Earnings Not Telling The Story For Zhewen Pictures Group co.,ltd (SHSE:601599) After Shares Rise 25%

Zhewen Pictures Group co.,ltd (SHSE:601599) shares have continued their recent momentum with a 25% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.0% over the last year.

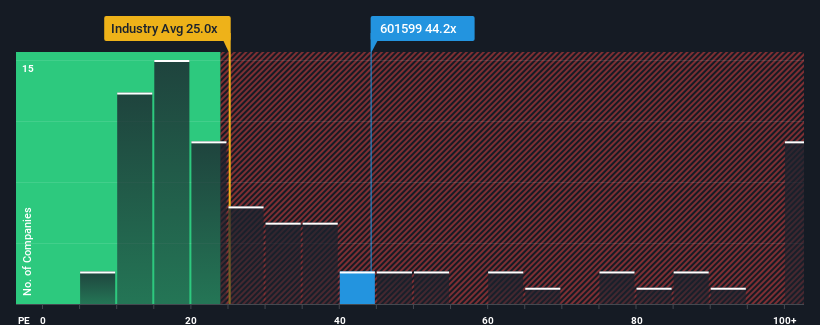

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 37x, you may consider Zhewen Pictures Groupltd as a stock to potentially avoid with its 44.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

The earnings growth achieved at Zhewen Pictures Groupltd over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Zhewen Pictures Groupltd

How Is Zhewen Pictures Groupltd's Growth Trending?

In order to justify its P/E ratio, Zhewen Pictures Groupltd would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a decent 9.1% gain to the company's bottom line. Pleasingly, EPS has also lifted 121% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Zhewen Pictures Groupltd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Zhewen Pictures Groupltd's P/E

The large bounce in Zhewen Pictures Groupltd's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhewen Pictures Groupltd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Zhewen Pictures Groupltd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhewen Pictures Groupltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601599

Zhewen Pictures Groupltd

Zhewen Pictures Group co., ltd produces and sells yarns in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.