- China

- /

- Consumer Durables

- /

- SHSE:600234

There's Reason For Concern Over Kexin Development Co.,Ltd,Shanxi's (SHSE:600234) Massive 32% Price Jump

Those holding Kexin Development Co.,Ltd,Shanxi (SHSE:600234) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

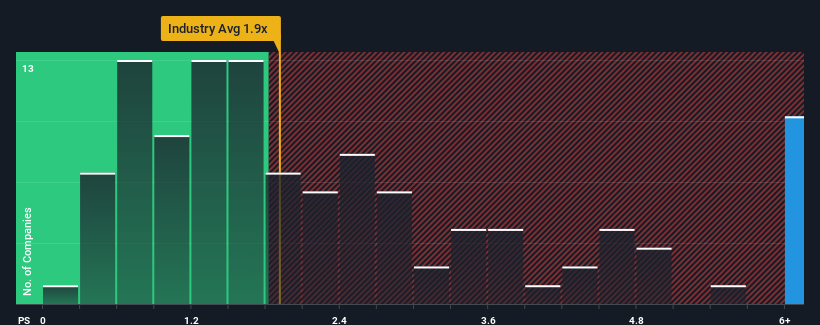

Following the firm bounce in price, you could be forgiven for thinking Kexin DevelopmentLtdShanxi is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.6x, considering almost half the companies in China's Consumer Durables industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Kexin DevelopmentLtdShanxi

How Kexin DevelopmentLtdShanxi Has Been Performing

For instance, Kexin DevelopmentLtdShanxi's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Kexin DevelopmentLtdShanxi, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Kexin DevelopmentLtdShanxi's Revenue Growth Trending?

Kexin DevelopmentLtdShanxi's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 51% decrease to the company's top line. As a result, revenue from three years ago have also fallen 84% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Kexin DevelopmentLtdShanxi is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Kexin DevelopmentLtdShanxi's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Kexin DevelopmentLtdShanxi currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 2 warning signs for Kexin DevelopmentLtdShanxi that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kexin DevelopmentLtdShanxi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600234

Kexin DevelopmentLtdShanxi

Provides media advertising, self-owned housing leasing, and architectural decoration engineering services.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives