- China

- /

- Professional Services

- /

- SZSE:002663

Spotlight On Jiumaojiu International Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields and the Federal Reserve's cautious approach to rate cuts, investors are exploring diverse opportunities for growth. Penny stocks, though often overlooked due to their speculative nature, can still present intriguing possibilities when backed by robust financial health. In this article, we will highlight several promising penny stocks that combine financial strength with the potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.86B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.31M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.69 | MYR119.52M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.53 | CN¥2.22B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.24 | £304.09M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,798 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited operates Chinese cuisine restaurant brands across the People's Republic of China, Singapore, Canada, Malaysia, Thailand, and the United States with a market cap of HK$4.89 billion.

Operations: The company's revenue is primarily generated from its Tai Er segment, contributing CN¥4.54 billion, followed by Jiu Mao Jiu with CN¥603.83 million and Song Hot Pot with CN¥885.66 million.

Market Cap: HK$4.89B

Jiumaojiu International Holdings has shown significant earnings growth, with a 42% increase over the past year, surpassing the hospitality industry's average. Despite its high volatility and low return on equity at 9.8%, the company maintains strong financial health, with short-term assets exceeding liabilities and debt well-covered by cash flow. Recent earnings reported a sales increase to CN¥3.06 billion, though net income declined compared to last year. The company completed a share buyback of HK$243.18 million, reflecting confidence in its valuation while maintaining more cash than total debt and improving profit margins slightly from last year.

- Dive into the specifics of Jiumaojiu International Holdings here with our thorough balance sheet health report.

- Evaluate Jiumaojiu International Holdings' prospects by accessing our earnings growth report.

China Oil HBP Science & Technology (SZSE:002554)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Oil HBP Science & Technology Co., Ltd offers solutions for oil and gas development and exploitation across the Middle East, Central Asia, Africa, and other international markets with a market cap of CN¥3.70 billion.

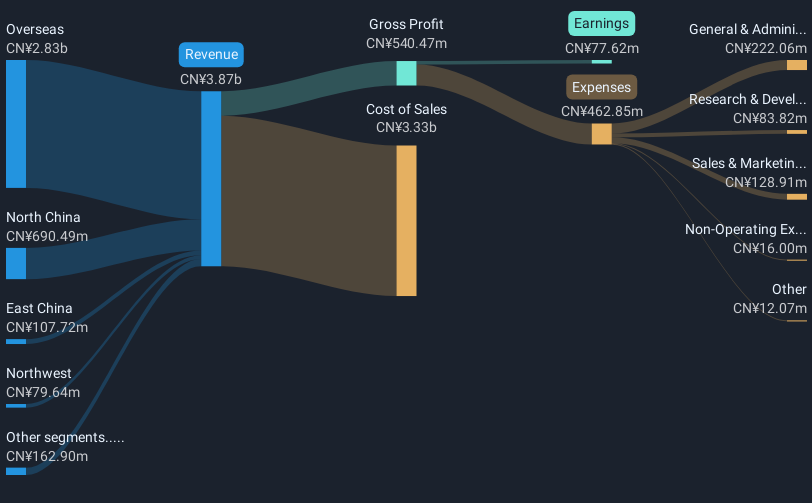

Operations: The company generated CN¥3.87 billion from its Oil and Gas Exploration Service Industry segment.

Market Cap: CN¥3.7B

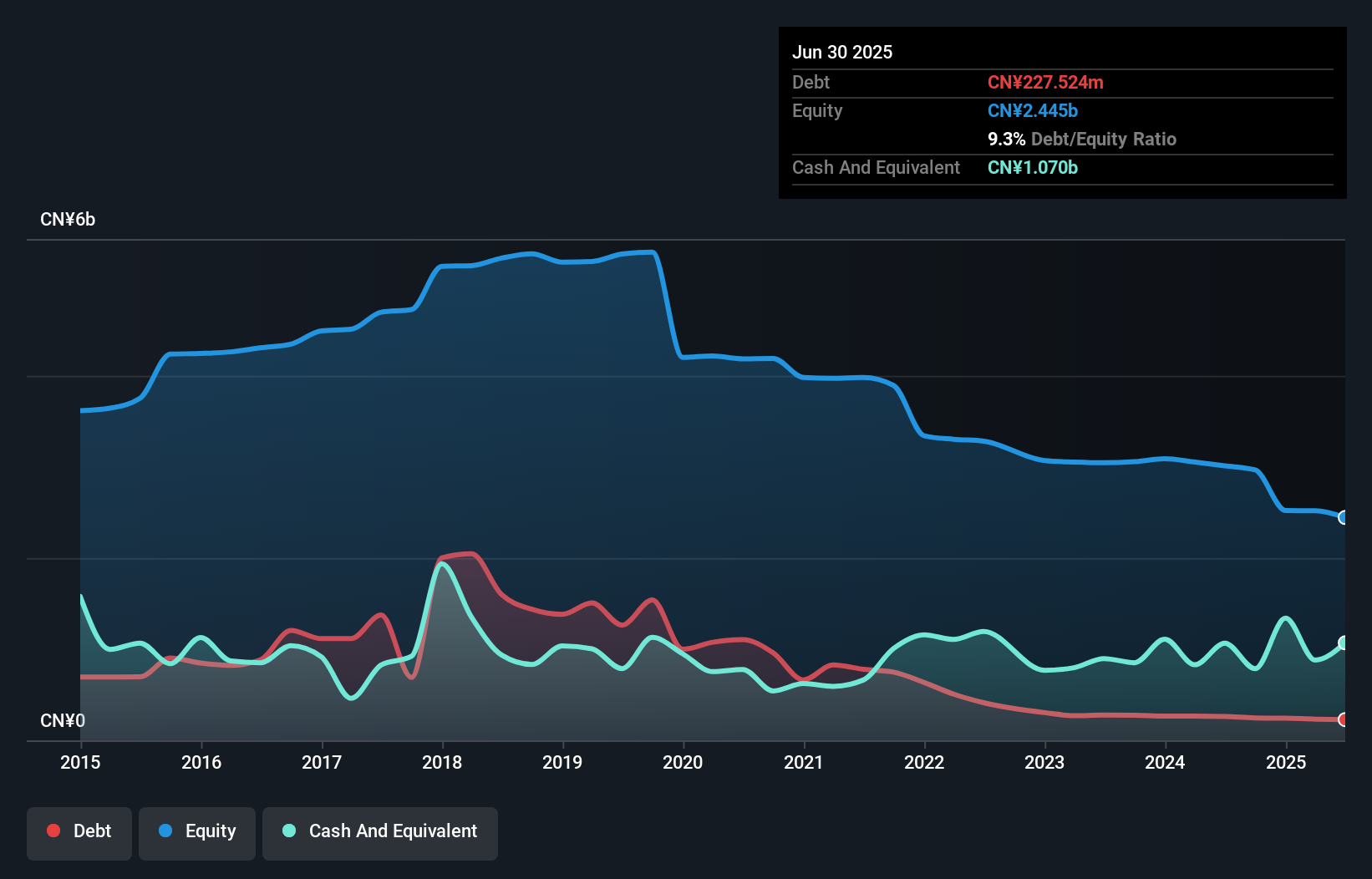

China Oil HBP Science & Technology Co., Ltd faces challenges with declining earnings, reporting a net loss of CN¥76.69 million for the nine months ending September 2024 compared to a profit last year. Despite negative earnings growth and reduced profit margins, the company maintains financial stability with short-term assets exceeding liabilities and satisfactory debt levels. The management team is experienced, and interest coverage is not an issue. Recent strategic actions include completing a share buyback program worth CN¥29.98 million, signaling confidence amidst volatility in its financial performance within international markets.

- Click here to discover the nuances of China Oil HBP Science & Technology with our detailed analytical financial health report.

- Examine China Oil HBP Science & Technology's past performance report to understand how it has performed in prior years.

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pubang Landscape Architecture Co., Ltd operates in garden planning, design, and engineering primarily in China with a market cap of CN¥3.07 billion.

Operations: The company's revenue is primarily derived from its operations in South China (CN¥1.18 billion), East China (CN¥485.11 million), Southwest China (CN¥88.52 million), North East China (CN¥38.57 million), North China (CN¥26.31 million), Central China (CN¥20.42 million), and Northwest China (CN¥8.93 million).

Market Cap: CN¥3.07B

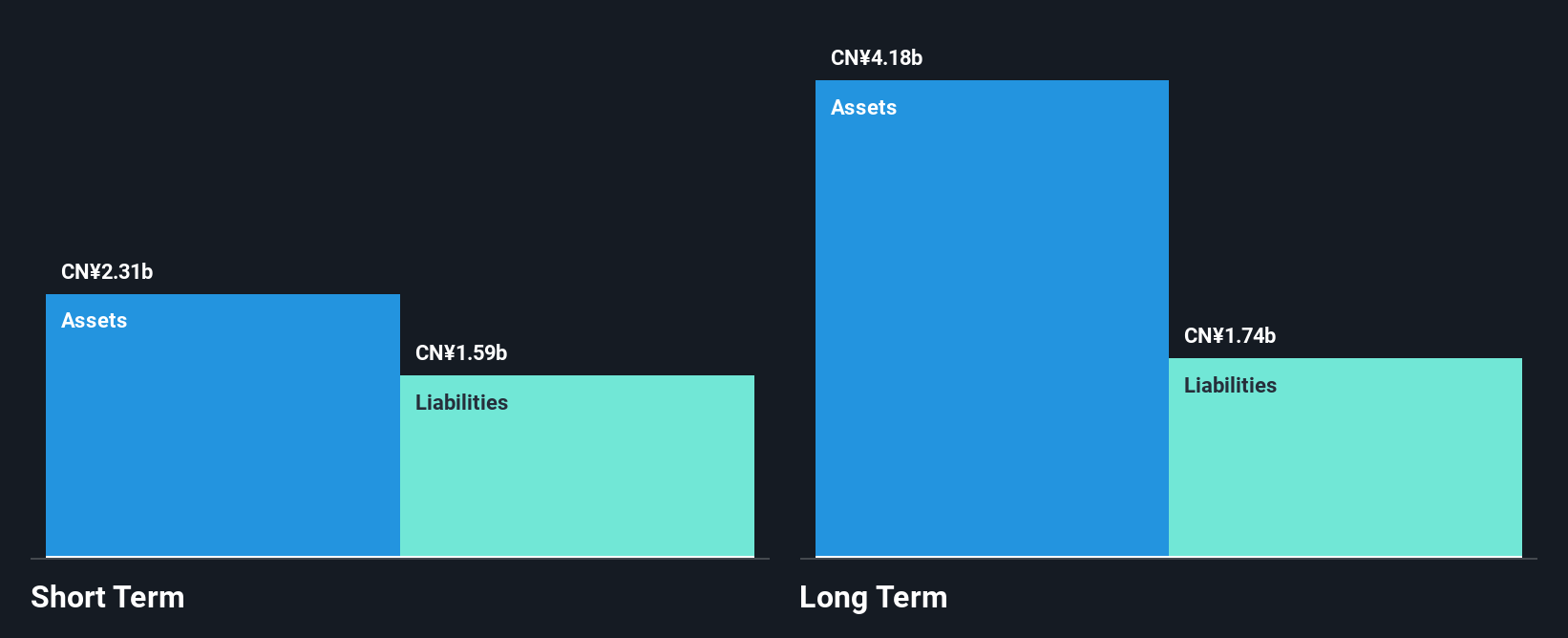

Pubang Landscape Architecture Co., Ltd has shown financial improvement, becoming profitable in the past year with net income of CN¥5.97 million for the half-year ending June 2024, compared to a net loss previously. The company's revenue is primarily from South China, contributing significantly to its CN¥873.49 million total revenue for the period. Despite low return on equity at 1.7%, Pubang's short-term assets cover both short and long-term liabilities adequately, and it holds more cash than debt. A recent share buyback of 72,541,550 shares indicates strategic confidence amidst stable weekly volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of Pubang Landscape Architecture.

- Explore historical data to track Pubang Landscape Architecture's performance over time in our past results report.

Next Steps

- Navigate through the entire inventory of 5,798 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002663

Pubang Landscape Architecture

Engages in the garden planning and design and garden engineering businesses primarily in China.

Adequate balance sheet with acceptable track record.