market cap of CN¥7.21 billion.

Operations: No revenue segments are reported for Global Top E-Commerce Co., Ltd.

Market Cap: CN¥7.21B

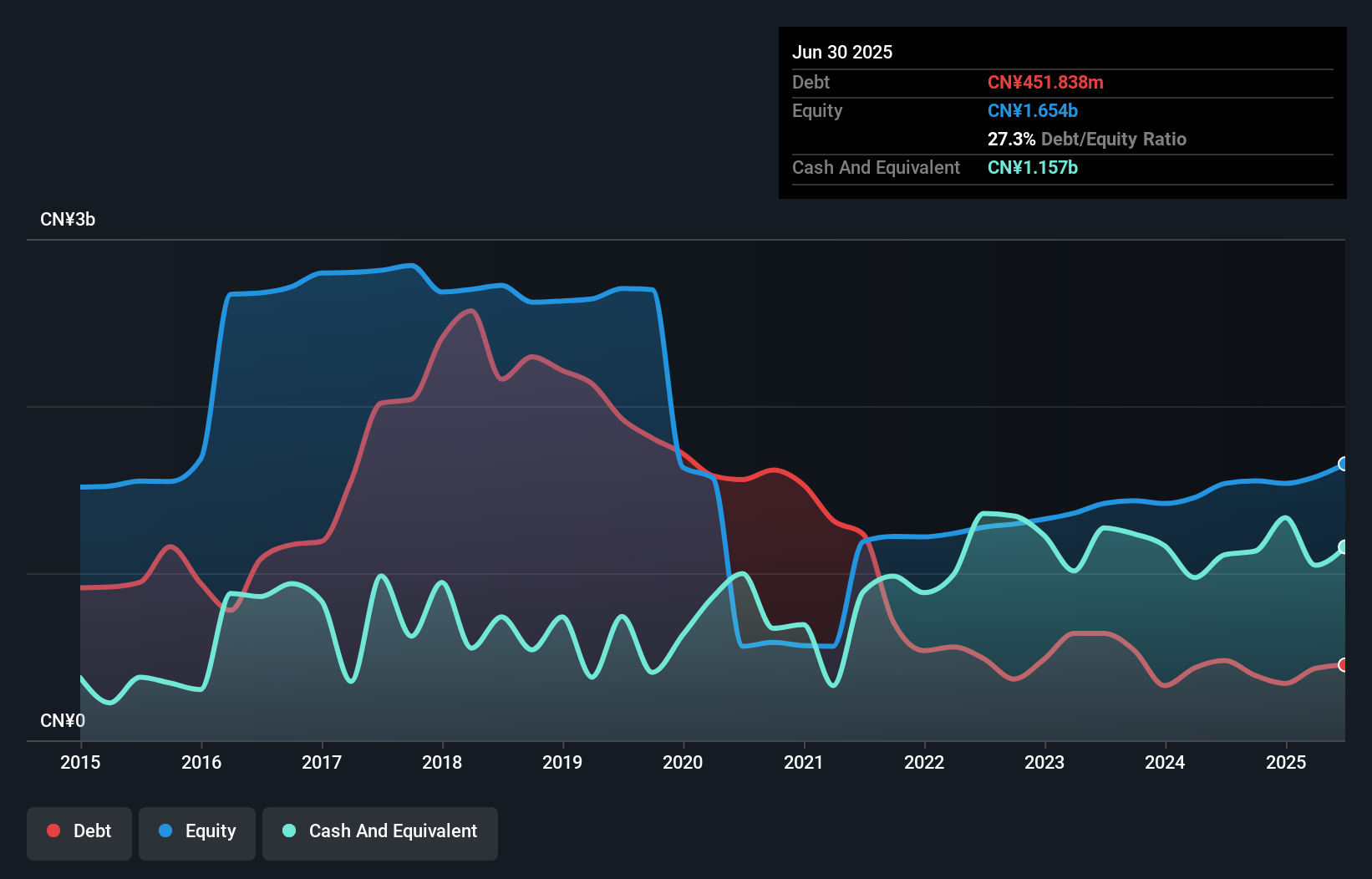

Global Top E-Commerce Co., Ltd. is currently unprofitable but has managed to reduce its losses by 50.1% annually over the past five years, showing potential for improvement. The company is debt-free and holds short-term assets of CN¥2 billion, though these do not fully cover its short-term liabilities of CN¥2.1 billion. Despite a negative return on equity of -56.9%, it benefits from an experienced board with an average tenure of 3.9 years and a stable cash runway exceeding three years if free cash flow continues growing at historical rates, offering some financial stability amidst ongoing challenges in profitability and management experience.

- Navigate through the intricacies of Global Top E-Commerce with our comprehensive balance sheet health report here.

- Evaluate Global Top E-Commerce's historical performance by accessing our past performance report.

Make It Happen

- Navigate through the entire inventory of 3,573 Global Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002640

Global Top E-Commerce

Operates as a cross-border e-commerce company in the People’s Republic of China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.