October 2024's Top Growth Companies With Strong Insider Commitment

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, growth stocks have managed to outperform value counterparts, with the tech-heavy Nasdaq Composite Index showing resilience despite broader market pressures. In this environment, companies with high insider ownership can signal strong internal confidence and alignment with shareholder interests, making them particularly appealing for investors seeking growth opportunities amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Sabaf (BIT:SAB)

Simply Wall St Growth Rating: ★★★★☆☆

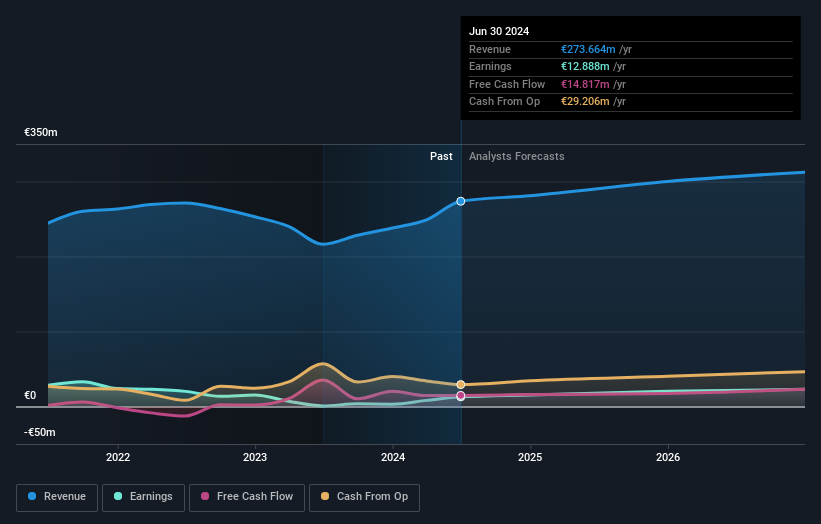

Overview: Sabaf S.p.A. designs, manufactures, and sells components for household cooking appliances and has a market cap of €231.51 million.

Operations: The company's revenue segments include Hinges at €85.18 million, Gas Parts at €156.47 million, and Electronic Components at €25.39 million.

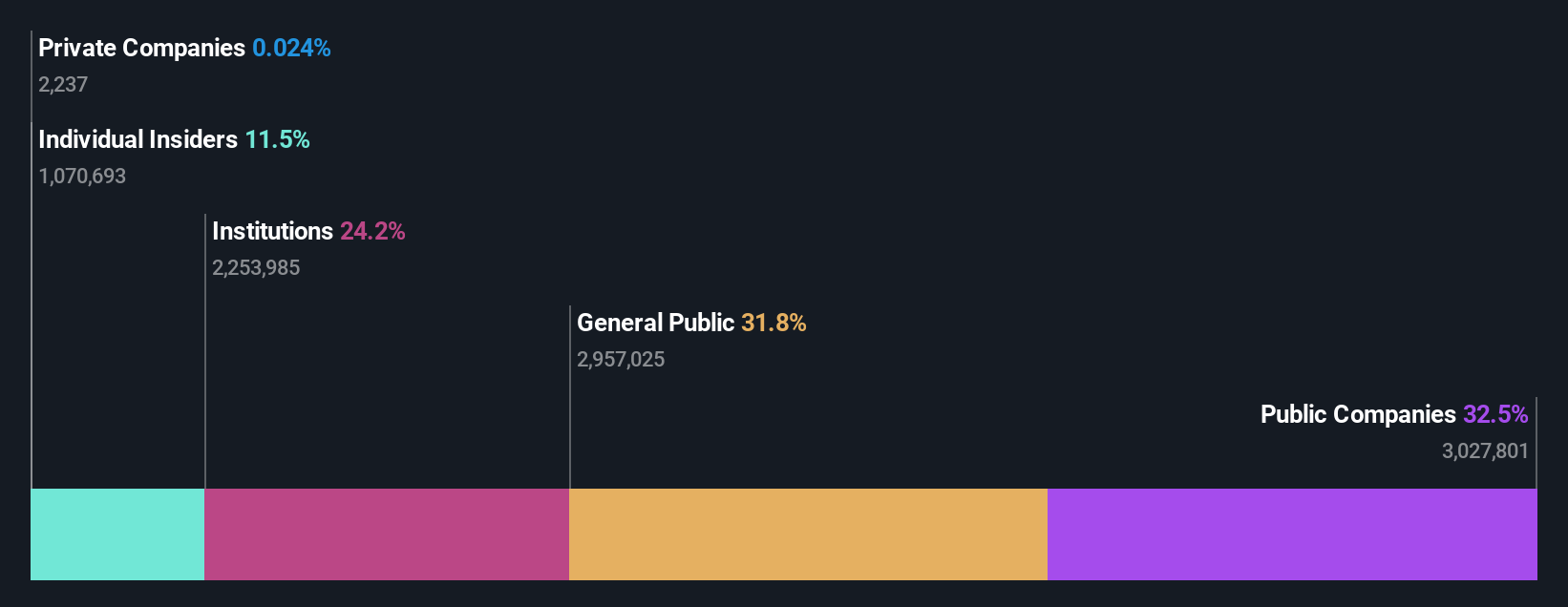

Insider Ownership: 19.8%

Sabaf S.p.A. demonstrates robust growth potential, with earnings expected to rise significantly at 22.73% annually, outpacing the Italian market's 7.6%. The company reported a strong turnaround in recent results, achieving a net income of €8.36 million for the first half of 2024 compared to a loss last year. Despite its unstable dividend history and low future return on equity forecast, Sabaf's revenue growth aligns slightly above market expectations at 4.2% annually.

- Dive into the specifics of Sabaf here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Sabaf's current price could be inflated.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩3.68 trillion.

Operations: The company's revenue is primarily derived from its Heavy Industry segment, contributing ₩3.35 trillion, and its Construction segment, which accounts for ₩1.78 trillion.

Insider Ownership: 16.4%

Hyosung Heavy Industries shows promising growth potential, with earnings expected to rise significantly at 34.74% annually, surpassing the Korean market's 29.6%. Despite high share price volatility and debt not well covered by operating cash flow, the company trades at a substantial discount to its estimated fair value. Recent presentations at Shinhan Securities highlight strategic plans that may drive future performance. Revenue growth of 10.5% annually is slightly above market expectations in Korea.

- Unlock comprehensive insights into our analysis of Hyosung Heavy Industries stock in this growth report.

- Upon reviewing our latest valuation report, Hyosung Heavy Industries' share price might be too pessimistic.

Zhejiang Truelove Vogue (SZSE:003041)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Truelove Vogue Co., Ltd. engages in the research and development, design, manufacture, and sale of blankets in China with a market cap of CN¥1.79 billion.

Operations: The company's revenue is primarily derived from the sale of blankets, amounting to CN¥863.09 million, and bedding products, which contribute CN¥14.70 million.

Insider Ownership: 10.2%

Zhejiang Truelove Vogue is poised for growth with earnings projected to increase by 32.6% annually, outpacing the Chinese market's average. Despite a recent decline in sales and revenue, the company maintains a favorable price-to-earnings ratio of 16.8x compared to the market's 34.1x, indicating good value relative to peers. However, its dividend yield of 3.23% is not well covered by free cash flows, and Return on Equity is forecasted low at 14%.

- Click here and access our complete growth analysis report to understand the dynamics of Zhejiang Truelove Vogue.

- According our valuation report, there's an indication that Zhejiang Truelove Vogue's share price might be on the cheaper side.

Next Steps

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1510 more companies for you to explore.Click here to unveil our expertly curated list of 1513 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Truelove Vogue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003041

Zhejiang Truelove Vogue

Research and development, designs, manufactures, and sells blankets in China.

Excellent balance sheet with reasonable growth potential.