- China

- /

- Commercial Services

- /

- SZSE:300864

We Believe Academy of Environmental Planning and DesignLtd. Nanjing University's (SZSE:300864) Earnings Are A Poor Guide For Its Profitability

We didn't see Academy of Environmental Planning and Design, Co.,Ltd. Nanjing University's (SZSE:300864) stock surge when it reported robust earnings recently. We think that investors might be worried about the foundations the earnings are built on.

View our latest analysis for Academy of Environmental Planning and DesignLtd. Nanjing University

Zooming In On Academy of Environmental Planning and DesignLtd. Nanjing University's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

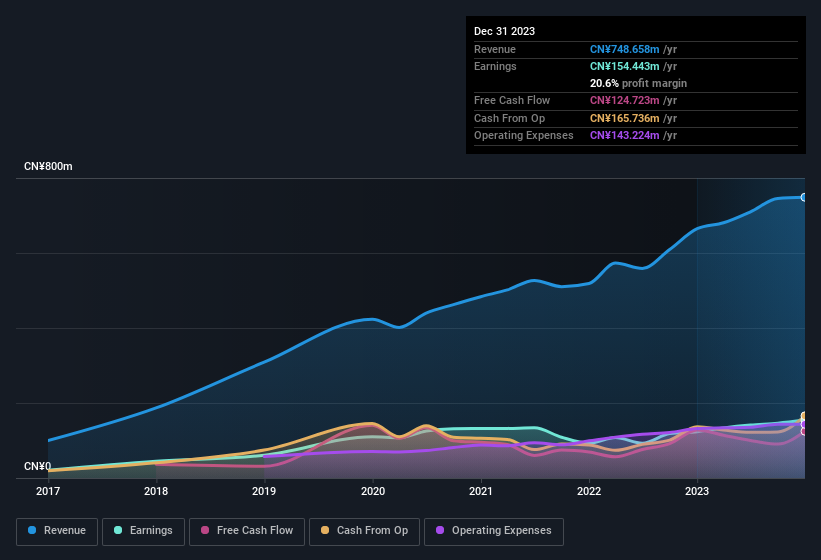

For the year to December 2023, Academy of Environmental Planning and DesignLtd. Nanjing University had an accrual ratio of 1.01. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. In fact, it had free cash flow of CN¥125m in the last year, which was a lot less than its statutory profit of CN¥154.4m. Academy of Environmental Planning and DesignLtd. Nanjing University shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. The good news for shareholders is that Academy of Environmental Planning and DesignLtd. Nanjing University's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Academy of Environmental Planning and DesignLtd. Nanjing University.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by CN¥20m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Academy of Environmental Planning and DesignLtd. Nanjing University's Profit Performance

Summing up, Academy of Environmental Planning and DesignLtd. Nanjing University received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at Academy of Environmental Planning and DesignLtd. Nanjing University's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Academy of Environmental Planning and DesignLtd. Nanjing University as a business, it's important to be aware of any risks it's facing. For example, Academy of Environmental Planning and DesignLtd. Nanjing University has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300864

Academy of Environmental Planning and DesignLtd. Nanjing University

Academy of Environmental Planning and Design, Co.,Ltd.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives