- Japan

- /

- Specialty Stores

- /

- TSE:4732

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how policy changes might influence economic growth and inflation. Amidst these dynamic conditions, dividend stocks can offer a stable income stream, making them an attractive option for those looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

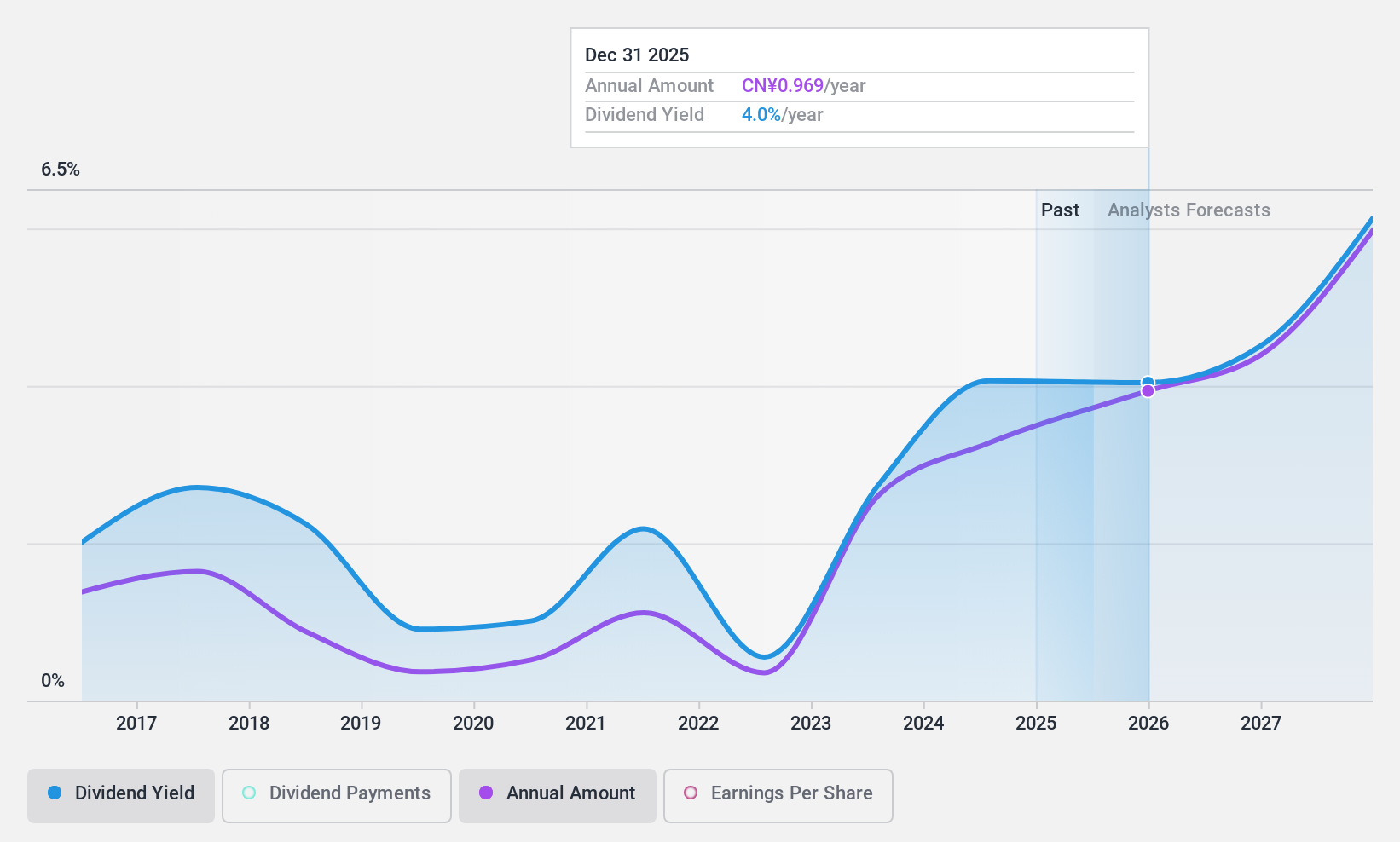

Hisense Visual Technology (SHSE:600060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisense Visual Technology Co., Ltd. focuses on the research, development, production, and sale of display products and related industry chain components both in China and internationally, with a market cap of CN¥28.17 billion.

Operations: Hisense Visual Technology Co., Ltd. generates revenue primarily from its multimedia segment, which amounts to CN¥55.04 billion.

Dividend Yield: 3.7%

Hisense Visual Technology's dividend payments have been volatile over the past decade, yet they are covered by earnings and cash flows with payout ratios of 58.7% and 40.1%, respectively. Trading at a value below its estimated fair price, Hisense offers a competitive dividend yield in the Chinese market. Despite recent revenue growth to CNY 40.65 billion for nine months ending September 2024, net income declined compared to the previous year, reflecting potential earnings challenges.

- Take a closer look at Hisense Visual Technology's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Hisense Visual Technology is trading behind its estimated value.

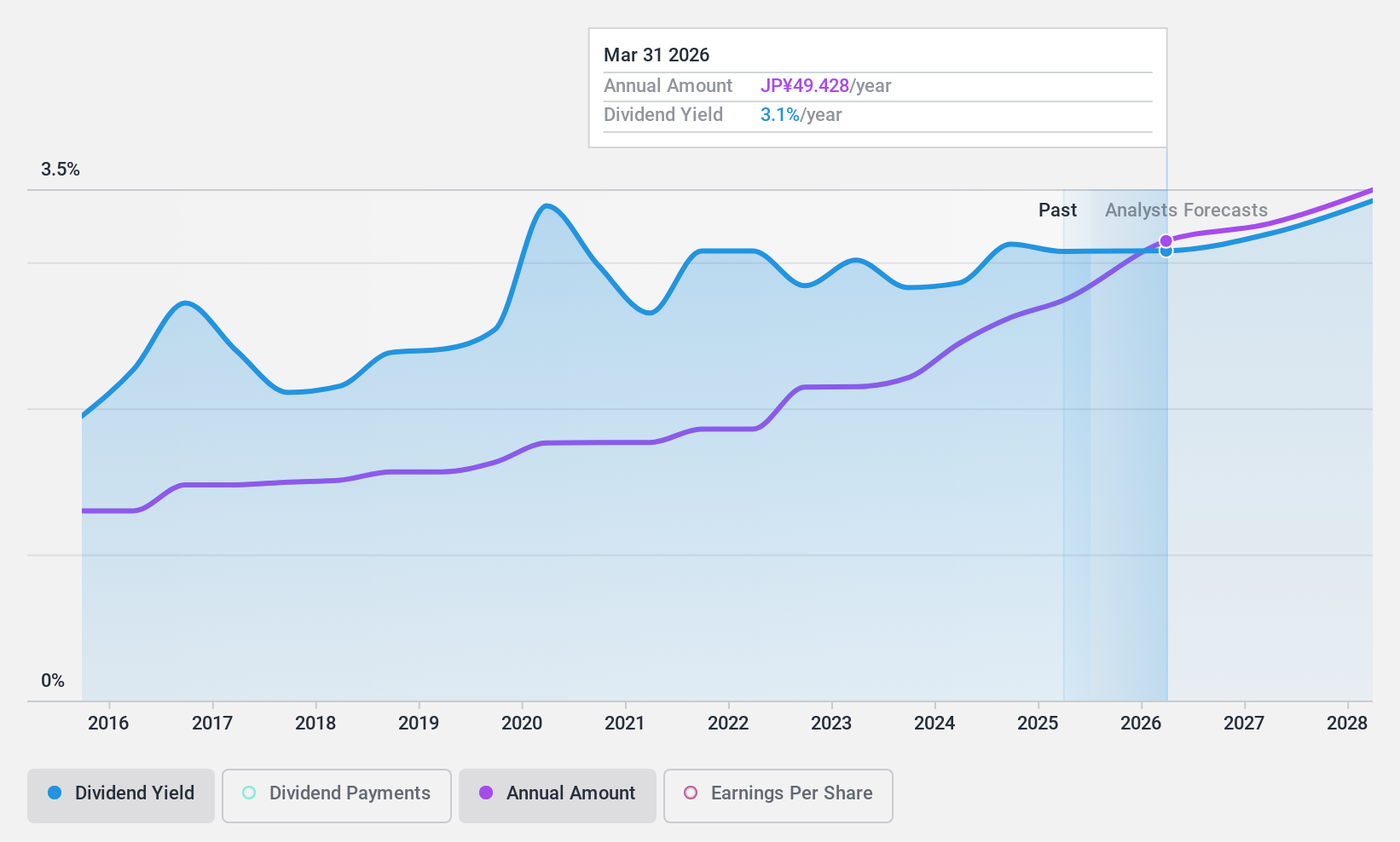

USS (TSE:4732)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: USS Co., Ltd., along with its subsidiaries, operates and manages used vehicle auction sites in Japan, with a market cap of ¥643.44 billion.

Operations: USS Co., Ltd. generates revenue primarily from its Auto Auction segment, which accounts for ¥78.36 billion, followed by the Purchase and Sales of Used Cars at ¥12.48 billion, and Recycling at ¥8.51 billion.

Dividend Yield: 3.1%

USS Co., Ltd. offers a stable dividend yield of 3.11%, though it falls below the top quartile in Japan. Dividends are well-covered by earnings and cash flow, with payout ratios of 28% and 52.3%, respectively, ensuring sustainability. The company has maintained reliable dividends over the past decade with consistent growth. Recent strategic moves include a ¥10 billion share buyback program aimed at enhancing shareholder returns and an ¥18.27 billion follow-on equity offering to support capital efficiency improvements.

- Get an in-depth perspective on USS' performance by reading our dividend report here.

- Our valuation report here indicates USS may be overvalued.

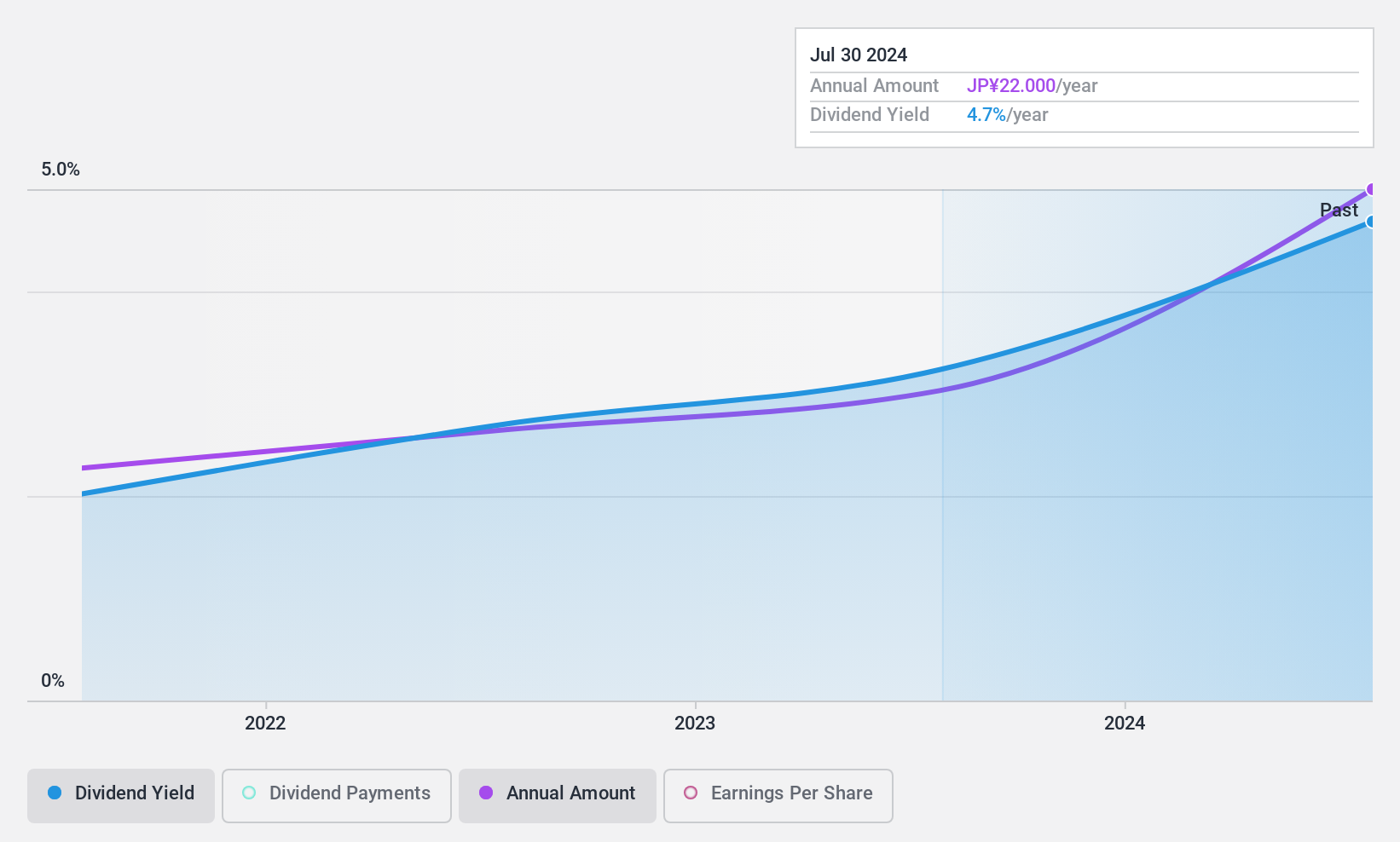

i-mobileLtd (TSE:6535)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: i-mobile Co., Ltd. operates in the Internet advertising sector in Japan and has a market cap of ¥29.97 billion.

Operations: i-mobile Co., Ltd. generates revenue primarily from its Consumer Service segment, which accounts for ¥15.95 billion, and its Internet Advertising Business segment, contributing ¥2.76 billion.

Dividend Yield: 5%

i-mobile Ltd. offers a dividend yield of 5%, placing it in the top quartile among Japanese dividend payers. The company's dividends are well-supported by earnings and cash flow, with payout ratios of 52.2% and 45%, respectively, indicating sustainability. Recent developments include a year-end dividend increase to ¥22 per share for fiscal year 2024 and guidance for further growth to ¥26 per share in fiscal year 2025, reflecting a commitment to enhancing shareholder value amidst stable financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of i-mobileLtd.

- Upon reviewing our latest valuation report, i-mobileLtd's share price might be too pessimistic.

Next Steps

- Unlock our comprehensive list of 1939 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4732

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives