- China

- /

- Professional Services

- /

- SZSE:301228

SEP Analytical (Shanghai) Co., Ltd.'s (SZSE:301228) 27% Share Price Plunge Could Signal Some Risk

SEP Analytical (Shanghai) Co., Ltd. (SZSE:301228) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

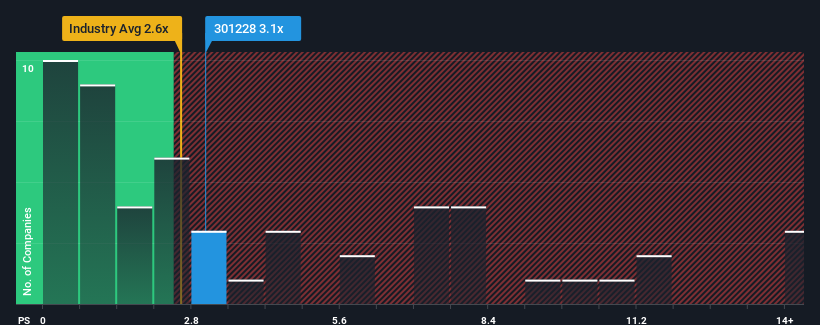

Although its price has dipped substantially, there still wouldn't be many who think SEP Analytical (Shanghai)'s price-to-sales (or "P/S") ratio of 3.1x is worth a mention when the median P/S in China's Professional Services industry is similar at about 2.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for SEP Analytical (Shanghai)

What Does SEP Analytical (Shanghai)'s Recent Performance Look Like?

The recent revenue growth at SEP Analytical (Shanghai) would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on SEP Analytical (Shanghai) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SEP Analytical (Shanghai) will help you shine a light on its historical performance.How Is SEP Analytical (Shanghai)'s Revenue Growth Trending?

SEP Analytical (Shanghai)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.4% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 41% shows it's noticeably less attractive.

With this in mind, we find it intriguing that SEP Analytical (Shanghai)'s P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

With its share price dropping off a cliff, the P/S for SEP Analytical (Shanghai) looks to be in line with the rest of the Professional Services industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of SEP Analytical (Shanghai) revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 2 warning signs for SEP Analytical (Shanghai) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301228

SEP Analytical (Shanghai)

Engages in the provision of third-party testing services in China.

Flawless balance sheet very low.

Market Insights

Community Narratives