- Japan

- /

- Trade Distributors

- /

- TSE:9960

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding U.S. trade policies and softer-than-expected job growth have led to a cautious sentiment among investors, with major indexes like the S&P 500 experiencing slight declines. Despite these challenges, opportunities still exist for discerning investors who can identify stocks with strong fundamentals and resilience in uncertain times. In this context, uncovering lesser-known companies that demonstrate robust financial health, innovative capabilities, or niche market leadership can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Whirlpool China (SHSE:600983)

Simply Wall St Value Rating: ★★★★★★

Overview: Whirlpool China Co., Ltd. is involved in the research, development, procurement, production, and sale of kitchen appliances both in China and internationally, with a market cap of CN¥7.28 billion.

Operations: Whirlpool China's primary revenue stream is from the manufacture and sale of consumer electrical appliances, generating CN¥3.56 billion. The company's financial performance can be analyzed through its cost structures and profit margins, with a focus on trends in either gross or net profit margins to understand its profitability dynamics.

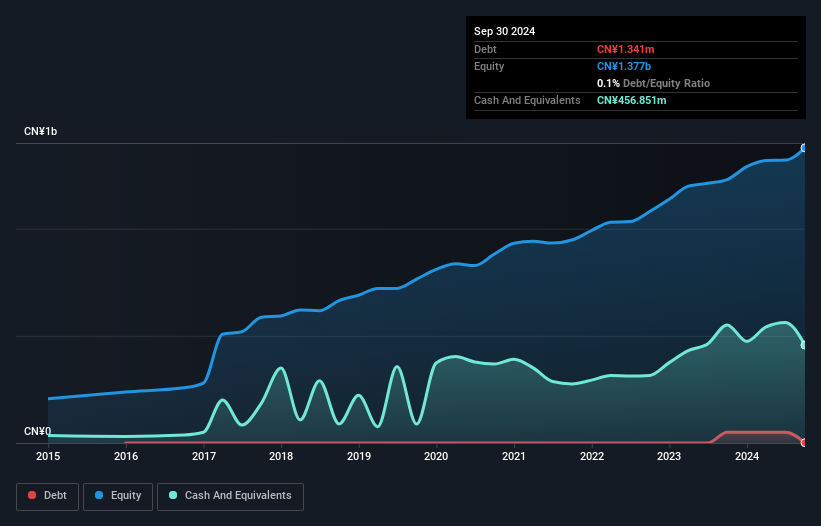

Whirlpool China, a small player in the consumer durables sector, has shown a promising trajectory with earnings growth of 2.3% over the past year, outpacing the industry average of -1.9%. This performance is bolstered by its debt-free status and reduced debt levels from five years ago when it had a debt-to-equity ratio of 1.5%. However, a significant one-off gain of CN¥39.8M has influenced recent financial results, suggesting some volatility in earnings quality. Despite this, the company remains free cash flow positive and continues to manage its capital expenditures efficiently at CN¥40M as of September 2024.

- Get an in-depth perspective on Whirlpool China's performance by reading our health report here.

Assess Whirlpool China's past performance with our detailed historical performance reports.

Hangzhou XZB Tech (SHSE:603040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou XZB Tech Co., Ltd specializes in the research, development, production, and sale of precision parts both in China and internationally with a market capitalization of approximately CN¥3.48 billion.

Operations: XZB Tech generates revenue primarily from the sale of precision parts. The company's cost structure includes expenses related to research, development, and production.

XZB Tech, a promising small player in the tech sector, showcases impressive financial health with its levered free cash flow reaching US$244.45 million as of September 2023. The company has been on an upward trajectory, with earnings growth of 18.4% last year outpacing the Auto Components industry average of 10.5%. XZB Tech's debt-to-equity ratio slightly increased to 0.1% over five years but remains manageable due to its cash surplus over total debt. Trading at a valuation below fair value by about 17%, it presents an intriguing opportunity for those seeking undervalued tech investments with solid growth potential.

Totech (TSE:9960)

Simply Wall St Value Rating: ★★★★★★

Overview: Totech Corporation specializes in the sale of environment control equipment in Japan and has a market capitalization of ¥96.84 billion.

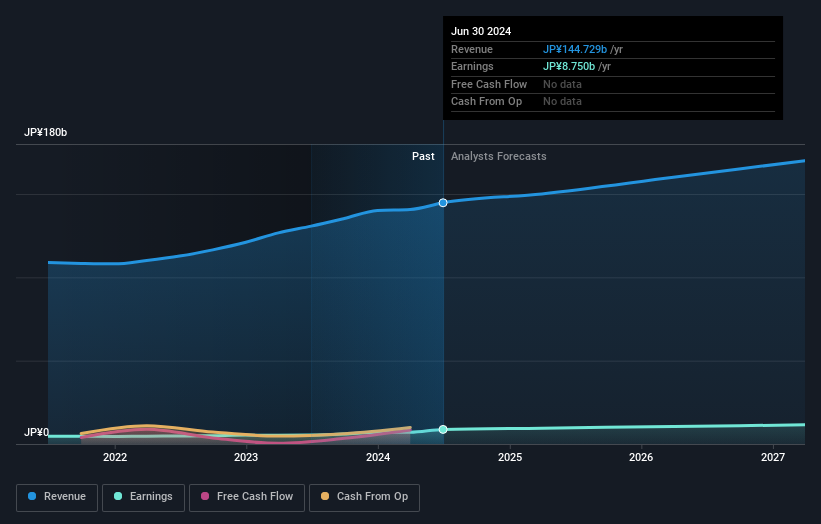

Operations: Totech generates revenue primarily from its environment control equipment sales. The company's market capitalization stands at ¥96.84 billion.

Totech, a nimble player in the market, has seen its debt to equity ratio plummet from 99.7% to 10.4% over five years, signaling robust financial health. Trading at a significant discount of 44% below estimated fair value, it offers an intriguing opportunity for investors seeking undervalued stocks. The company's earnings surged by nearly 40% last year, outpacing industry growth of just 3%. With free cash flow remaining positive and more cash than total debt on hand, Totech seems poised for continued stability despite recent equity offerings aimed at raising capital through common stock issuance.

- Click to explore a detailed breakdown of our findings in Totech's health report.

Evaluate Totech's historical performance by accessing our past performance report.

Taking Advantage

- Explore the 4692 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Totech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9960

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives