- China

- /

- Auto Components

- /

- SZSE:301550

Discovering Undiscovered Gems in Global Markets April 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade uncertainties and mixed performances across major indices, smaller-cap stocks have emerged as resilient performers, with the S&P MidCap 400 and Russell 2000 Indexes posting gains despite broader market challenges. In this environment, identifying undiscovered gems requires a keen eye for companies that can thrive amid economic fluctuations and policy shifts, offering potential opportunities for investors seeking growth beyond the well-trodden paths of large-cap equities.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Top Union Electronics | 1.20% | 7.68% | 18.91% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hunan Junxin Environmental Protection (SZSE:301109)

Simply Wall St Value Rating: ★★★★★★

Overview: Hunan Junxin Environmental Protection Co., Ltd. specializes in providing environmental protection solutions and services, with a market cap of CN¥11.33 billion.

Operations: The company generates revenue primarily through its environmental protection solutions and services.

Hunan Junxin Environmental Protection, a nimble player in its sector, has shown impressive financial strides with earnings growing 11.1% over the past year, surpassing industry growth of 0.4%. The company's debt to equity ratio has significantly improved from 108.4% to a satisfactory 30.8% over five years, reflecting sound financial management. Despite recent shareholder dilution, the firm is taking steps to enhance value through a CNY 300 million share buyback program at prices up to CNY 30.57 per share. Recent earnings reveal robust sales growth from CNY 1,857 million to CNY 2,431 million year-on-year and net income rising modestly from CNY 514 million to CNY 536 million.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Value Rating: ★★★★★☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the digital marketing industry, providing advertising and promotion services, with a market capitalization of approximately CN¥11.87 billion.

Operations: The company generates revenue primarily from advertising and promotion services, amounting to CN¥2.31 billion.

Easy Click Worldwide Network Technology, a smaller player in the tech scene, has seen its debt to equity ratio rise from 0.02% to 15.7% over five years, indicating increased leverage. Despite this, the company covers its interest payments comfortably and remains profitable with positive free cash flow. Earnings have grown by 20.1%, outpacing the media industry's -17.9% performance last year, though they were impacted by a CN¥51.9M one-off gain recently. Trading at nearly 90% below estimated fair value suggests potential undervaluation but also highlights market volatility concerns over recent months for investors considering this stock's prospects.

Zhejiang Sling Automobile Bearing (SZSE:301550)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Sling Automobile Bearing Co., Ltd. operates in the automotive industry, focusing on the production of bearings and related components, with a market capitalization of CN¥10.95 billion.

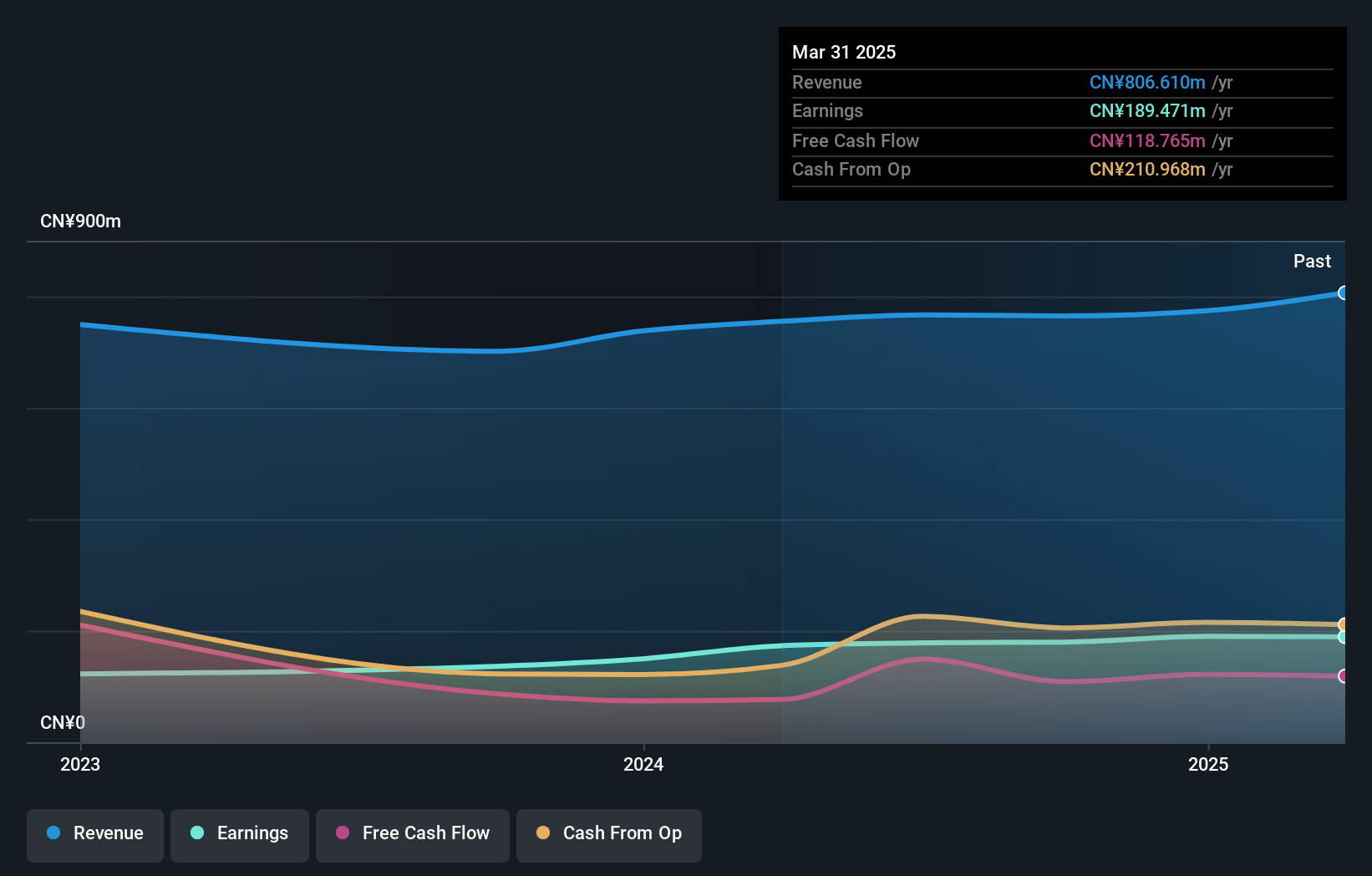

Operations: The company generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥764.93 million.

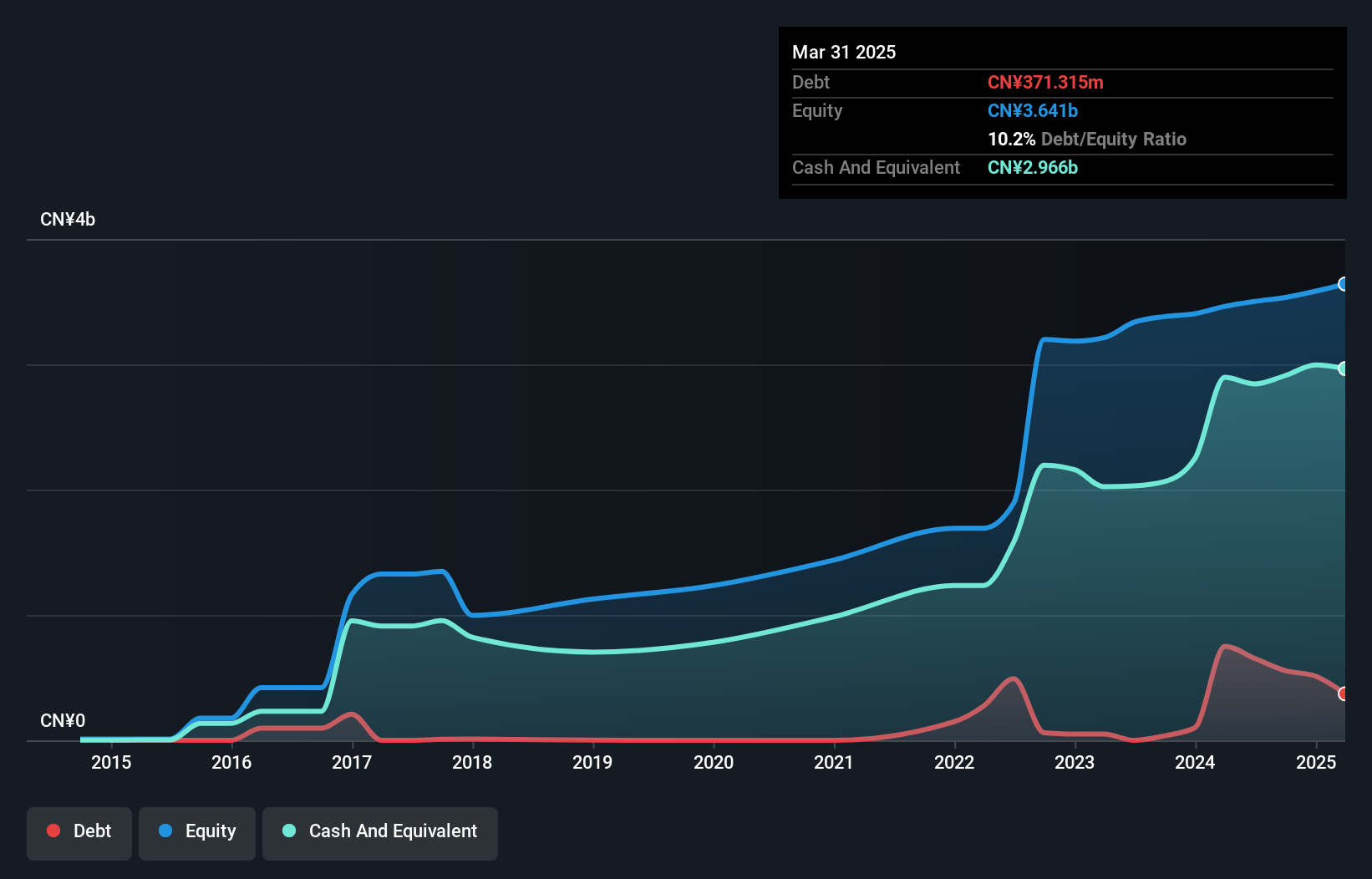

Zhejiang Sling Automobile Bearing, a nimble player in the auto components sector, has shown impressive financial health with zero debt compared to a 47.7% debt to equity ratio five years ago. Its earnings surged by 31.7% over the past year, outpacing the industry's growth of 10%. The company's high level of non-cash earnings suggests robust operational efficiency. Despite recent share price volatility, its free cash flow remains positive at US$108.69 million as of April 2025. This combination of strong earnings growth and financial prudence positions Zhejiang Sling as a compelling prospect within its industry niche.

Next Steps

- Investigate our full lineup of 3252 Global Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sling Automobile Bearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301550

Zhejiang Sling Automobile Bearing

Zhejiang Sling Automobile Bearing Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives