- China

- /

- Life Sciences

- /

- SHSE:688758

Suzhou Sepax Technologies And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile equity movements and cautious monetary policies, investors are increasingly turning their attention to Asia's small-cap sector for potential opportunities. Amidst this backdrop, identifying stocks that demonstrate resilience and growth potential can be particularly rewarding, as exemplified by Suzhou Sepax Technologies and two other emerging companies in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Xinan Technology | NA | 10.11% | 4.92% | ★★★★★★ |

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Ascentech K.K | NA | 112.83% | 113.50% | ★★★★★★ |

| Namuga | 14.63% | -4.73% | 24.37% | ★★★★★★ |

| Sinotherapeutics | NA | 29.32% | -5.40% | ★★★★★★ |

| Pacific Construction | 22.17% | -12.87% | 37.11% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Techno Smart | 24.76% | 15.56% | 25.47% | ★★★★☆☆ |

| Wuhan Huakang Century Clean Technology | 57.04% | 17.95% | 6.20% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Suzhou Sepax Technologies (SHSE:688758)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Sepax Technologies Co., Ltd. engages in the research, development, production, and sale of liquid chromatography materials for the separation and purification of biomacromolecules and other drugs globally, with a market cap of CN¥7.85 billion.

Operations: With a market cap of CN¥7.85 billion, Suzhou Sepax Technologies generates revenue through the sale of liquid chromatography materials. The company's financial performance can be evaluated by its net profit margin, reflecting its ability to convert sales into actual profit after accounting for all expenses.

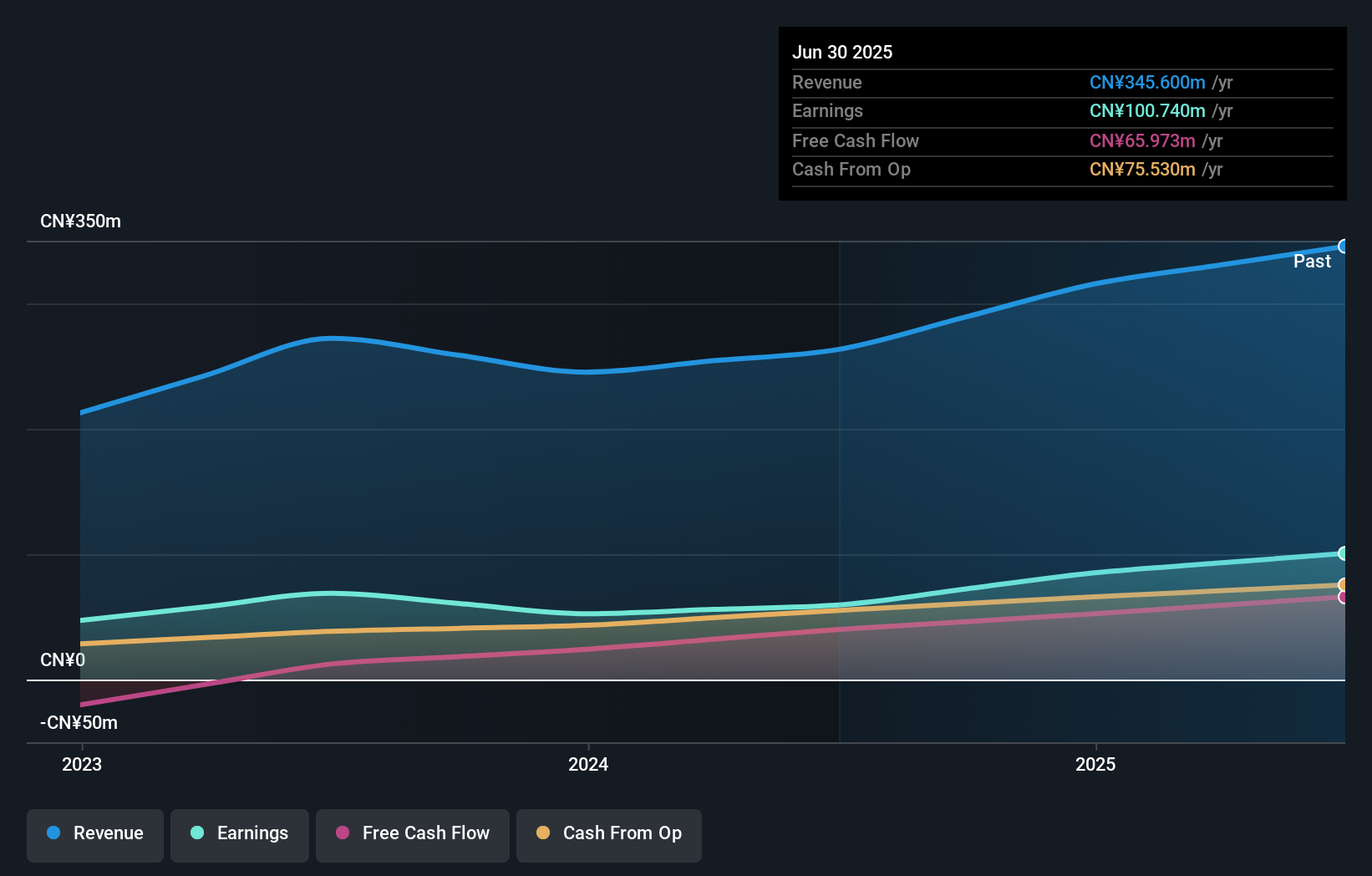

Suzhou Sepax Technologies, a standout in the life sciences sector, has demonstrated robust financial health with earnings growth of 69.3% over the past year, outpacing the industry's 7.5%. The company's net income for H1 2025 reached CNY 53.66 million, up from CNY 38.08 million a year earlier, reflecting its strong performance trajectory. With more cash than total debt and a significant reduction in its debt-to-equity ratio from 53% to just 0.05% over five years, it seems well-positioned financially. Recent revenue figures show an increase to CNY 182.63 million compared to last year's CNY 152.49 million, indicating solid business momentum.

- Get an in-depth perspective on Suzhou Sepax Technologies' performance by reading our health report here.

Gain insights into Suzhou Sepax Technologies' past trends and performance with our Past report.

EMTEK (Shenzhen) (SZSE:300938)

Simply Wall St Value Rating: ★★★★★☆

Overview: EMTEK (Shenzhen) Co., Ltd. operates as a third-party testing business in China with a market cap of CN¥6.22 billion.

Operations: The company generates revenue primarily from its research services, amounting to CN¥729.96 million.

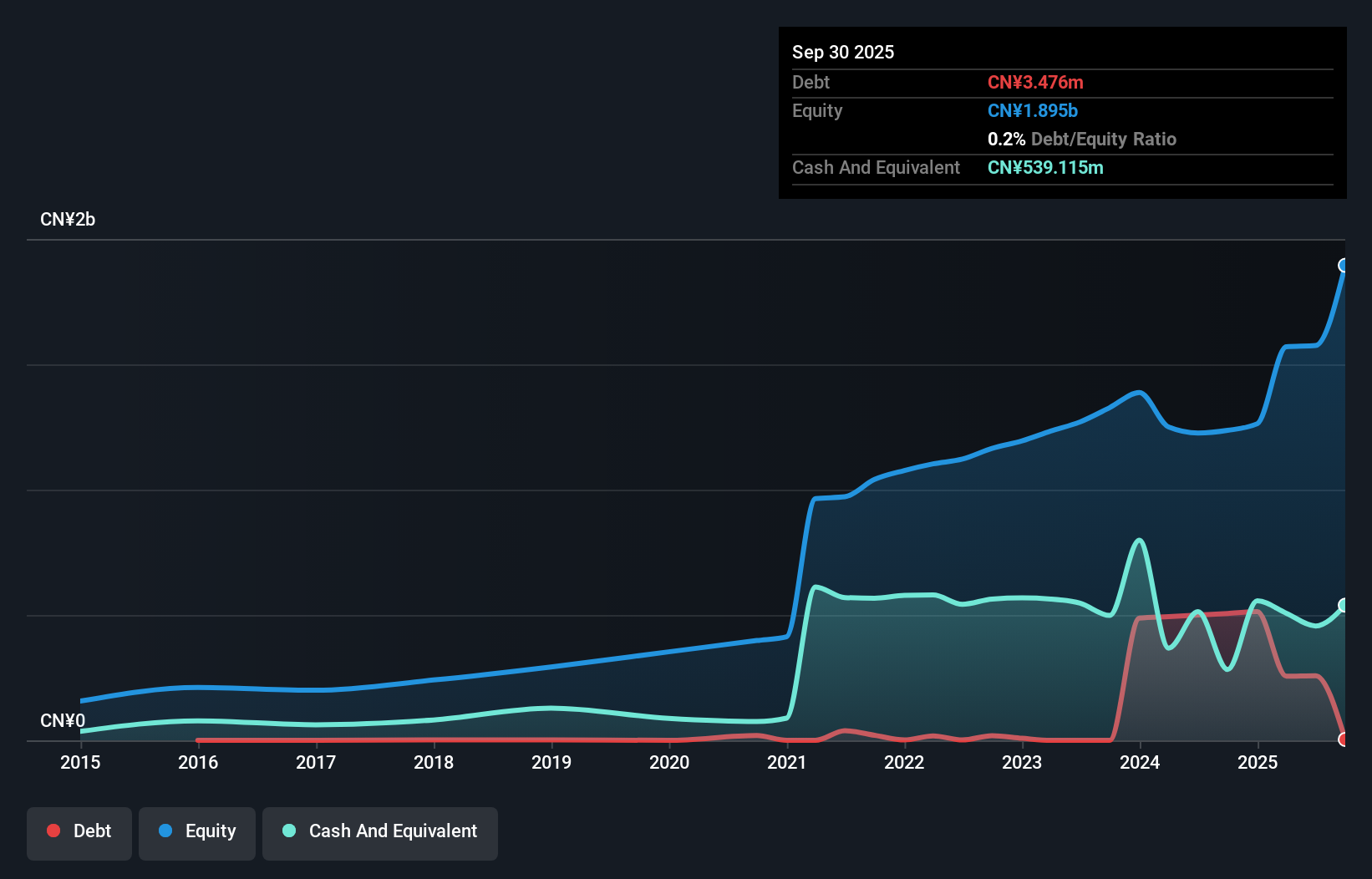

EMTEK (Shenzhen) has been making waves with a steady earnings growth of 23.6% annually over the past five years, showcasing its robust financial health. The company's recent inclusion in the S&P Global BMI Index highlights its growing recognition on the global stage. Despite an increase in debt-to-equity ratio from 3.3 to 16.4 over five years, EMTEK maintains more cash than total debt, ensuring financial stability. With a price-to-earnings ratio of 34.9x, it offers better value compared to the CN market average of 45.3x and continues to generate positive free cash flow, indicating solid operational efficiency.

ARCS (TSE:9948)

Simply Wall St Value Rating: ★★★★★☆

Overview: ARCS Company Limited, with a market cap of ¥174.90 billion, operates in Japan through its retail business and related activities alongside its subsidiaries.

Operations: ARCS generates revenue primarily through its retail operations in Japan. The company's financial performance is highlighted by a net profit margin of 2.5%, reflecting its ability to convert sales into profits effectively.

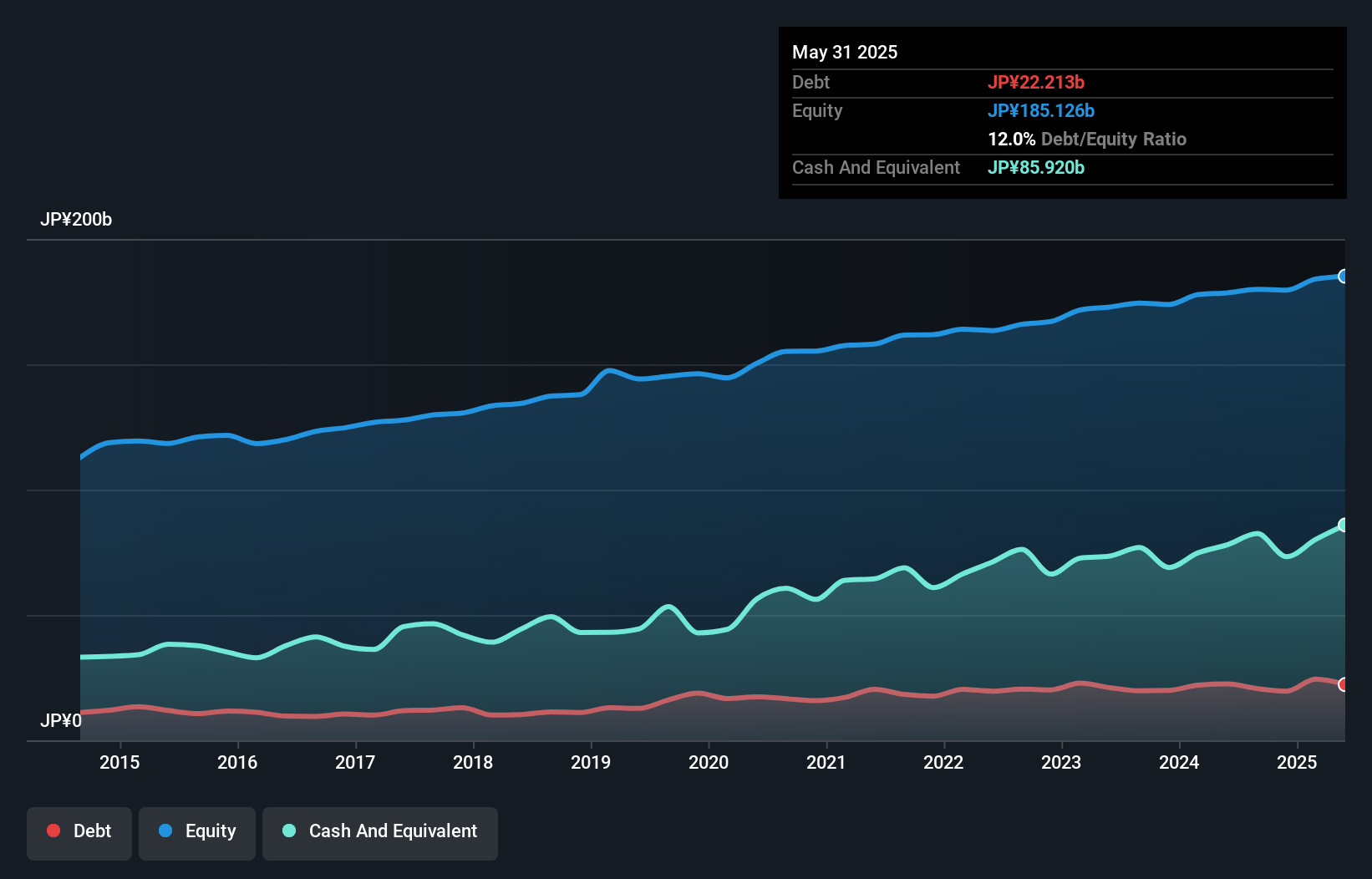

ARCS, a promising player in the Consumer Retailing sector, has been making waves with its recent moves. The company announced a share repurchase program to buy back 700,000 shares for ¥2.5 billion, aiming to boost shareholder returns and enhance capital efficiency. This initiative aligns with ARCS trading at 33% below its estimated fair value, highlighting potential undervaluation. Over the past year, earnings grew by 7%, outpacing the industry average of 6.9%. Additionally, ARCS declared a dividend increase from ¥34 to ¥37 per share for Q2 of fiscal year ending February 2026, reflecting confidence in its financial health and future prospects.

- Unlock comprehensive insights into our analysis of ARCS stock in this health report.

Assess ARCS' past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 2377 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688758

Suzhou Sepax Technologies

Researches, develops, produces, and sells liquid chromatography materials for the separation and purification of biomacromolecules and other drugs worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives