- China

- /

- Professional Services

- /

- SZSE:301228

Subdued Growth No Barrier To SEP Analytical (Shanghai) Co., Ltd. (SZSE:301228) With Shares Advancing 29%

SEP Analytical (Shanghai) Co., Ltd. (SZSE:301228) shares have continued their recent momentum with a 29% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.8% over the last year.

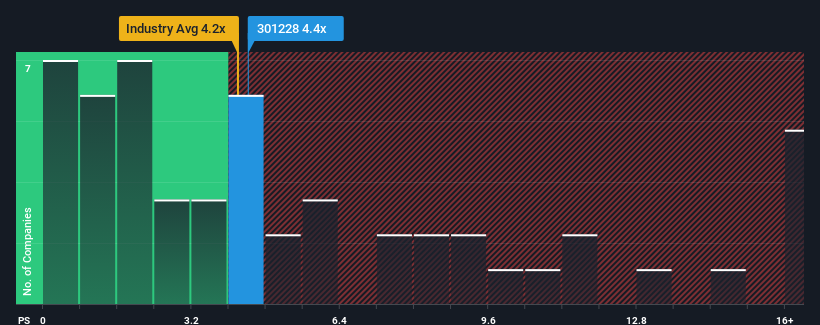

In spite of the firm bounce in price, there still wouldn't be many who think SEP Analytical (Shanghai)'s price-to-sales (or "P/S") ratio of 4.4x is worth a mention when the median P/S in China's Professional Services industry is similar at about 4.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for SEP Analytical (Shanghai)

What Does SEP Analytical (Shanghai)'s Recent Performance Look Like?

Revenue has risen firmly for SEP Analytical (Shanghai) recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on SEP Analytical (Shanghai) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for SEP Analytical (Shanghai), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like SEP Analytical (Shanghai)'s is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that SEP Analytical (Shanghai)'s P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

SEP Analytical (Shanghai)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that SEP Analytical (Shanghai)'s average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

And what about other risks? Every company has them, and we've spotted 1 warning sign for SEP Analytical (Shanghai) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301228

SEP Analytical (Shanghai)

Engages in the provision of third-party testing services in China.

Flawless balance sheet very low.

Market Insights

Community Narratives