As global markets continue to reach new heights, with indices like the S&P 500 and Nasdaq Composite hitting all-time highs, investors are keenly observing the impact of rising inflation and evolving trade dynamics on smaller-cap stocks. In this environment, discovering stocks that offer unique value propositions or operate in niche markets can be particularly rewarding for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market cap of CN¥7.76 billion.

Operations: Revenue and cost data for Hui Lyu Ecological Technology Groups Ltd. is not provided, limiting detailed financial analysis.

Hui Lyu Ecological Technology Groups, a relatively small player in its sector, has shown impressive performance with earnings growth of 48.7% over the past year, outpacing the Commercial Services industry's 0.9%. The company maintains a satisfactory net debt to equity ratio at 20.1%, ensuring financial stability. Recent developments include a significant revenue increase to CNY 308.81 million from CNY 99.49 million and net income rising to CNY 19.83 million from CNY 3.05 million compared to last year’s first quarter figures, reflecting strong operational momentum and potential for future expansion within its market niche.

- Navigate through the intricacies of Hui Lyu Ecological Technology GroupsLtd with our comprehensive health report here.

Understand Hui Lyu Ecological Technology GroupsLtd's track record by examining our Past report.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and sales of chemical fibers, other textile materials, and rubber and plastic products both in China and internationally, with a market cap of approximately CN¥6.49 billion.

Operations: Zhejiang Hailide New Material Ltd generates revenue through the production and sales of chemical fibers, textile materials, and rubber and plastic products. The company has a market cap of approximately CN¥6.49 billion.

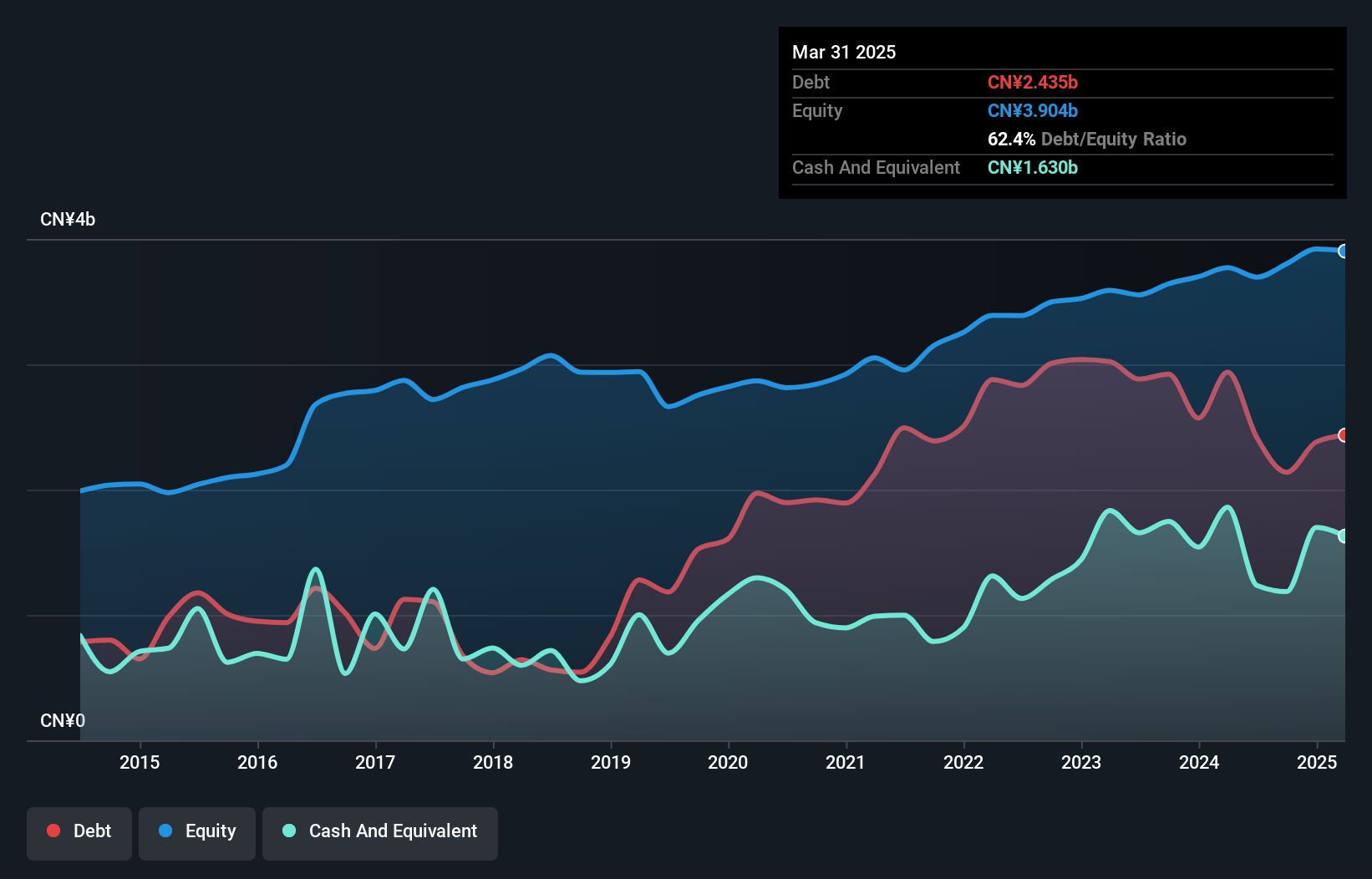

Zhejiang Hailide, a nimble player in the chemicals sector, has been making waves with its impressive earnings growth of 33.3% over the past year, outpacing the industry average. Its net debt to equity ratio stands at a satisfactory 20.6%, indicating prudent financial management. The company’s interest payments are well covered by EBIT at 16.1x coverage, showcasing robust operational efficiency. Recent board changes and amendments to its articles of association suggest an evolving governance structure aimed at future growth. With a price-to-earnings ratio of 13.9x below market averages, it trades attractively compared to peers in China (39.6x).

Jiangsu Xiuqiang Glasswork (SZSE:300160)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Xiuqiang Glasswork Co., Ltd. engages in the research, development, manufacture, marketing, and sale of glass deep-processing products using advanced technologies in printing, coating, and multi-curved surfaces both domestically and internationally with a market cap of approximately CN¥5.13 billion.

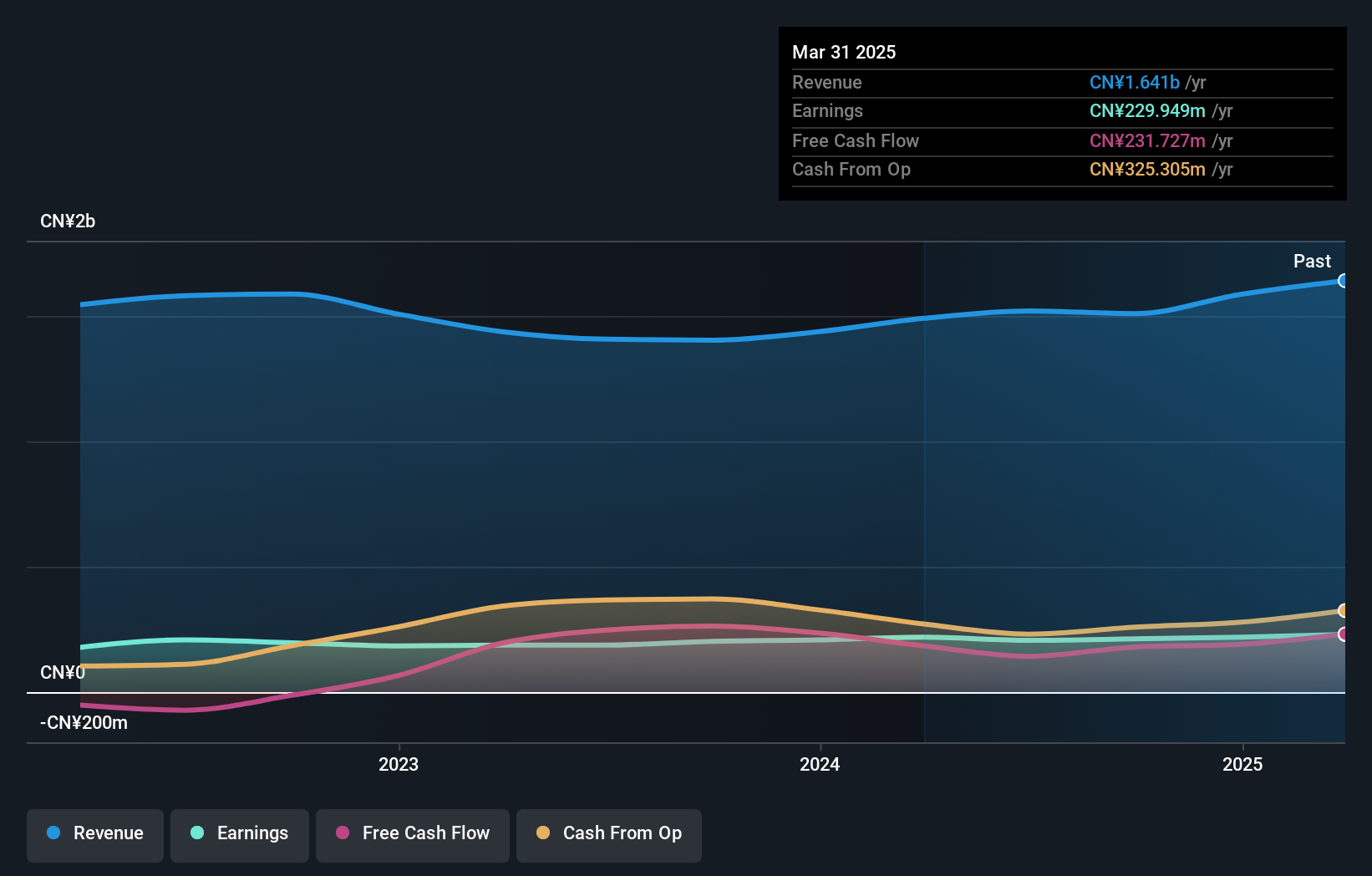

Operations: Xiuqiang Glasswork generates revenue primarily from its glass deep-processing industry, amounting to approximately CN¥1.64 billion. The company's net profit margin is a critical financial metric to consider when evaluating its profitability and efficiency in managing expenses relative to revenue.

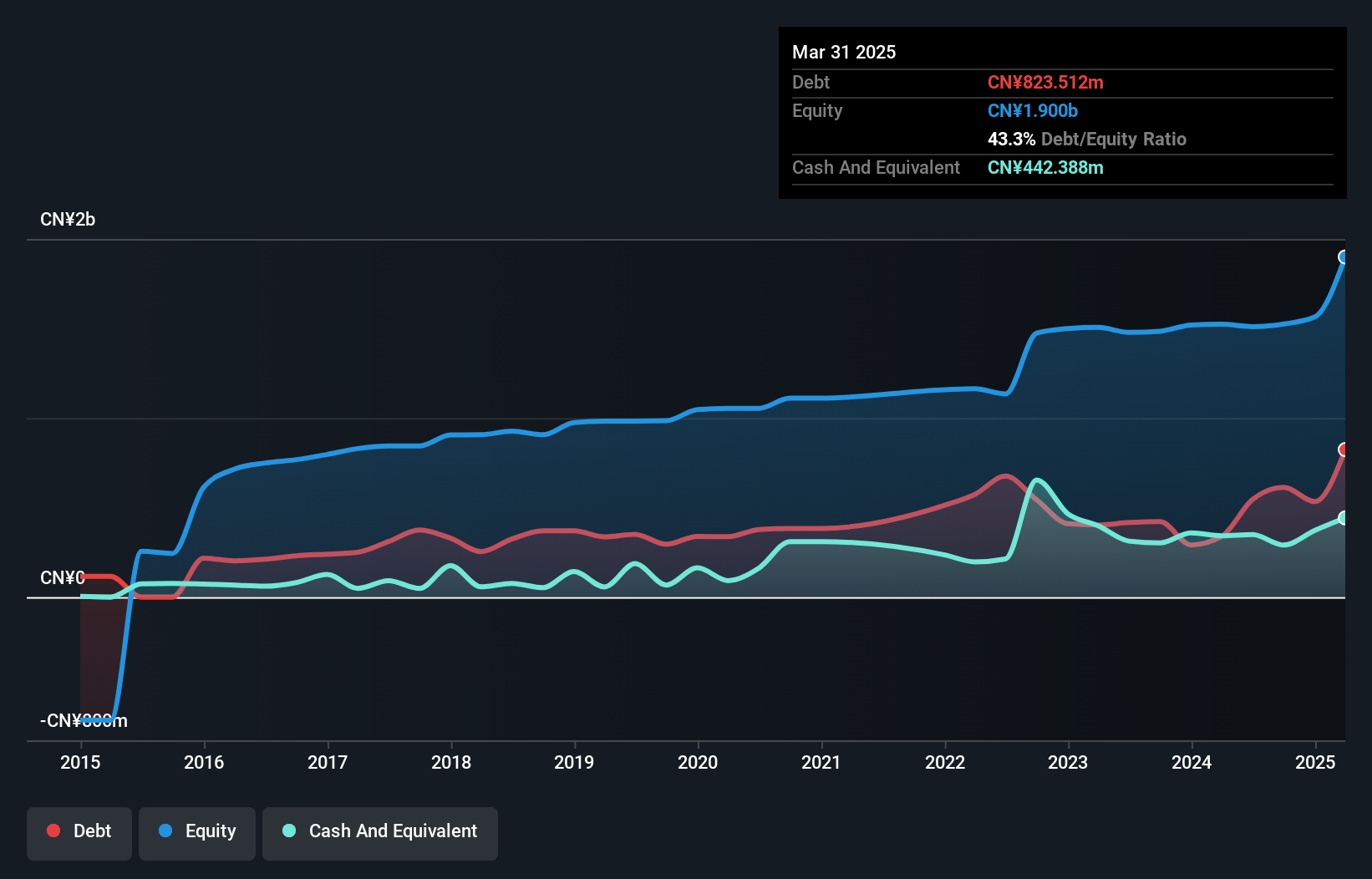

Jiangsu Xiuqiang Glasswork, a nimble player in the consumer durables space, has shown promising growth with earnings rising 5.1% over the past year, outpacing the industry’s negative trend. Its debt-to-equity ratio impressively dropped from 26.1% to 1.1% in five years, reflecting strong financial management. The company’s price-to-earnings ratio of 22.9x is notably lower than China’s market average of 39.6x, suggesting potential value for investors. Recent earnings reports highlight a revenue increase to CNY 449 million from CNY 395 million year-on-year and net income climbing to CNY 84 million from CNY 74 million previously.

Taking Advantage

- Click through to start exploring the rest of the 3159 Global Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hailide New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002206

Zhejiang Hailide New MaterialLtd

Engages in the research, development, production, and sales of chemical fibers, other textile materials, and rubber and plastic products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives