- China

- /

- Professional Services

- /

- SZSE:002663

Asian Penny Stocks Under US$70M Market Cap To Watch

Reviewed by Simply Wall St

As global markets experience volatility, with recent trade tensions between the U.S. and China impacting investor sentiment, the Asian market remains a focal point for many investors seeking opportunities. Penny stocks, although an older term, continue to represent smaller or newer companies that can offer unique investment potential. By focusing on those with solid financials and clear growth paths, investors can uncover promising opportunities within this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.18 | SGD478.24M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.66 | THB2.8B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$3.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 964 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YH Entertainment Group, with a market cap of HK$2.04 billion, is an investment holding company that operates as an artist management company in Mainland China and Korea.

Operations: The company's revenue is derived from Artist Management (CN¥748.30 million), Pan-Entertainment Business (CN¥39.32 million), and Music IP Production and Operation (CN¥43.87 million).

Market Cap: HK$2.04B

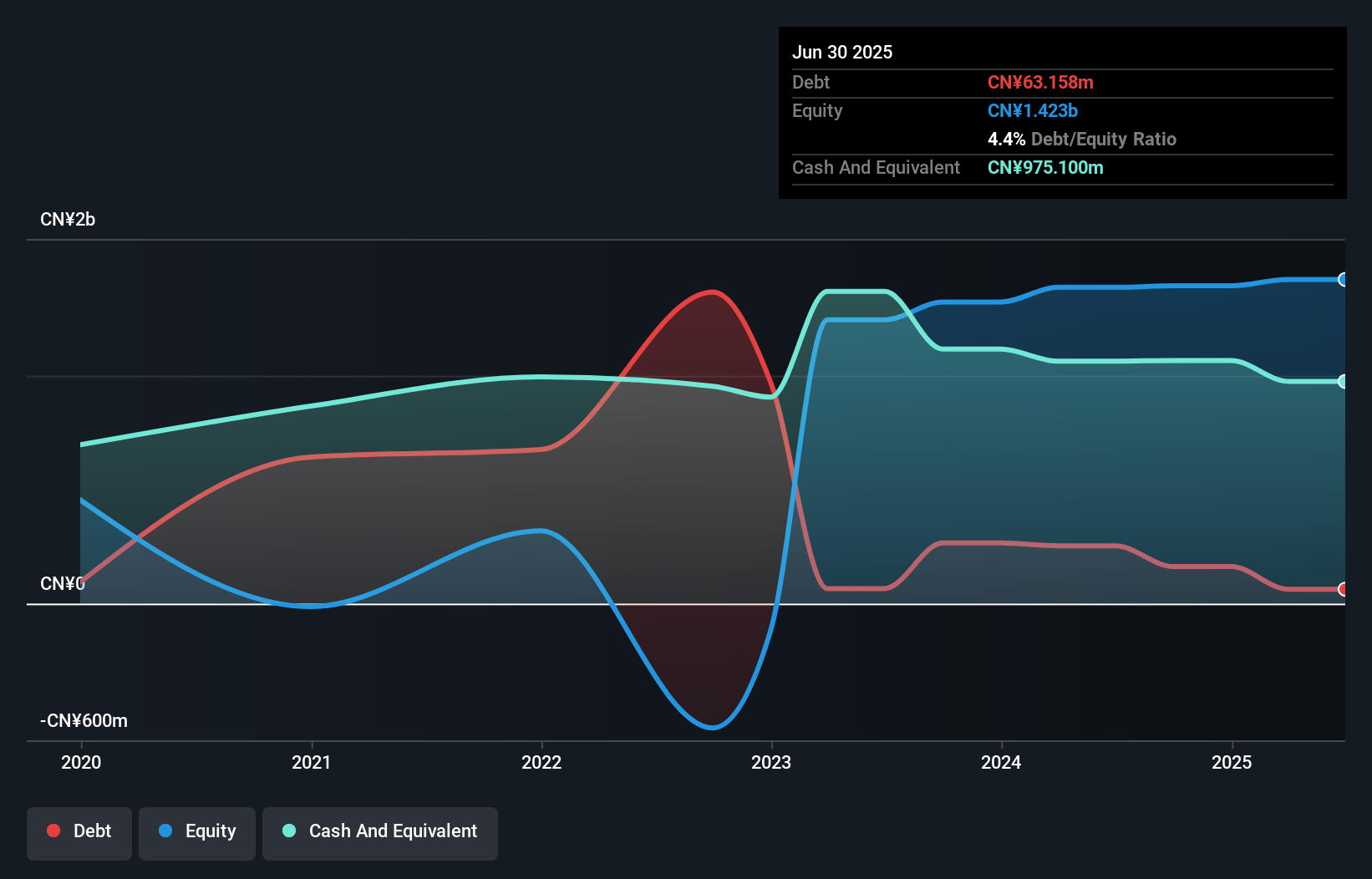

YH Entertainment Group, with a market cap of HK$2.04 billion, has shown financial stability by maintaining short-term assets (CN¥1.1 billion) that cover both short and long-term liabilities. The company has successfully reduced its debt-to-equity ratio from 165.2% to 4.4% over five years and maintains more cash than total debt, indicating prudent financial management. Recent earnings reports reveal an increase in net income to CN¥58.1 million for the first half of 2025 from CN¥30.8 million a year ago, driven by growth in artist management revenue and decreased share-based payment expenses, alongside strategic share buybacks enhancing shareholder value.

- Click here to discover the nuances of YH Entertainment Group with our detailed analytical financial health report.

- Gain insights into YH Entertainment Group's past trends and performance with our report on the company's historical track record.

Kencana Agri (SGX:BNE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kencana Agri Limited, with a market cap of SGD100.45 million, operates as a plantation company in Indonesia, Malaysia, and internationally through its subsidiaries.

Operations: The company's revenue is primarily generated from its Oil Palm Plantation Business, amounting to $186.35 million.

Market Cap: SGD100.45M

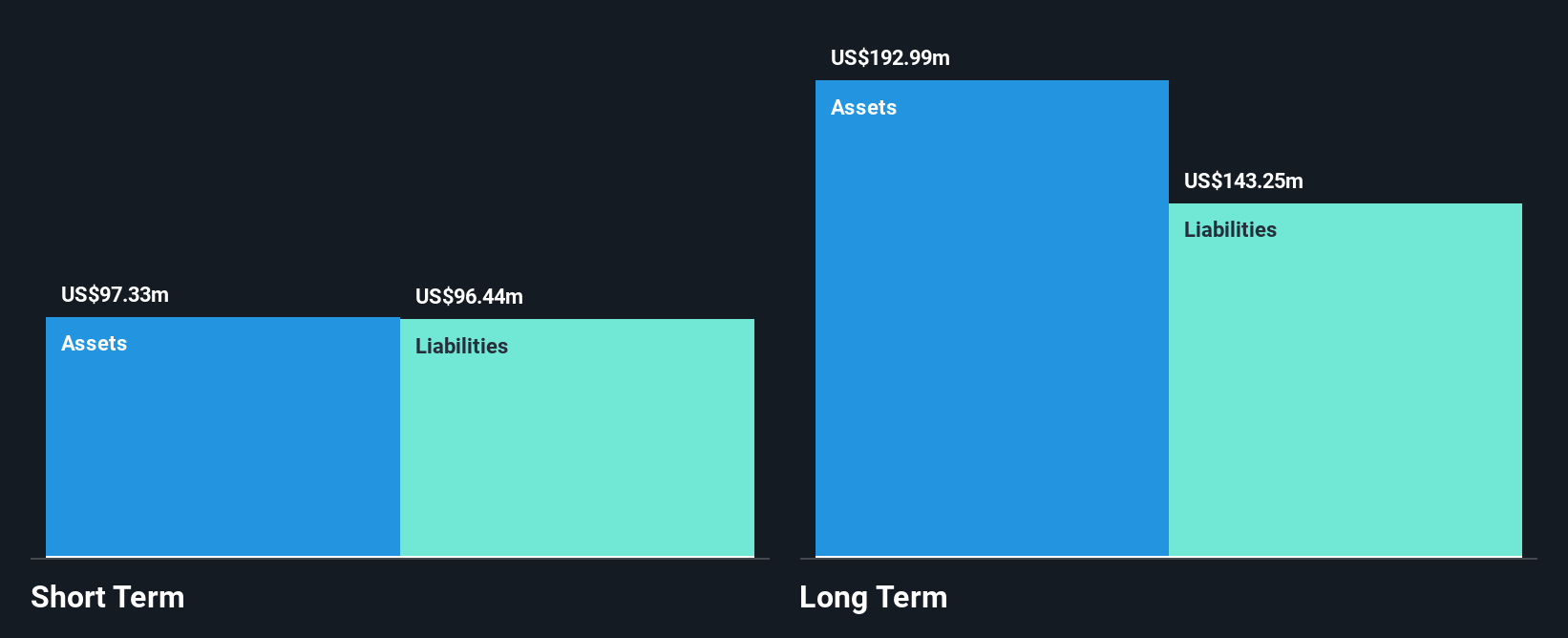

Kencana Agri Limited, with a market cap of SGD100.45 million, has demonstrated growth in its financial performance. The company reported sales of US$87.15 million for the first half of 2025, up from US$54.53 million the previous year, and net income rose to US$9.78 million from US$0.568 million. Despite its high net debt to equity ratio of 298.8%, which indicates significant leverage, the company's operating cash flow adequately covers its debt obligations at 28.5%. However, short-term assets barely exceed short-term liabilities and fall short against long-term liabilities, highlighting potential liquidity concerns amidst volatile share prices.

- Dive into the specifics of Kencana Agri here with our thorough balance sheet health report.

- Gain insights into Kencana Agri's future direction by reviewing our growth report.

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pubang Landscape Architecture Co., Ltd operates in China, focusing on garden engineering construction and garden landscape design, with a market cap of CN¥3.65 billion.

Operations: The company's revenue is primarily generated from South China with CN¥1.35 billion, followed by East China at CN¥351.33 million, Central China at CN¥113.18 million, North China at CN¥39.30 million, Southwest China at CN¥59.29 million, Northwest China at CN¥8.80 million, and North East China contributing CN¥8.57 million; overseas operations add a modest CN¥0.73 million to the total revenue mix.

Market Cap: CN¥3.65B

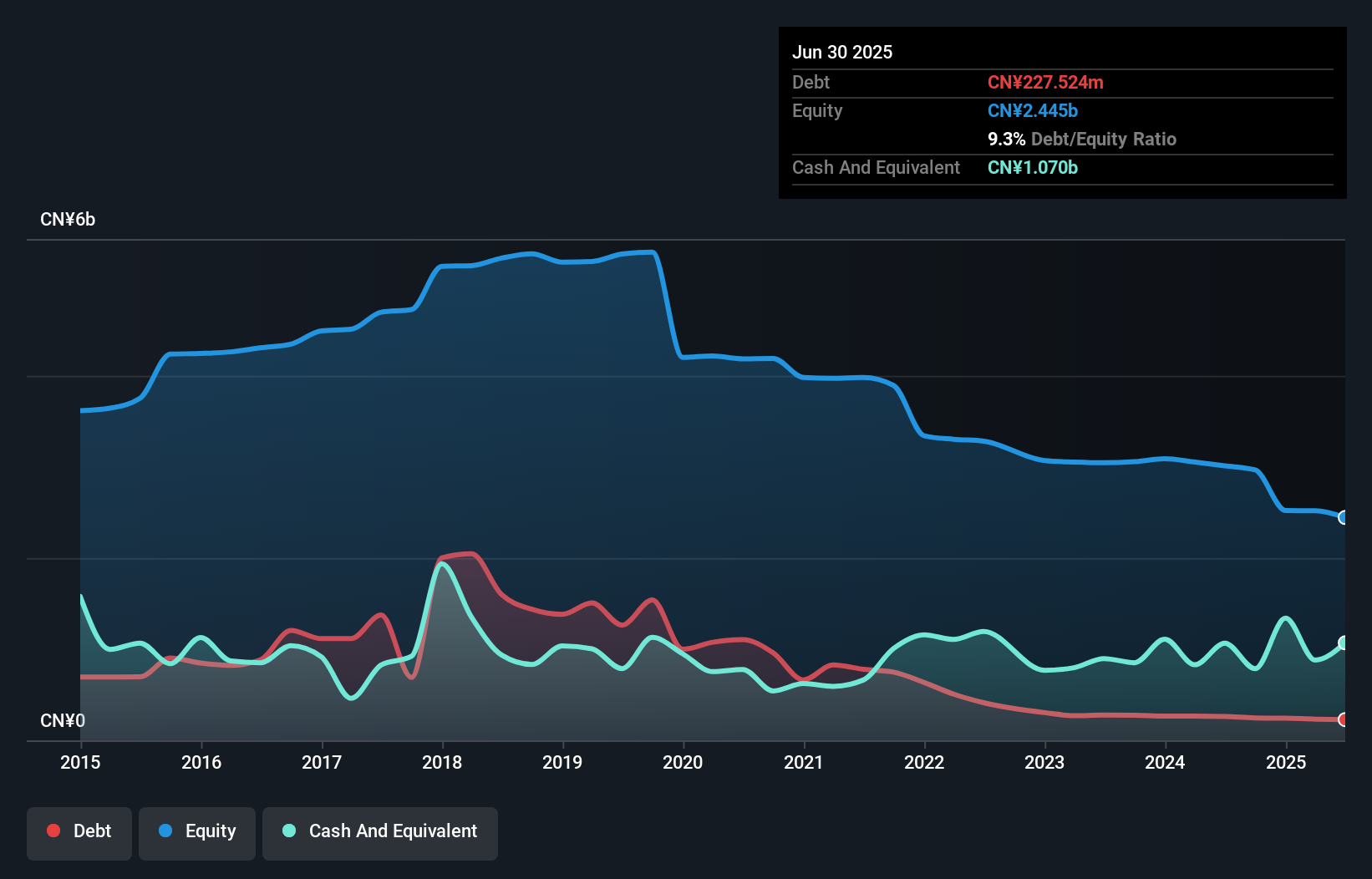

Pubang Landscape Architecture Co., Ltd, with a market cap of CN¥3.65 billion, operates primarily in China and has reported a net loss of CN¥33.61 million for the first half of 2025, reversing from a net income the previous year. Despite being unprofitable, it has reduced its losses over five years by 27.1% annually and maintains more cash than total debt. Short-term assets cover both short-term and long-term liabilities comfortably, providing financial stability amidst earnings decline. The company benefits from an experienced management team but faces challenges in achieving profitability as reflected by its negative return on equity and declining revenues.

- Jump into the full analysis health report here for a deeper understanding of Pubang Landscape Architecture.

- Understand Pubang Landscape Architecture's track record by examining our performance history report.

Key Takeaways

- Navigate through the entire inventory of 964 Asian Penny Stocks here.

- Seeking Other Investments? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002663

Pubang Landscape Architecture

Engages in the garden engineering construction and garden landscape design businesses in China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives