- China

- /

- Entertainment

- /

- SZSE:300031

Undiscovered Gems in Global Markets for May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap stocks have shown resilience with indices like the S&P MidCap 400 and Russell 2000 advancing for several weeks. Amid this backdrop, discerning investors are on the lookout for undiscovered gems—stocks that combine strong fundamentals with potential for growth in an environment of cautious optimism.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 4.97% | 0.98% | 14.37% | ★★★★★★ |

| Ryoyu Systems | NA | 5.05% | 16.94% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Anapass | 10.32% | 10.52% | 50.07% | ★★★★★★ |

| Neosem | 2.26% | 26.11% | 25.59% | ★★★★★★ |

| Ascentech K.K | NA | 134.28% | 78.96% | ★★★★★★ |

| Creative & Innovative System | 0.65% | 57.93% | 84.89% | ★★★★★★ |

| Techno Ryowa | 1.66% | 6.08% | 18.65% | ★★★★★☆ |

| OUG Holdings | 97.54% | 2.27% | 32.89% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in the research, development, production, and sale of passenger car components for OEMs and automakers both within China and internationally, with a market cap of CN¥13.22 billion.

Operations: The company's revenue is primarily derived from the sale of passenger car components to OEMs and automakers in both domestic and international markets. Its financial performance includes a market capitalization of CN¥13.22 billion, reflecting its scale within the automotive interior sector.

Shanghai Daimay Automotive Interior, a nimble player in the auto components sector, is making waves with its robust financials. Earnings surged 17.4% last year, outpacing the industry's 6.5%, and are expected to grow annually by 21.46%. The company's price-to-earnings ratio of 16.6x highlights its attractive valuation compared to the broader CN market's 36.6x. With cash exceeding total debt and interest payments covered by EBIT at an impressive 33.1x, financial stability seems solid despite a rise in debt-to-equity from 12.3% to 28.3% over five years, suggesting strategic investments or expansions might be underway.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Daimay Automotive Interior.

Learn about Shanghai Daimay Automotive Interior's historical performance.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and globally, with a market cap of CN¥9.63 billion.

Operations: Wuxi Boton Technology generates revenue primarily from its industrial bulk material handling and mobile Internet segments. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

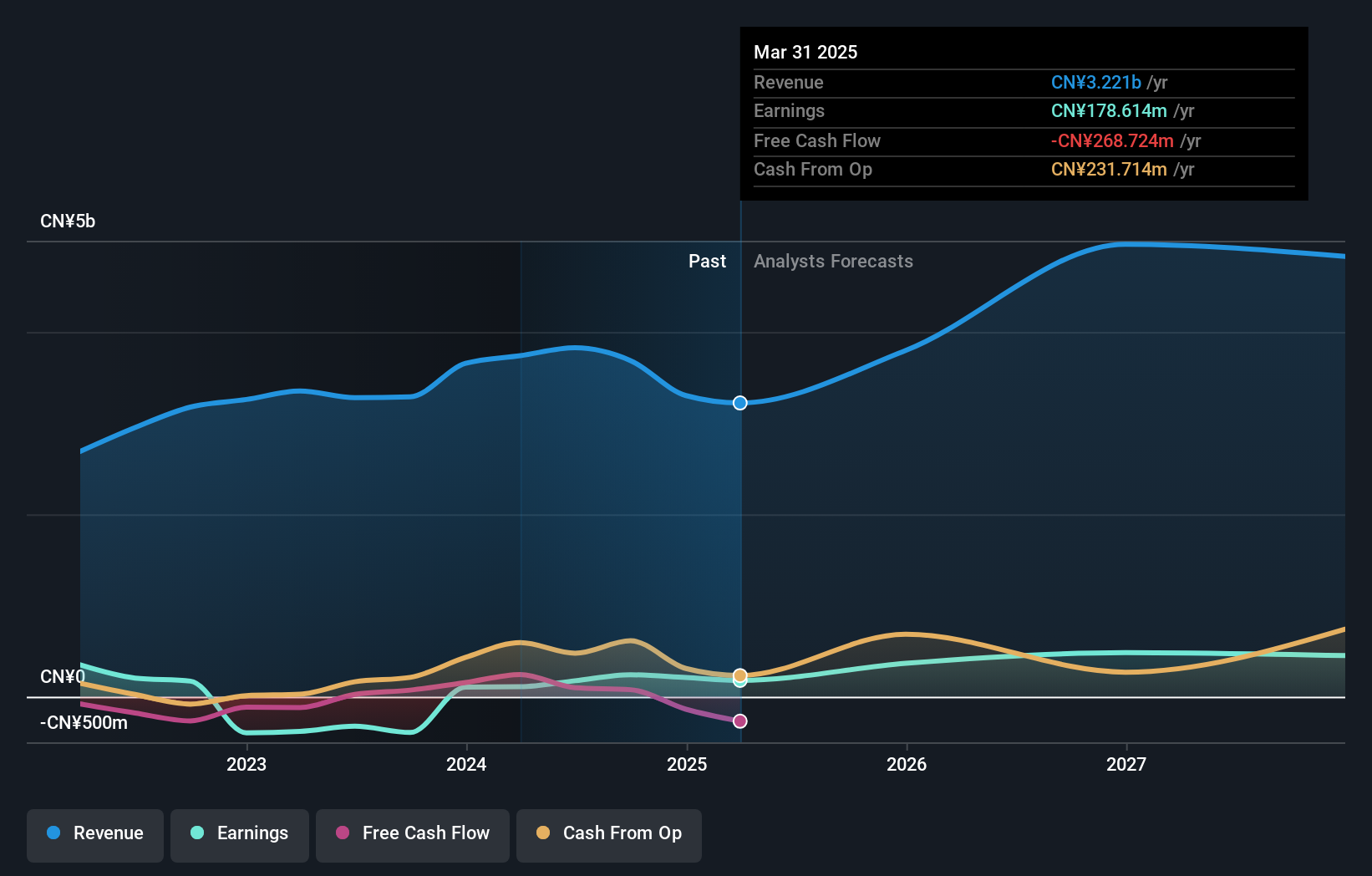

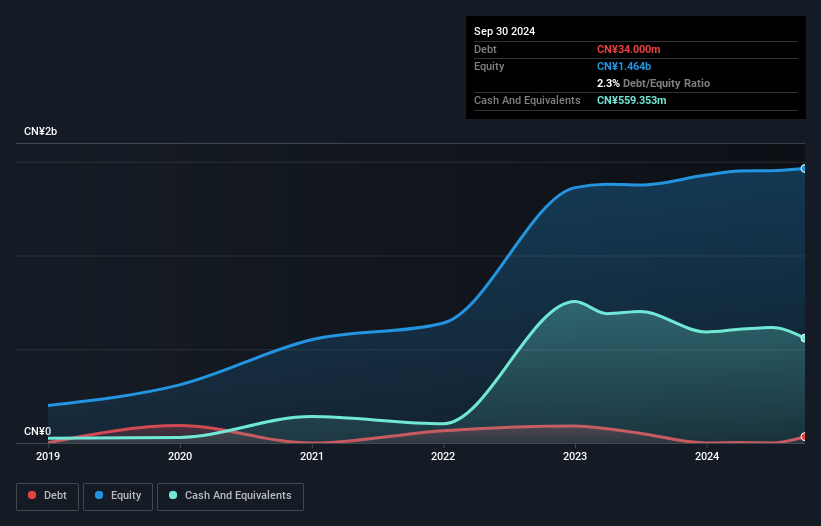

Wuxi Boton Technology, a smaller player in its field, has shown notable financial movements. The company's earnings surged by 97.9% last year, significantly outpacing the Entertainment industry's -2.4%. Despite a drop in sales from CNY 3,655 million to CNY 3,302 million over the past year, net income rose to CNY 209.93 million from CNY 106.06 million due to improved operational efficiencies and reduced debt levels—the debt-to-equity ratio decreased from 27.5% to 20.8% over five years. However, free cash flow remains negative despite profitability and forecasts of an annual earnings growth rate of about 25%.

Ferrotec (An Hui) Technology DevelopmentLTD (SZSE:301297)

Simply Wall St Value Rating: ★★★★★★

Overview: Ferrotec (An Hui) Technology Development Co., LTD specializes in providing semiconductor equipment precision cleaning services and has a market cap of CN¥12.93 billion.

Operations: Ferrotec (An Hui) Technology Development Co., LTD generates revenue primarily through semiconductor equipment precision cleaning services. The company's financial performance is highlighted by a net profit margin of 15.2%, reflecting its operational efficiency in this niche market.

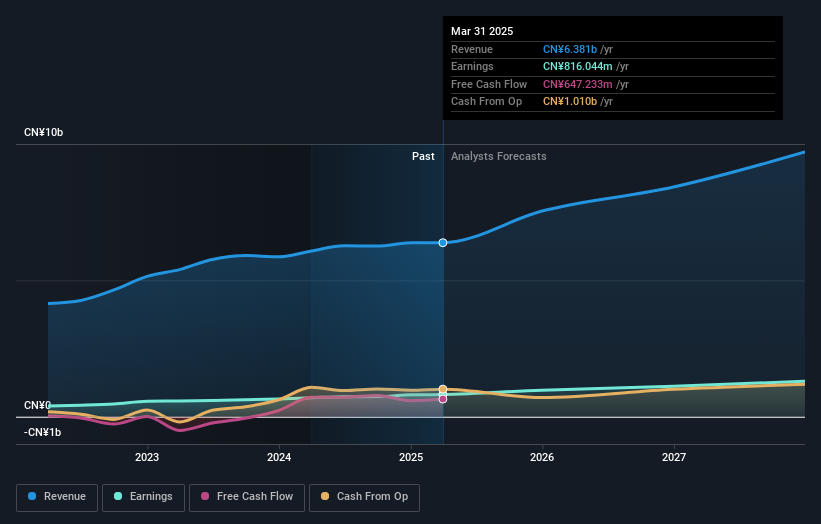

Ferrotec (An Hui) Technology Development Co., LTD, a nimble player in its field, has shown notable progress with its earnings growing by 11.1% over the past year, outpacing the industry average of 1.7%. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 24.8%, indicating financial prudence. Recent quarterly results highlight sales reaching CN¥214.22 million from CN¥166.92 million previously, while net income rose to CN¥28.9 million from CN¥26.31 million last year, suggesting robust operational performance despite large one-off gains impacting prior results by CN¥25.2M.

Make It Happen

- Embark on your investment journey to our 3290 Global Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Boton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300031

Wuxi Boton Technology

Engages in the industrial bulk material handling and mobile Internet businesses in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives