- Hong Kong

- /

- Consumer Services

- /

- SEHK:1765

Asian Penny Stocks Under US$600M Market Cap To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances and economic uncertainties, the Asian market remains a focal point for investors seeking growth opportunities. Penny stocks, often seen as relics of earlier market days, continue to offer potential for significant returns, especially when backed by strong financial health and solid fundamentals. In this article, we explore several Asian penny stocks that stand out with robust balance sheets and promising prospects in today's evolving market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.85 | HK$2.32B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.90 | THB3.04B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.09B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.90 | THB2.94B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.10 | SGD52.35M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.98 | HK$2.63B | ✅ 4 ⚠️ 1 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.87 | NZ$238.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 939 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

XJ International Holdings (SEHK:1765)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: XJ International Holdings Co., Ltd. is an investment holding company that provides higher education and secondary vocational education services in China and Malaysia, with a market cap of HK$1.88 billion.

Operations: The company generates its revenue from Domestic Education amounting to CN¥3.35 billion and Global Education contributing CN¥494.83 million.

Market Cap: HK$1.88B

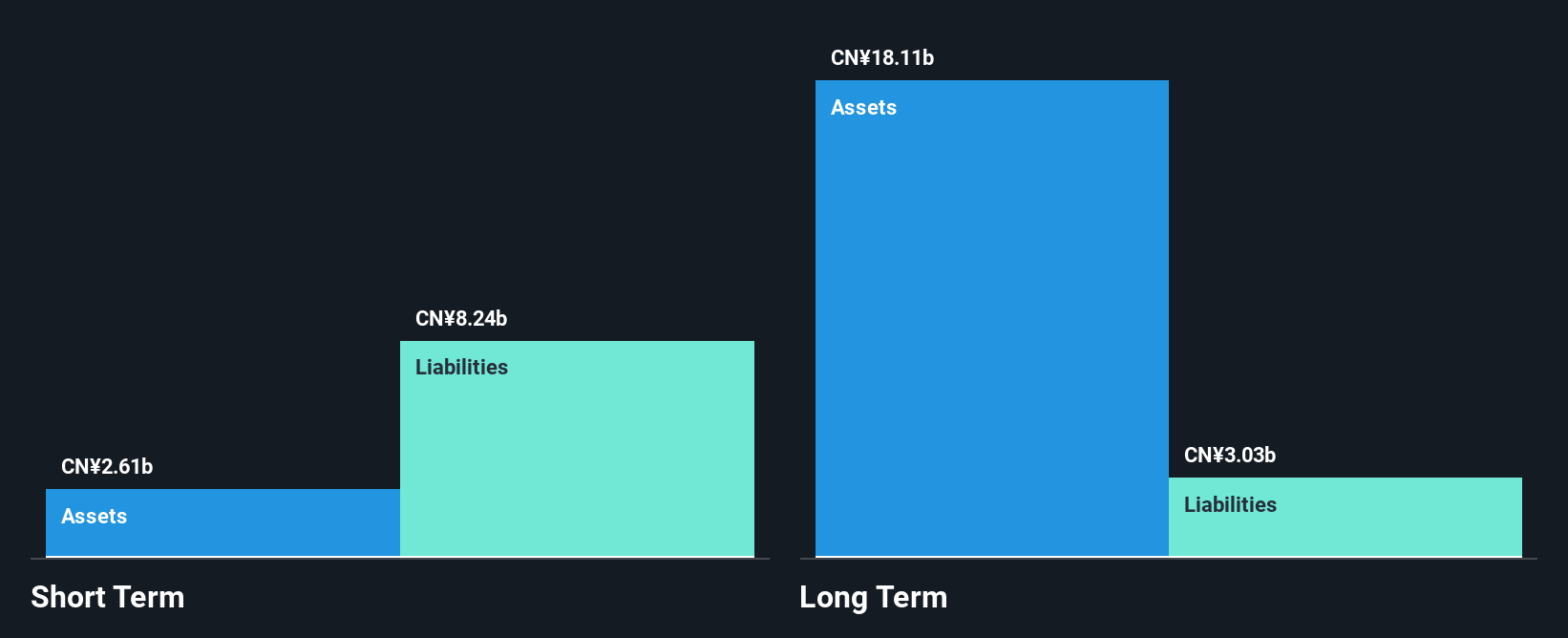

XJ International Holdings has demonstrated significant earnings growth, with a very large increase over the past year, far outpacing the industry average. The company's debt is well managed, with operating cash flow covering 41.3% of its debt and a satisfactory net debt to equity ratio of 28.9%. However, short-term liabilities significantly exceed short-term assets by CN¥5.6 billion, indicating potential liquidity concerns. Recent events include a follow-on equity offering raising HK$88.96 million and changes in board committee memberships, reflecting ongoing strategic adjustments within the company’s governance structure. Despite trading below estimated fair value, investors should consider these financial dynamics carefully.

- Click here and access our complete financial health analysis report to understand the dynamics of XJ International Holdings.

- Understand XJ International Holdings' track record by examining our performance history report.

Fangzhou (SEHK:6086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangzhou Inc. offers online chronic disease management services in China with a market cap of approximately HK$4.37 billion.

Operations: The company's revenue is primarily derived from four segments: Wholesale (CN¥507 million), Comprehensive Medical Services (CN¥683 million), Online Retail Pharmacy Services (CN¥1.59 billion), and Customized Content and Marketing Solutions (CN¥93.41 million).

Market Cap: HK$4.37B

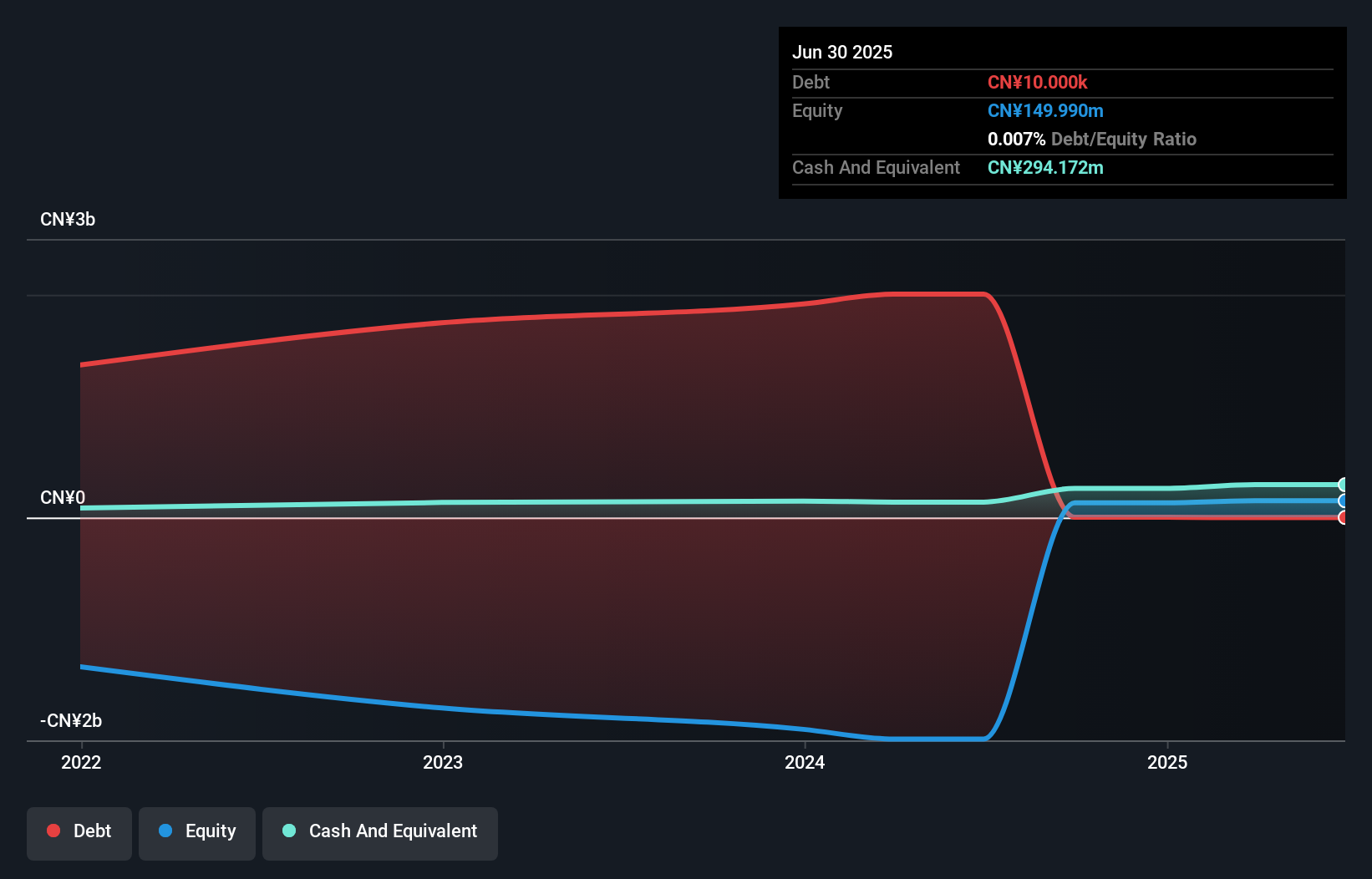

Fangzhou Inc. is navigating the penny stock landscape with a focus on digital health innovation in chronic disease management. Despite being unprofitable, the company maintains a strong cash position, exceeding its total debt and covering both short and long-term liabilities with assets. Revenue streams are robust across various segments, including CN¥1.59 billion from Online Retail Pharmacy Services. Strategic alliances with Novo Nordisk and Fosun Pharma highlight Fangzhou's commitment to AI-powered healthcare solutions, enhancing its ecosystem for conditions like psoriasis and obesity. Recent partnerships aim to integrate AI technology with innovative therapies, positioning Fangzhou as a key player in China's evolving healthcare sector.

- Unlock comprehensive insights into our analysis of Fangzhou stock in this financial health report.

- Examine Fangzhou's earnings growth report to understand how analysts expect it to perform.

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pubang Landscape Architecture Co., Ltd operates in garden engineering construction and landscape design in China, with a market cap of CN¥4.33 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥4.33B

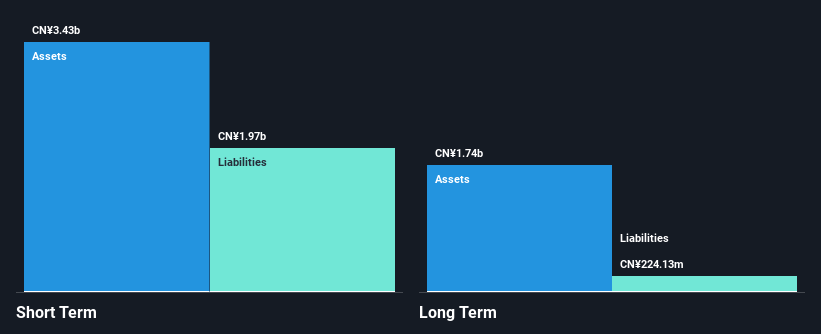

Pubang Landscape Architecture, operating within China's garden engineering sector, faces challenges typical of penny stocks. The company remains unprofitable with a net loss of CN¥39.04 million for the nine months ending September 2025, despite generating sales of CN¥1.26 billion. However, Pubang's financial health is bolstered by a strong cash position exceeding its total debt and sufficient assets to cover liabilities. Additionally, the management team is seasoned with an average tenure of 6.2 years, suggesting stability in leadership amidst ongoing efforts to reduce losses at an annual rate of 15.7% over five years.

- Take a closer look at Pubang Landscape Architecture's potential here in our financial health report.

- Review our historical performance report to gain insights into Pubang Landscape Architecture's track record.

Make It Happen

- Unlock our comprehensive list of 939 Asian Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1765

XJ International Holdings

An investment holding company, engages in the provision of higher education and secondary vocational education services in China and Malaysia.

Solid track record and good value.

Market Insights

Community Narratives