In a week marked by mixed performances in global markets, major U.S. stock indexes like the S&P 500 and Nasdaq Composite reached record highs, driven largely by growth stocks, while value-oriented sectors such as energy and utilities lagged behind. Amidst this backdrop of economic data releases and geopolitical developments, investors continue to seek stable income sources, making dividend stocks an attractive option for those looking to balance growth with reliable returns. A good dividend stock typically offers consistent payouts and potential for capital appreciation, which can be particularly appealing during periods of market volatility or uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.17% | ★★★★★☆ |

Click here to see the full list of 1924 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

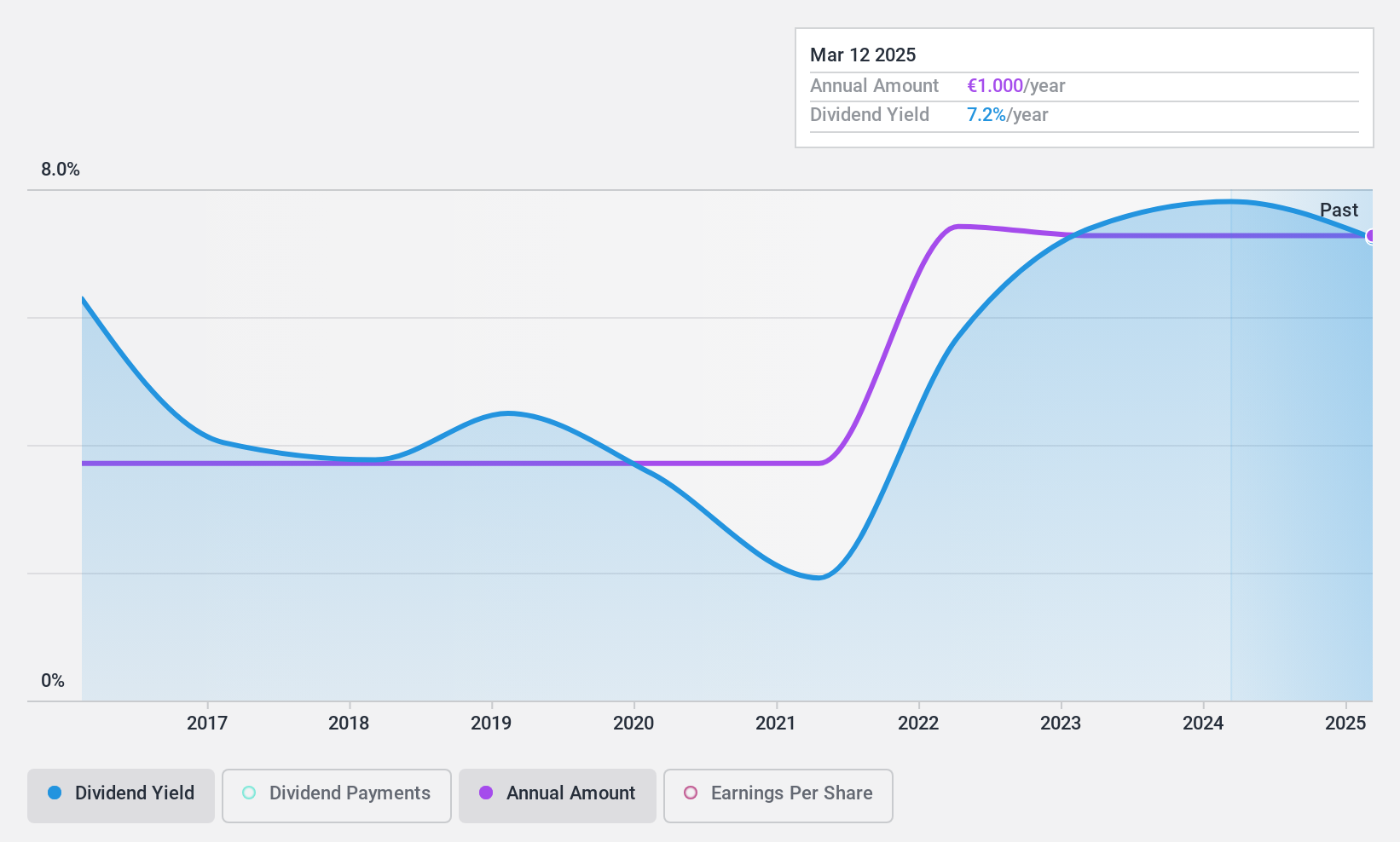

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products both in France and internationally, with a market cap of €113.53 million.

Operations: Piscines Desjoyaux SA generates revenue through the design, manufacture, and sale of swimming pools and related products in both domestic and international markets.

Dividend Yield: 7.9%

Piscines Desjoyaux offers a high and reliable dividend yield of 7.91%, placing it in the top 25% of French market dividend payers. The company's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 72.5%, indicating coverage by earnings. However, there is insufficient data to assess if dividends are covered by cash flows. Currently, the stock trades at 15.2% below its estimated fair value, suggesting potential undervaluation.

- Unlock comprehensive insights into our analysis of Piscines Desjoyaux stock in this dividend report.

- Our expertly prepared valuation report Piscines Desjoyaux implies its share price may be lower than expected.

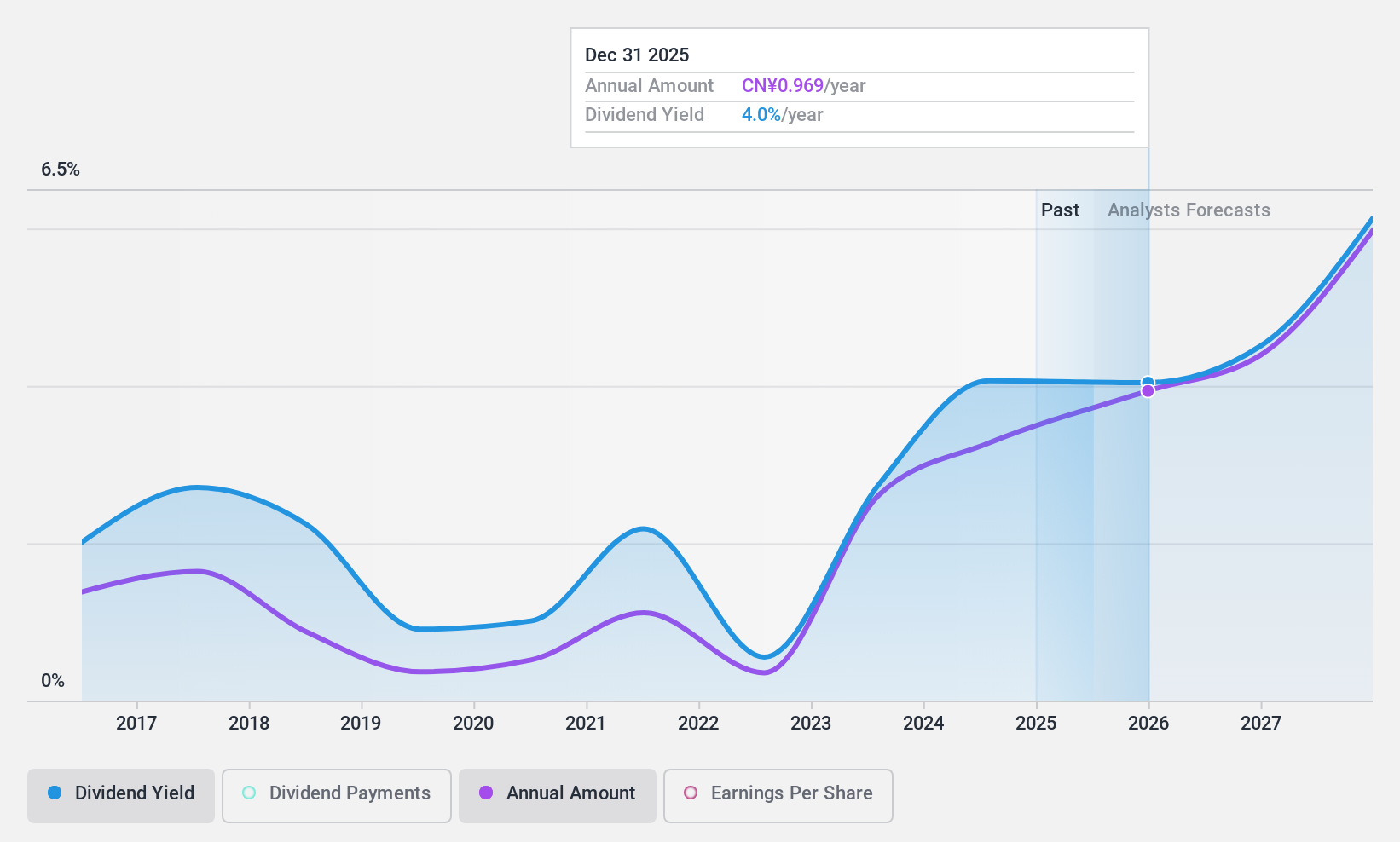

Hisense Visual Technology (SHSE:600060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisense Visual Technology Co., Ltd. is involved in the research, development, production, and sales of display chips and products both in China and internationally, with a market cap of approximately CN¥26.53 billion.

Operations: Hisense Visual Technology Co., Ltd.'s revenue primarily comes from its multimedia segment, which generated approximately CN¥55.04 billion.

Dividend Yield: 3.9%

Hisense Visual Technology's dividend yield ranks in the top 25% of China's market, with a payout ratio of 58.7%, indicating dividends are covered by earnings. Cash flow coverage is solid at a 40.1% cash payout ratio. Despite growth in dividend payments over the past decade, they have been volatile and unreliable at times. The stock trades below its estimated fair value, suggesting potential undervaluation amidst recent strategic expansions like its alliance with EPACK Durable Limited in India.

- Click here to discover the nuances of Hisense Visual Technology with our detailed analytical dividend report.

- Our valuation report here indicates Hisense Visual Technology may be undervalued.

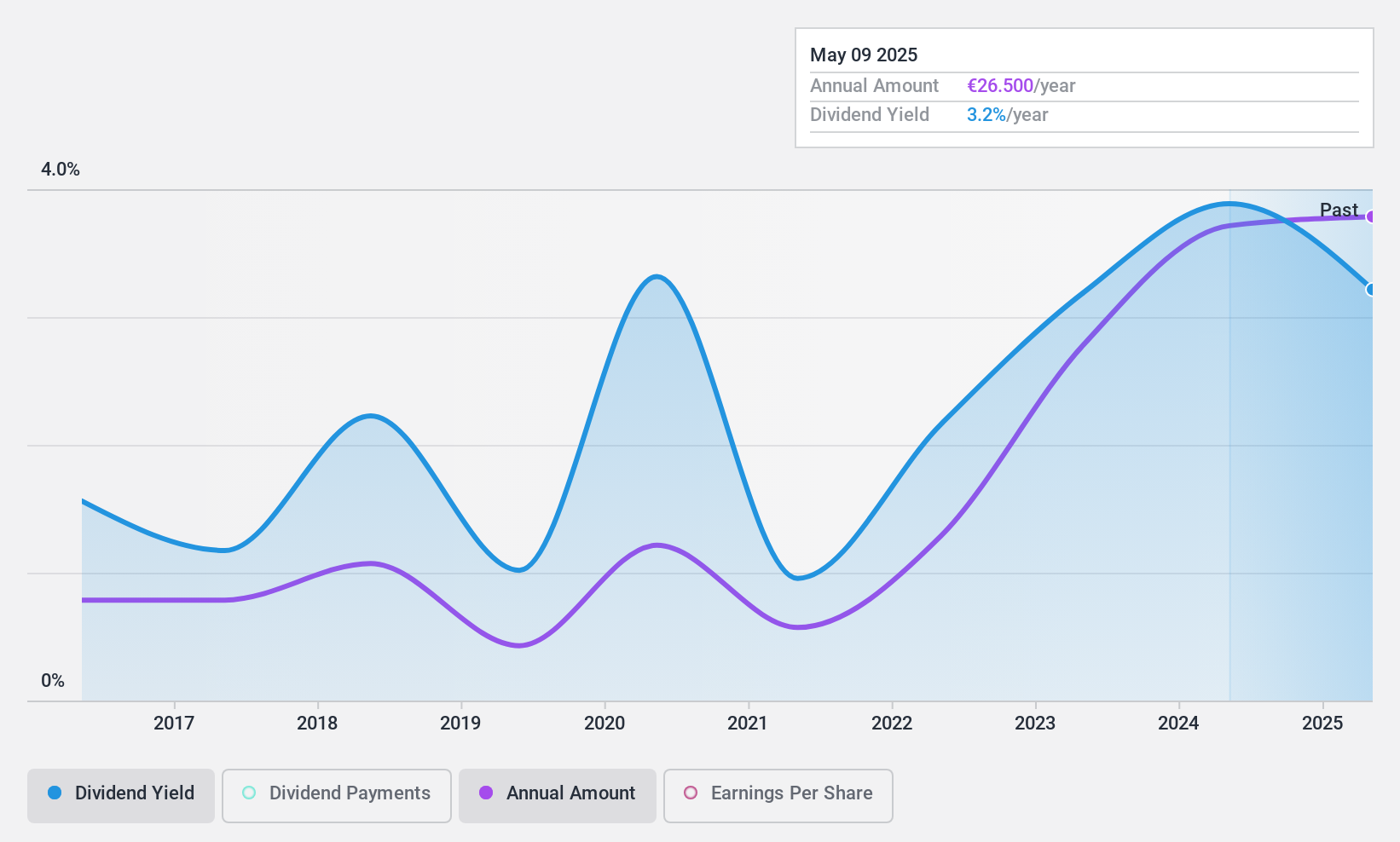

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, along with its subsidiaries, manufactures and supplies pumps, valves, and related services globally, with a market cap of approximately €1.13 billion.

Operations: KSB SE & Co. KGaA generates its revenue from three main segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

Dividend Yield: 3.9%

KSB SE KGaA's dividend yield is modest, trailing the top 25% of German dividend payers. The payout ratios, both earnings (29.9%) and cash flow (24.2%), suggest dividends are well covered, indicating sustainability despite a volatile payment history over the past decade. Trading at 76% below its estimated fair value, it might be undervalued relative to peers and industry benchmarks. Recent presentations highlight ongoing engagement with investors and stakeholders in Germany.

- Delve into the full analysis dividend report here for a deeper understanding of KSB SE KGaA.

- According our valuation report, there's an indication that KSB SE KGaA's share price might be on the cheaper side.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1924 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives