- China

- /

- Professional Services

- /

- SZSE:300564

What Zhubo Design Co., Ltd's (SZSE:300564) 29% Share Price Gain Is Not Telling You

Zhubo Design Co., Ltd (SZSE:300564) shares have continued their recent momentum with a 29% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.9% in the last twelve months.

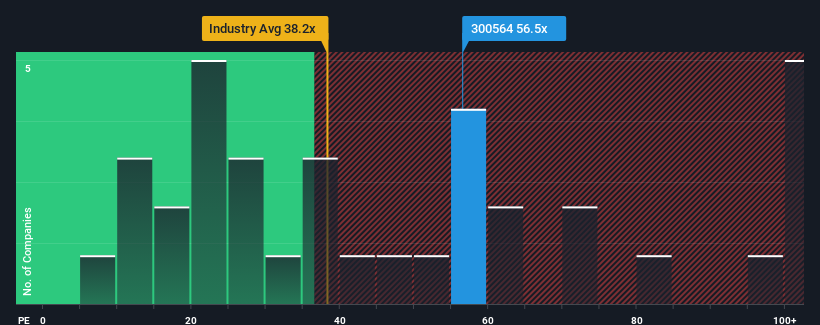

After such a large jump in price, Zhubo Design may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 56.5x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Zhubo Design's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Zhubo Design

How Is Zhubo Design's Growth Trending?

In order to justify its P/E ratio, Zhubo Design would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 68% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 76% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 39% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Zhubo Design is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Zhubo Design's P/E?

The strong share price surge has got Zhubo Design's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhubo Design revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Zhubo Design (2 are significant!) that you should be aware of before investing here.

If you're unsure about the strength of Zhubo Design's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Zhubo Design, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhubo Design might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300564

Flawless balance sheet slight.

Market Insights

Community Narratives