- China

- /

- Trade Distributors

- /

- SZSE:002102

Undervalued Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields, the S&P 500 Index has seen a decline after six weeks of gains, reflecting broader economic uncertainties and shifting investor expectations regarding Federal Reserve policies. In these conditions, investors often look towards smaller or newer companies for potential opportunities. Penny stocks—though an older term—remain relevant as they represent smaller firms that can offer significant value when backed by strong financials and growth prospects. This article highlights several penny stocks that exhibit financial strength and could present promising opportunities for those interested in exploring under-the-radar investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.91B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$488.79M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.69 | MYR127.31M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.95 | £474.22M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,793 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

5i5j Holding Group (SZSE:000560)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 5i5j Holding Group Co., Ltd. offers real estate brokerage services both in China and internationally, with a market cap of CN¥7.94 billion.

Operations: The company's revenue is primarily derived from Asset Management (CN¥6.20 billion), Brokerage (CN¥3.53 billion), New Home Business (CN¥852.00 million), and Commercial Leasing and Services (CN¥391.63 million).

Market Cap: CN¥7.94B

5i5j Holding Group Co., Ltd. operates with a market cap of CN¥7.94 billion and has shown some improvement in financial performance, reporting a net income of CN¥29.36 million for the half year ended June 30, 2024, compared to a net loss previously. Despite this progress, the company remains unprofitable overall with losses increasing at a significant rate over the past five years. Its short-term assets do not cover its short-term liabilities (CN¥15.9 billion), though it does have more cash than total debt and its debt is well covered by operating cash flow (183.2%). The share price has been highly volatile recently but shows stable weekly volatility over the past year compared to other Chinese stocks.

- Unlock comprehensive insights into our analysis of 5i5j Holding Group stock in this financial health report.

- Assess 5i5j Holding Group's future earnings estimates with our detailed growth reports.

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HuBei NengTer Technology Co., Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥6.90 billion.

Operations: Currently, there are no specific revenue segments reported for the company.

Market Cap: CN¥6.9B

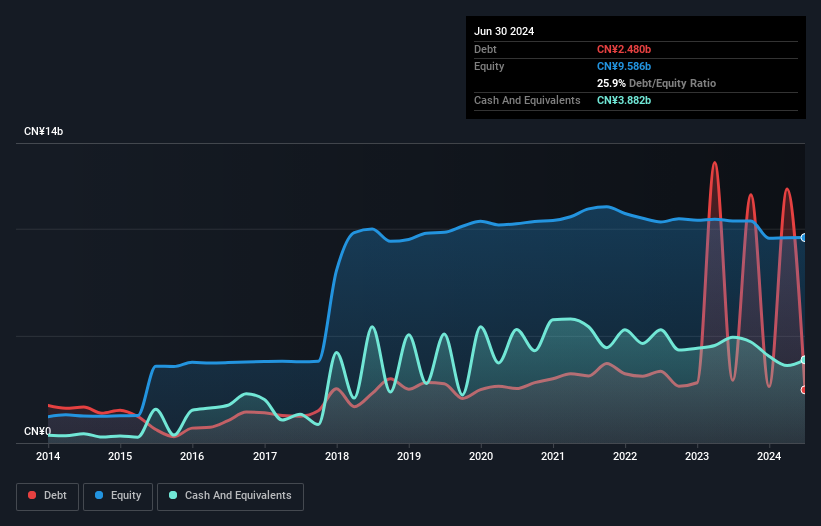

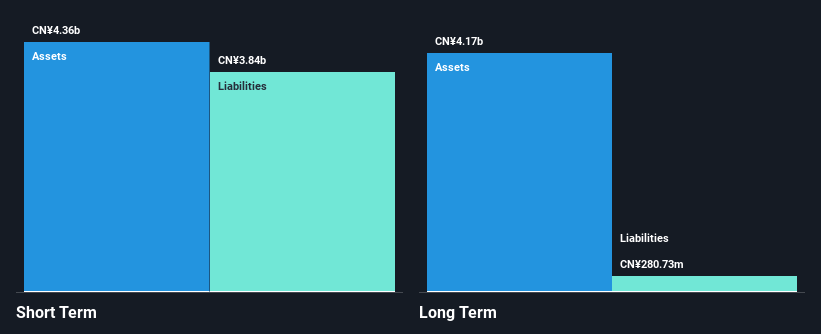

HuBei NengTer Technology Ltd. has demonstrated significant sales growth, reporting CN¥9.29 billion for the nine months ended September 30, 2024, up from CN¥7.94 billion a year earlier. However, net income decreased to CN¥120.24 million from CN¥329.69 million due to a large one-off loss of CN¥123.9 million impacting recent results. Despite negative earnings growth over the past year and low return on equity at 1.3%, the company maintains strong liquidity with short-term assets exceeding both short and long-term liabilities significantly, while its debt is well covered by operating cash flow (105%).

- Dive into the specifics of HuBei NengTer TechnologyLtd here with our thorough balance sheet health report.

- Understand HuBei NengTer TechnologyLtd's track record by examining our performance history report.

Goody Science and Technology (SZSE:002694)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goody Science and Technology Co., Ltd. focuses on the research, development, production, and sale of plastic pipes in China with a market cap of CN¥2.84 billion.

Operations: The company's revenue primarily comes from its Plastic Manufacturing segment, which generated CN¥861.74 million.

Market Cap: CN¥2.84B

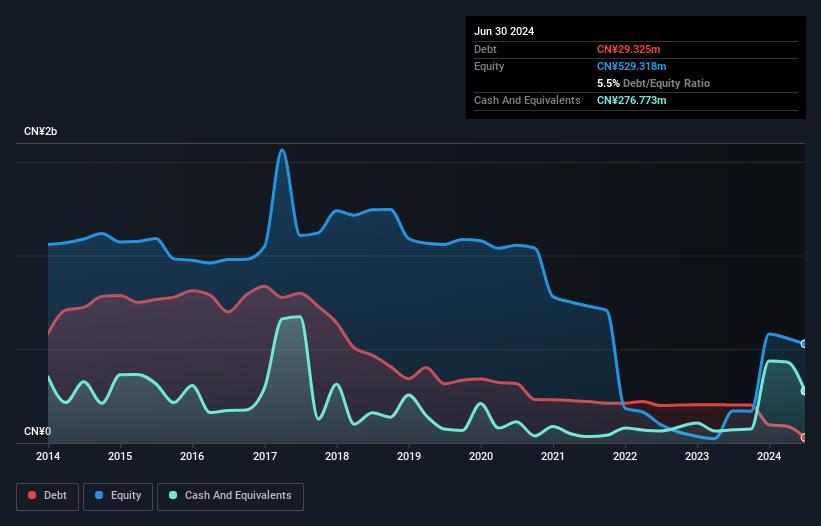

Goody Science and Technology Co., Ltd. has been navigating financial challenges, with a reported net loss of CN¥40.17 million for the first half of 2024 compared to a profit the previous year. Despite being unprofitable, its short-term assets exceed both short and long-term liabilities, indicating strong liquidity. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, suggesting prudent financial management. However, negative return on equity and an inexperienced board may pose risks as the company considers changes to its business scope following recent shareholder meetings.

- Take a closer look at Goody Science and Technology's potential here in our financial health report.

- Learn about Goody Science and Technology's historical performance here.

Taking Advantage

- Reveal the 5,793 hidden gems among our Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HuBei NengTer TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002102

HuBei NengTer TechnologyLtd

Operates an ecommerce platform for the supply chain of plastic raw materials in China.

Excellent balance sheet and slightly overvalued.