- China

- /

- Electronic Equipment and Components

- /

- SZSE:002808

Frencken Group And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been experiencing a mix of volatility and optimism, with U.S. stocks facing pressure from AI competition fears while European indices reach new highs following positive earnings and interest rate cuts. In this context, identifying promising investment opportunities requires careful consideration of financial health and growth potential, particularly in the realm of smaller or newer companies. Penny stocks, though often considered niche investments, can offer significant upside when supported by strong fundamentals and balance sheets.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.73 | HK$42.85B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frencken Group Limited is an investment holding company offering original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD478.34 million.

Operations: The company's revenue is primarily derived from its Mechatronics segment, contributing SGD670.12 million, and its Integrated Manufacturing Services (IMS) segment, which adds SGD91.79 million.

Market Cap: SGD478.34M

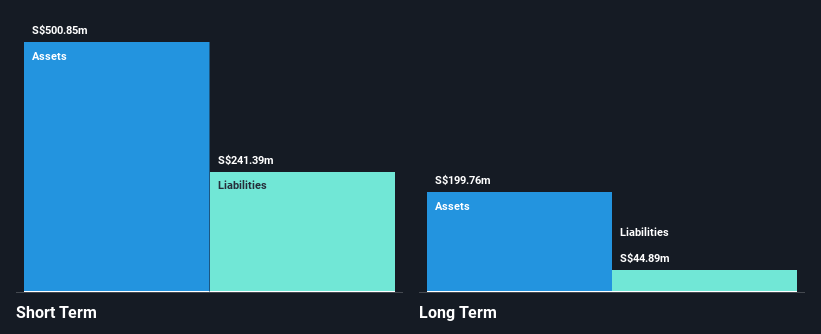

Frencken Group Limited, with a market cap of SGD478.34 million, has been selected by Gapwaves AB as a production partner for high-volume waveguide antennas, indicating potential revenue growth. The company trades significantly below its estimated fair value and maintains stable weekly volatility. Although its return on equity is low at 9.2%, Frencken has high-quality earnings and an experienced management team. Its short-term assets comfortably cover both short- and long-term liabilities, and it holds more cash than total debt, suggesting financial stability. Despite past challenges in profit growth, recent earnings have shown improvement compared to industry trends.

- Take a closer look at Frencken Group's potential here in our financial health report.

- Understand Frencken Group's earnings outlook by examining our growth report.

Shenzhen Ruihe Construction Decoration (SZSE:002620)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Ruihe Construction Decoration Co., Ltd. operates in the construction and decoration industry, with a market cap of CN¥1.20 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥950.31 million.

Market Cap: CN¥1.2B

Shenzhen Ruihe Construction Decoration Co., Ltd. faces challenges with increasing losses at a rate of 26.7% annually over the past five years, resulting in negative return on equity and unprofitability. Despite this, the company has a robust cash runway exceeding three years due to positive free cash flow growth of 49.8% per year, providing some financial stability amidst high volatility in share price. Its short-term assets cover both short- and long-term liabilities, although its debt-to-equity ratio is high at 162.3%. An upcoming shareholders meeting may address changes in auditing practices, potentially impacting future financial oversight.

- Dive into the specifics of Shenzhen Ruihe Construction Decoration here with our thorough balance sheet health report.

- Understand Shenzhen Ruihe Construction Decoration's track record by examining our performance history report.

Suzhou Goldengreen Technologies (SZSE:002808)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Goldengreen Technologies Ltd. and its subsidiaries focus on the research, development, manufacture, and sale of laser organic photo-conductor drum products in China, with a market cap of CN¥752.64 million.

Operations: No specific revenue segments are reported for Suzhou Goldengreen Technologies Ltd.

Market Cap: CN¥752.64M

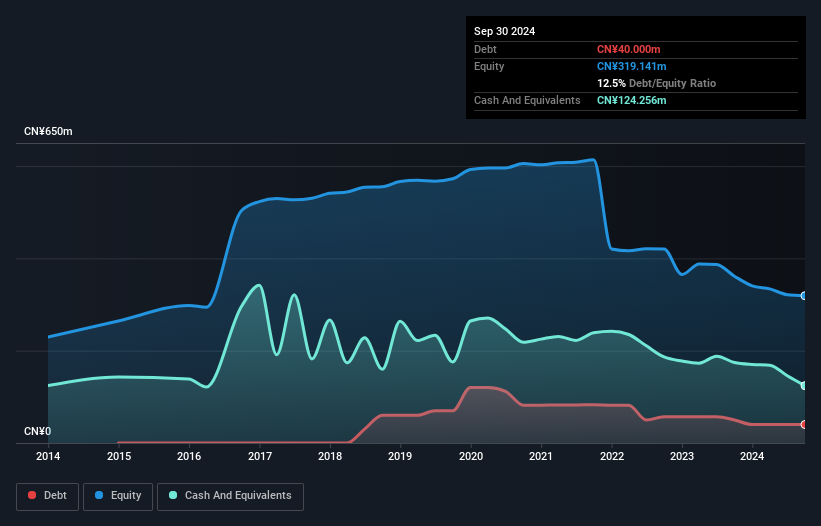

Suzhou Goldengreen Technologies Ltd. presents a mixed picture for investors. The company maintains more cash than its total debt, offering some financial stability despite being pre-revenue and unprofitable with a negative return on equity of -6.95%. Its share price has been highly volatile recently, yet shareholders have not faced significant dilution over the past year. The management team is experienced with an average tenure of 14.2 years, although the board's tenure suggests inexperience at 2.8 years on average. While short-term assets cover liabilities comfortably, earnings have declined significantly over five years, and losses continue to grow annually by 37.7%.

- Get an in-depth perspective on Suzhou Goldengreen Technologies' performance by reading our balance sheet health report here.

- Examine Suzhou Goldengreen Technologies' past performance report to understand how it has performed in prior years.

Next Steps

- Explore the 5,713 names from our Penny Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002808

Suzhou Goldengreen Technologies

Researches, develops, manufactures, and sells laser organic photo-conductor drum products in China.

Flawless balance sheet minimal.

Market Insights

Community Narratives