- China

- /

- Professional Services

- /

- SZSE:300712

Fujian Yongfu Power Engineering Co.,Ltd. (SZSE:300712) Screens Well But There Might Be A Catch

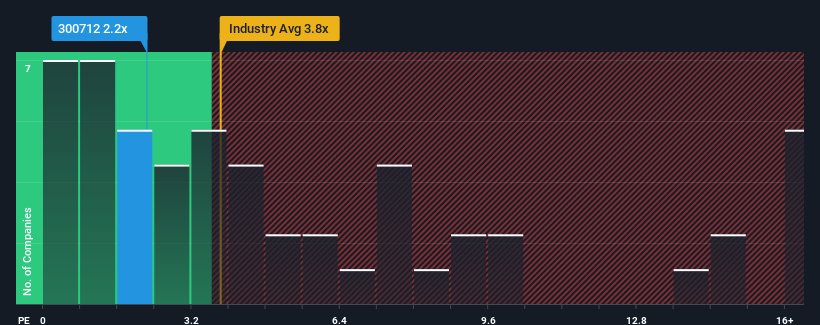

With a price-to-sales (or "P/S") ratio of 2.2x Fujian Yongfu Power Engineering Co.,Ltd. (SZSE:300712) may be sending bullish signals at the moment, given that almost half of all the Professional Services companies in China have P/S ratios greater than 3.8x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Fujian Yongfu Power EngineeringLtd

How Fujian Yongfu Power EngineeringLtd Has Been Performing

Fujian Yongfu Power EngineeringLtd could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Fujian Yongfu Power EngineeringLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Fujian Yongfu Power EngineeringLtd?

Fujian Yongfu Power EngineeringLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The latest three year period has also seen an excellent 76% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 103% over the next year. With the industry only predicted to deliver 24%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Fujian Yongfu Power EngineeringLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Fujian Yongfu Power EngineeringLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Fujian Yongfu Power EngineeringLtd.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300712

Fujian Yongfu Power EngineeringLtd

Provides solutions for power and energy systems in China and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives