- China

- /

- Electronic Equipment and Components

- /

- SZSE:002512

3 Promising Global Penny Stocks With At Least US$500M Market Cap

Reviewed by Simply Wall St

Global markets have experienced a volatile week, with U.S. stocks rebounding after a sharp sell-off and dovish signals from Federal Reserve officials suggesting potential monetary policy easing. For investors exploring beyond the major indices, penny stocks—typically representing smaller or newer companies—continue to hold relevance as an investment area despite their somewhat outdated label. This article will explore three penny stocks that demonstrate financial strength and offer promising opportunities in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$419.88M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.57 | MYR289.83M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.15 | SGD466.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.25 | MYR501.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.27 | SGD12.87B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.545 | $316.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,576 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd. operates in China, focusing on the production and sale of yarns, with a market capitalization of CN¥4.21 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥4.21B

Zhewen Pictures Group Co., Ltd. has demonstrated stable performance with sales reaching CN¥1.76 billion for the first half of 2025, up from CN¥1.6 billion a year prior, although net income slightly decreased to CN¥115.58 million from CN¥120.77 million. The company maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities, and its debt is well covered by operating cash flow at 56.9%. Despite low return on equity at 7.2%, Zhewen's price-to-earnings ratio of 38.4x suggests it may be undervalued relative to the broader Chinese market average of 44.9x.

- Unlock comprehensive insights into our analysis of Zhewen Pictures Groupltd stock in this financial health report.

- Gain insights into Zhewen Pictures Groupltd's past trends and performance with our report on the company's historical track record.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Infund Holding Co., Ltd. operates in China, focusing on the micro enameled wire and veterinary vaccine sectors, with a market cap of CN¥4.02 billion.

Operations: The company's revenue is primarily derived from its Biological Products Business, which generated CN¥42.77 million.

Market Cap: CN¥4.02B

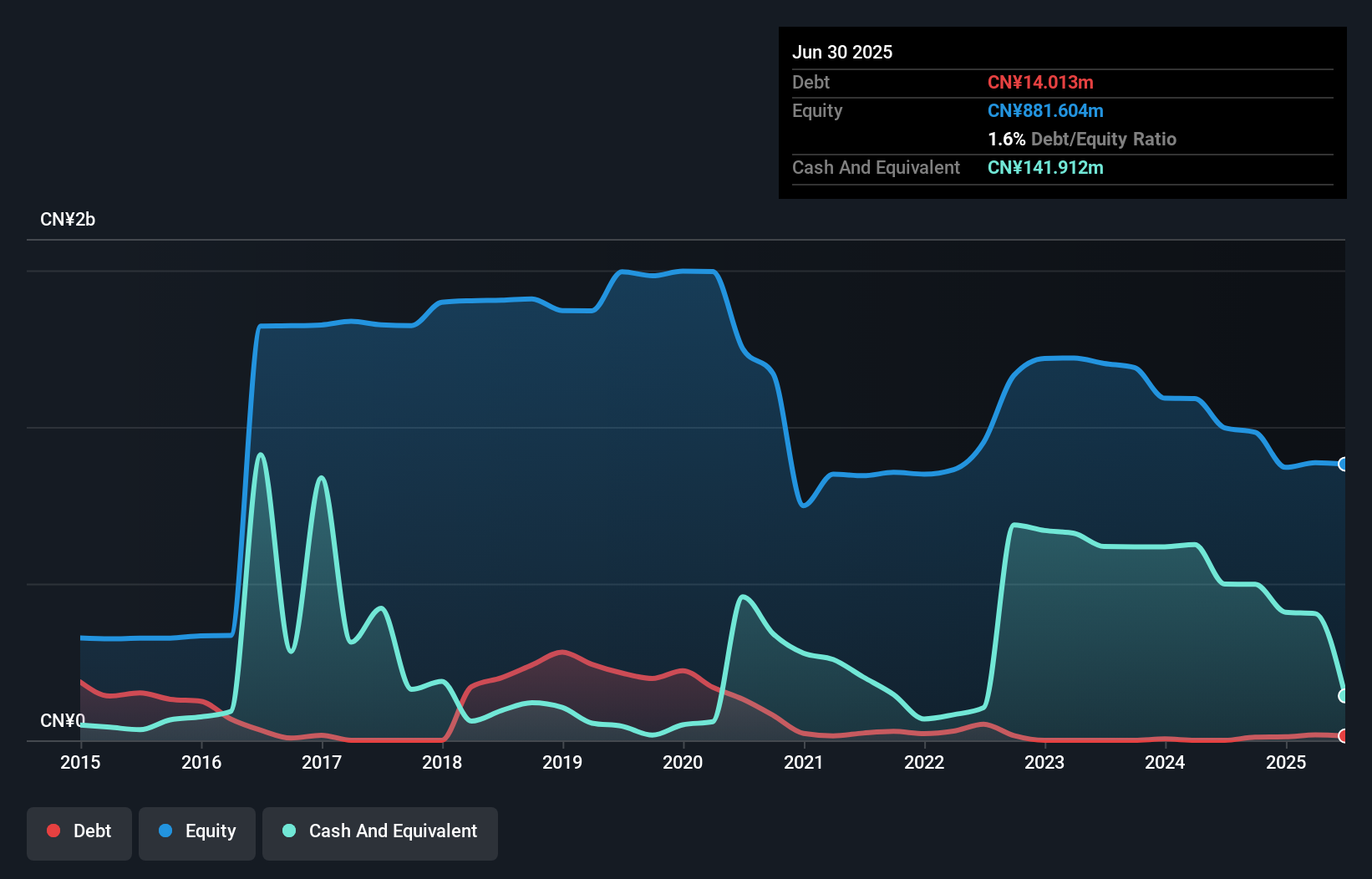

Infund Holding Co., Ltd.'s recent financial performance shows significant growth, with half-year revenue rising to CN¥613.46 million from CN¥28.56 million year-on-year, driven by its Biological Products Business. Despite being unprofitable, the company has reduced losses at a rate of 28.8% annually over five years and maintains more cash than total debt. Short-term assets of CN¥857.5 million comfortably cover both short and long-term liabilities, although it faces less than a year of cash runway based on current free cash flow trends. Recent amendments to its articles of association reflect strategic shifts in business scope and governance structure.

- Dive into the specifics of Infund Holding here with our thorough balance sheet health report.

- Learn about Infund Holding's historical performance here.

Tatwah SmartechLtd (SZSE:002512)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tatwah Smartech Co., Ltd. operates in the fields of communication networks, digital screens, and digital application services both in China and internationally, with a market cap of CN¥4.03 billion.

Operations: The company generates revenue from its operations in communication networks, digital screens, and digital application services across China and international markets.

Market Cap: CN¥4.03B

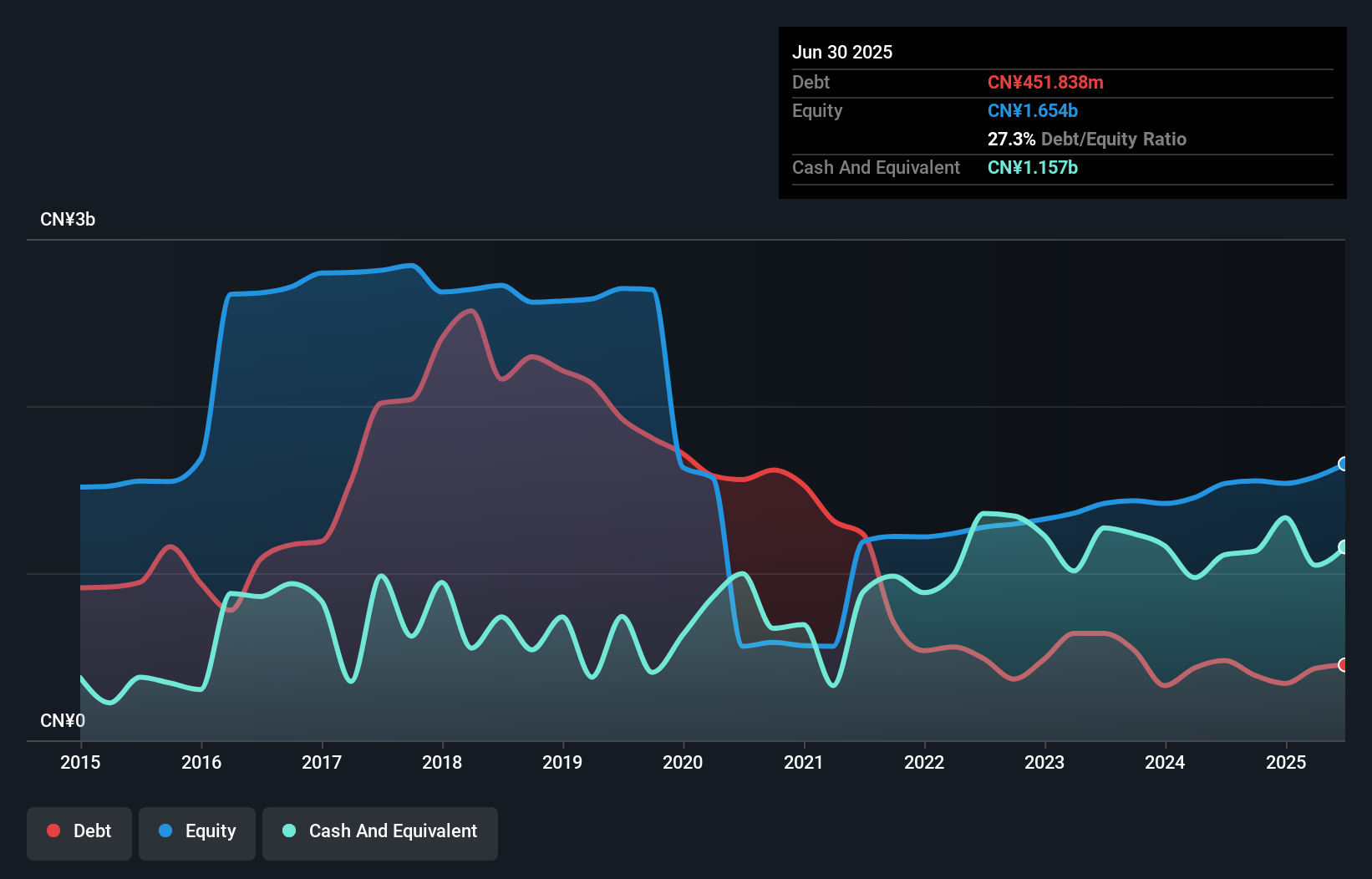

Tatwah Smartech Co., Ltd. faces challenges with a net loss of CN¥52.59 million for the first half of 2025, contrasting with a profit in the previous year. Despite stable weekly volatility and an experienced board, the company struggles with high net debt to equity at 50.1% and insufficient short-term assets to cover liabilities. Recent capital raises have extended its cash runway beyond three years, yet earnings have declined by 0.2% annually over five years. A recent extraordinary shareholders meeting focused on providing guarantees for subsidiaries, indicating ongoing financial restructuring efforts amidst declining revenues and profitability concerns.

- Click here to discover the nuances of Tatwah SmartechLtd with our detailed analytical financial health report.

- Explore historical data to track Tatwah SmartechLtd's performance over time in our past results report.

Summing It All Up

- Click here to access our complete index of 3,576 Global Penny Stocks.

- Seeking Other Investments? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tatwah SmartechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002512

Tatwah SmartechLtd

Provides communication networks, digital screens, and digital application services in China and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives