- China

- /

- Professional Services

- /

- SZSE:002949

Further Upside For Shenzhen Capol International & Associatesco.,Ltd (SZSE:002949) Shares Could Introduce Price Risks After 30% Bounce

Those holding Shenzhen Capol International & Associatesco.,Ltd (SZSE:002949) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

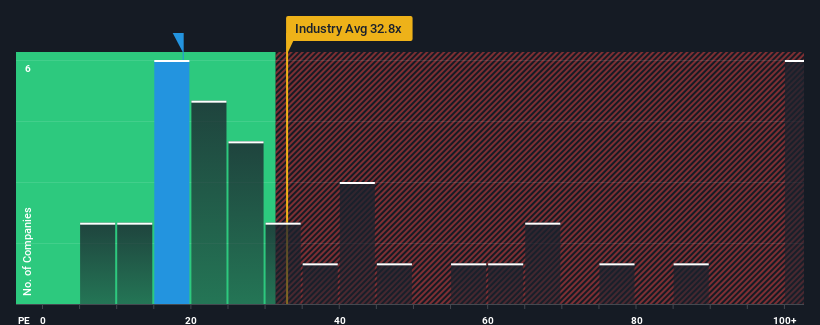

In spite of the firm bounce in price, Shenzhen Capol International & Associatesco.Ltd's price-to-earnings (or "P/E") ratio of 18.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Shenzhen Capol International & Associatesco.Ltd's and the market's retreating earnings lately. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Shenzhen Capol International & Associatesco.Ltd

Is There Any Growth For Shenzhen Capol International & Associatesco.Ltd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shenzhen Capol International & Associatesco.Ltd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. As a result, earnings from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 99% as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

In light of this, it's peculiar that Shenzhen Capol International & Associatesco.Ltd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Shenzhen Capol International & Associatesco.Ltd's P/E

The latest share price surge wasn't enough to lift Shenzhen Capol International & Associatesco.Ltd's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Capol International & Associatesco.Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 1 warning sign for Shenzhen Capol International & Associatesco.Ltd that you need to take into consideration.

You might be able to find a better investment than Shenzhen Capol International & Associatesco.Ltd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002949

Shenzhen Capol International & Associatesco.Ltd

Provides architectural design services.

Excellent balance sheet and good value.

Market Insights

Community Narratives