- China

- /

- Professional Services

- /

- SZSE:300887

Market Cool On Pony Testing Co., Ltd.'s (SZSE:300887) Revenues Pushing Shares 31% Lower

The Pony Testing Co., Ltd. (SZSE:300887) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

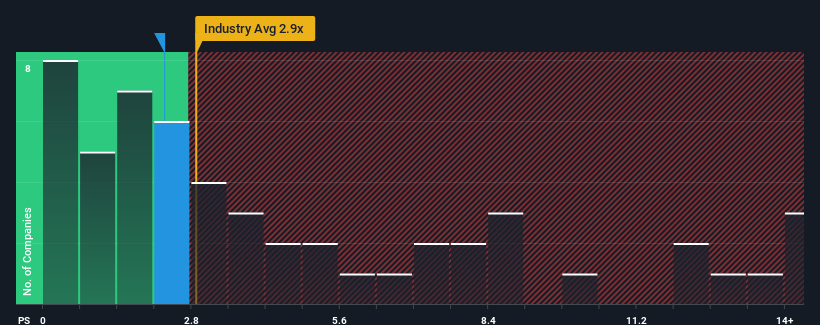

Although its price has dipped substantially, Pony Testing may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the Professional Services industry in China have P/S ratios greater than 2.9x and even P/S higher than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Pony Testing

How Has Pony Testing Performed Recently?

Pony Testing could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pony Testing.Is There Any Revenue Growth Forecasted For Pony Testing?

Pony Testing's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 39%. Even so, admirably revenue has lifted 45% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the seven analysts following the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Pony Testing's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The southerly movements of Pony Testing's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Pony Testing currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Pony Testing is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Pony Testing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300887

Pony Testing

Provides testing services and solutions in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives