- China

- /

- Auto Components

- /

- SHSE:605133

Undiscovered Gems in Global Markets to Explore This October 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating trade tensions, dovish signals from the U.S. Federal Reserve, and emerging concerns in the credit market, investors are keenly observing how these dynamics impact small-cap stocks. With major indices like the S&P 500 rebounding despite recent setbacks and economic indicators showing mixed signals, identifying undiscovered gems requires a focus on companies with strong fundamentals that can thrive amid uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| DINE. de | 78.90% | 35.52% | -13.75% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangsu Rongtai Industry (SHSE:605133)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Rongtai Industry Co., Ltd. focuses on the research, development, production, and sale of automotive aluminum alloy precision die casting products both in China and internationally, with a market capitalization of CN¥11.22 billion.

Operations: Rongtai Industry generates revenue primarily from the sale of automotive aluminum alloy precision die casting products. The company's net profit margin has shown a notable trend, reflecting its ability to manage costs relative to its revenue streams effectively.

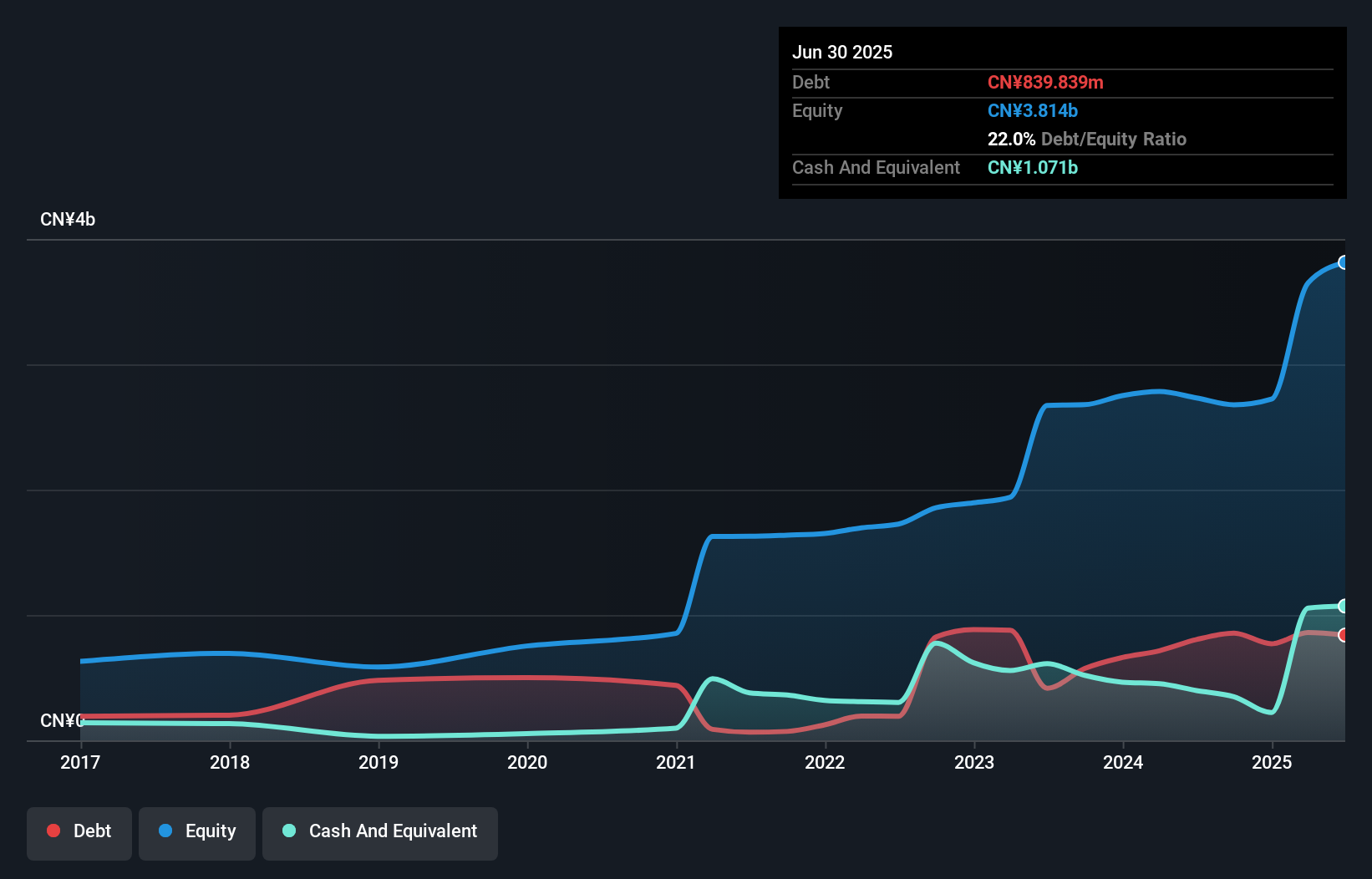

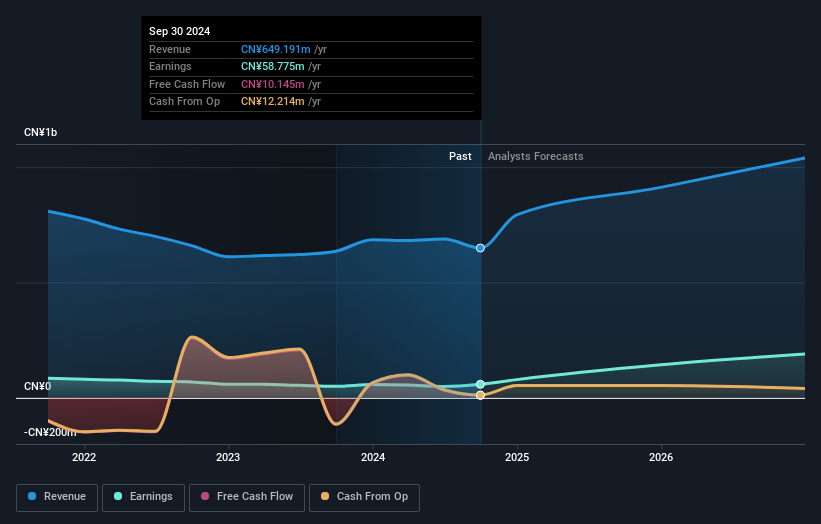

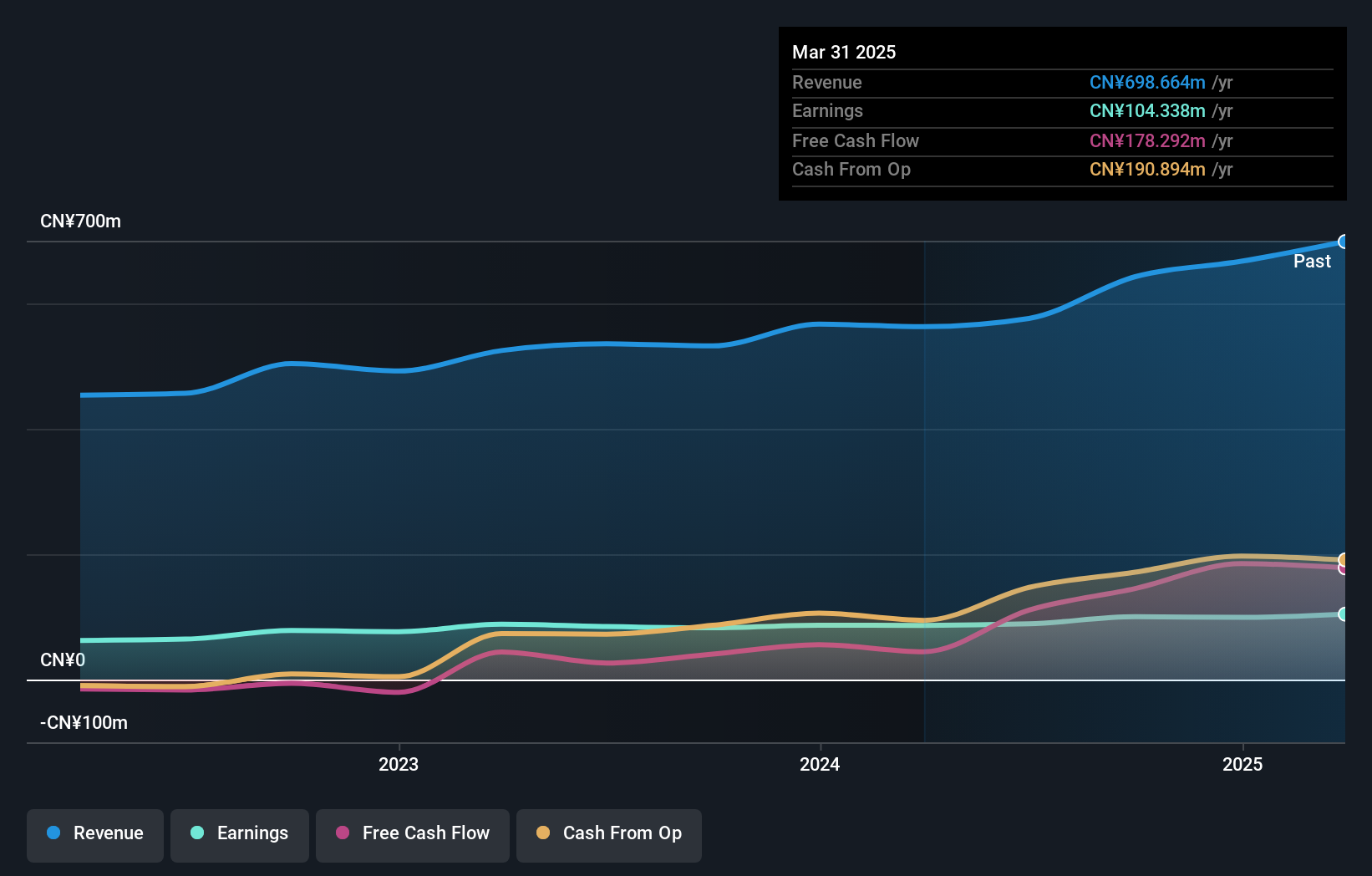

Jiangsu Rongtai Industry, a smaller player in the auto components sector, has shown notable earnings growth of 9.9%, outpacing the industry's 2.5% increase over the past year. Despite a significant one-off gain of CN¥38.7 million impacting recent results, its debt-to-equity ratio improved from 58.5% to 22% over five years, indicating strengthened financial health. However, shareholder dilution occurred recently and free cash flow remains negative. The company’s inclusion in the S&P Global BMI Index suggests growing recognition while its net income rose to CN¥97.72 million for H1 2025 compared to CN¥86.26 million previously, reflecting operational progress amidst volatility concerns.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector, focusing on sustainable and innovative environmental solutions, with a market capitalization of CN¥12.74 billion.

Operations: Hui Lyu Ecological Technology Groups Co., Ltd. generates revenue primarily from its gardening business, which reported a segment adjustment of CN¥1.06 billion.

Hui Lyu Ecological Technology, a dynamic player in its field, has shown impressive earnings growth of 83% over the past year, outpacing the industry average. Despite this surge, their net debt to equity ratio climbed from 35.8% to 44.4% over five years, indicating a rise in leverage but remains within satisfactory limits at 24%. A notable CN¥26.9 million one-off gain influenced recent financials; however, it's worth noting that earnings have decreased by an average of 10.1% annually over five years. Recent inclusion in the S&P Global BMI Index and strategic asset transactions reflect active corporate maneuvers aimed at future positioning.

- Click here to discover the nuances of Hui Lyu Ecological Technology GroupsLtd with our detailed analytical health report.

Understand Hui Lyu Ecological Technology GroupsLtd's track record by examining our Past report.

Dezhou United Petroleum TechnologyLtd (SZSE:301158)

Simply Wall St Value Rating: ★★★★★★

Overview: Dezhou United Petroleum Technology Co., Ltd. operates in the petroleum technology sector with a market capitalization of CN¥3.17 billion.

Operations: The company generates revenue primarily from its operations in the petroleum technology sector. It has a market capitalization of CN¥3.17 billion, reflecting its standing in the industry.

Dezhou United Petroleum Technology, a nimble player in the energy sector, has shown impressive momentum with earnings growth of 23.1%, outpacing the industry average. Its debt-to-equity ratio improved dramatically from 11.5 to just 0.07 over five years, highlighting effective financial management. The company trades at a compelling value, estimated to be 65% below its fair market price. Recent half-year results reveal sales climbing to CNY 270 million and net income rising to CNY 45 million from last year’s figures, reflecting robust operational performance and high-quality earnings that bolster investor confidence in its future potential.

Summing It All Up

- Click through to start exploring the rest of the 2922 Global Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605133

Jiangsu Rongtai Industry

Engages in the research and development, production, and sale of automotive aluminum alloy precision die casting products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives